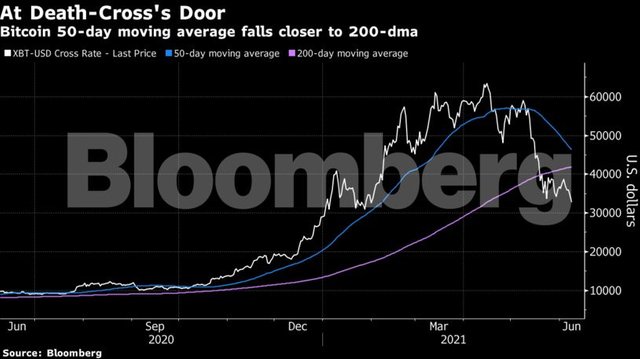

In the midst of Bitcoin's decay this week, extremely observant graph watchers saw an inauspicious sounding specialized penetrate could be nearby: the coin is moving toward a bearish example known as a passing cross.

The world's biggest computerized money has drooped, pushing its normal cost throughout the most recent 50 days near its 200-day moving normally. Should the momentary line cross underneath the drawn-out one, the coin would arrive at the denying arrangement. The pointer is commonly seen as an intently watched specialized measure that could offer indicate more torment to come.

The last time Bitcoin denoted a passing cross was in November 2019 - the cryptographic money was down generally 5% one month in the wake of intersection it.

While it's not done as such yet, "the impact appears to be unavoidable now," composed Mati Greenspan, author of

Quantum Economics.

"A passing cross could be a sign that costs may stay quelled for some time to come."

Bitcoin has been buried in a downtrend twisting as of late, losing about 45% since mid-April, when it hit a record high. The new selloff was exacerbated by tycoon Elon Musk's public censure of the measure of energy utilized by the workers supporting the token. Expanded Chinese administrative oversight additionally soured the mind-set.