Whilst speculation is one thing in the booming crypto market, utilitarian value is another shadow of it, and the real one. Speculation could very well end up with a pump/dump kind of market. But the utility makes the fundamental stronger for a coin. Even without a broader market sentiment, a coin with a strong underlying fundamental rally significantly. Serious investors always keenly follow the utility value of a coin & the underlying fundamentals before investing in it.

One thing Bitcoin and the extension of the crypto sphere since 2009 have taught us-- we evolve each day, we turn the page each day, we add value each day. The Blockchain keeps on recording immutable regardless of bull or bear. So it's a continuous process, the bull run and the bear run are just the transformations of the market. Just like we exercise patience in a bear market(HODL), so do we celebrate the bull run(MOON).

To pick a coin from the list of altcoins, we should do little research on the fundamental aspect of the coin, what use-case it is catering to and how strong that is in solving an existing problem interface. That way we will psychologically remain assured with our investment even during the drawdown period of a market.

So in the ongoing #bitcoinfomoing week, I will outline some of the potential coins that can make some good returns. Today I have picked Serum(SRM) as my favorite coin.

Serum(SRM)

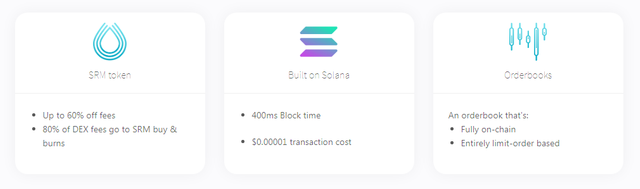

Serum is a DEX native to Solana Blockchain. However, it is completely interoperable with Etherum and Bitcoin. SRM is the native coin of the Serum project. Serum is fully integrated with both Solana and Etherum Blockchain.

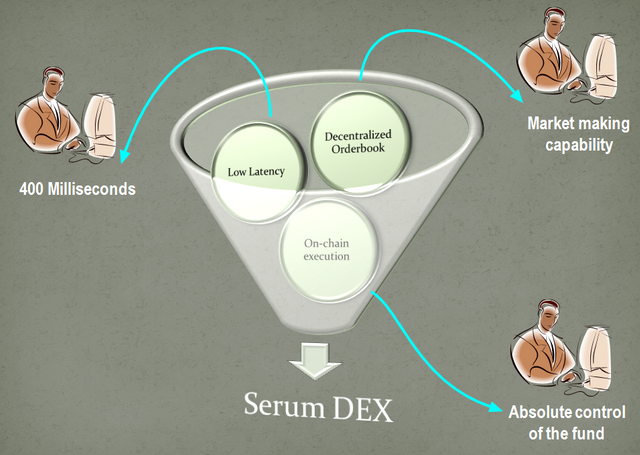

The Serum project as a DEX comes with the advantage of both centralized exchange and the decentralized exchanges(Both Order-book & AMM), which means a user can trade with low latency in Serum DEX(millisecond execution) and it will also happen on-chain. The decentralized order-book of Serum DEX further extends liberty to a trader in choosing the direction of the trade, market-making ability, etc.

.png)

Serum has chosen Solana Blockchain to ensure that execution of the trade is as quick as 400 milliseconds and with a transaction cost as low as $0.00001(negligible).

It can handle a transaction capacity of 50000-65000 tps.

Existing state of CEX & DEX and solution by Serum DEX

In general, the traders prefer CEX for better liquidity and low latency in the execution of trades. CEX is the custodian of the crypto asset.

In contrast, in DEX, the trade happens on-chain, because it happen on-chain the trade execution depends on block confirmation and it takes time, depending on the scaling capacity of a particular chain. However, the user enjoys absolute control of the asset.

The order-book-based DEX lacks liquidity, AMM-based DEX solves it by eliminating the order-book, but limits the trader to chose a particular direction in trade and market-making capability.

Serum DEX combines the advantages of all the three in one place. It offers decentralized order-book, on-chain execution, low latency, cost-effective exchange, etc.

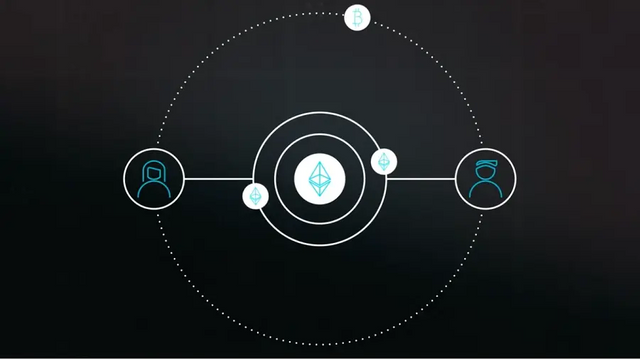

Existing cross-chain swap and solution by Serum

Interoperability between heterogenous Blockchains is still a major bottleneck in crypto. There have been serious attempts to solve this to make it a completely decentralized and fast cross-chain swap. The wrapped token is the new name of cross-chain swap in today's DeFi.

In most of the cross-chain swaps, we are still dependent on the arbitrator and that does not make a strong case for an absolute decentralized cross-chain swap.

The serum makes the cross-chain swap completely decentralized. Here the arbitrator is replaced by the programmable code: Smart Contract.

Take the case of a swap between ETH and BTC. Both sender and receiver will have to collateralize ETH to the Smart Contract. Then the sender will send BTC and in exchange, he will receive ETH. If the delivery goes through, the Smart contract will release the collateral.

In case of a dispute, the Smart Contract is programmed in such a way that it will be able to verify the transaction of BTC between sender and receiver, and if does not find the transaction, then it will settle the case in favor of the honest party. Further, as it is collateralized, it will be a costly affair for a dishonest party to cheat someone.

Non-SPL tokens can also be used & traded in Serum DEX

SPL is the token standard of Solana. Serum DEX is native to Solana Blockchain and it has both USDT and USDC markets. But the USDT and USDC are not ERC-20 tokens in Serum DEX, rather they are SPL-standard token tokens. That means they are SPL tokens.

So with Serum DEX non-SPL tokens can also be traded in the same way wrapped version of BTC is traded in other DeFi ecosystems.

Tokneomics

Serum's native token SRM is natively available in both Solana and Etherum Blockchain.

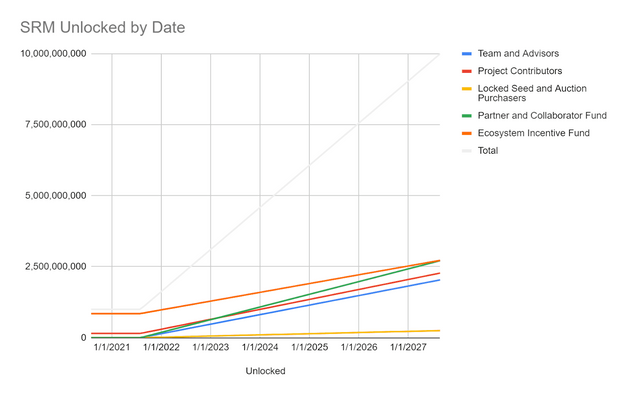

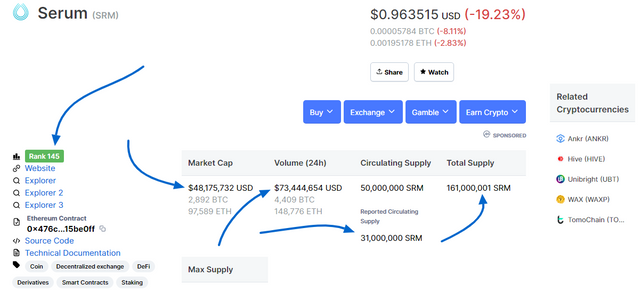

The maximum total supply is 10 Billion. At present, the reported circulating supply is 31 Million whereas the Total supply is 161 Million. The remaining supply(Max Supply minus Toral Supply) will be unlocked over a period of 6 years starting from Aug 2021.

Being a DEX focused project, most of the utilitarian value will come from the trading fees. Those fees will go to SRM burn. That makes a favorable case of a deflationary supply of SRM tokens.

SRM Coin-Market-cap & Rank

The market cap of SRM is reported as 48.175 Million USD. And it is sitting at 145th position in market cap.

.png)

The 24 hr trading volume of SRM caught my attention; the reported 24h trading volume is 73.444 Million USD. That's impressive because the 24h trading volume is more than the market cap of the SRM token. This kind of dynamics is mostly observed in stable coins such as USDT because they are used as base-currencies in the Exchange market. If any other currency is replicating such dynamics then it implies a strong demand for the coin.

SRM is also listed in major crypto exchanges like Binance, OKEx, Bithumb, and many others.

Technical Picture

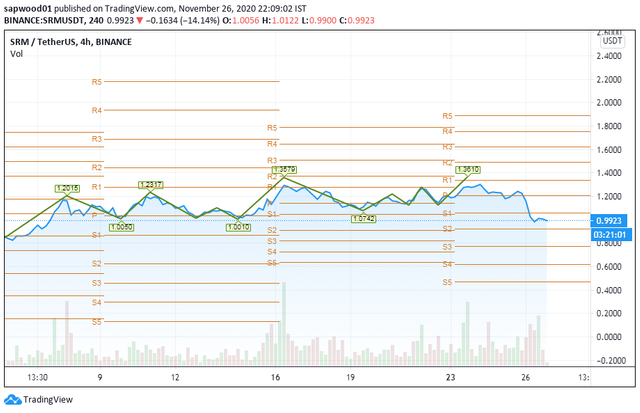

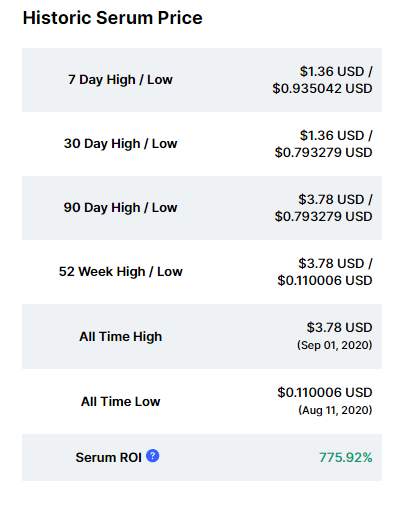

With the recent correction in Bitcoin, almost all Altcoins also corrected by around 15 to 20% today. But if we look into its performance excluding today then it has steadily traded most of the time and comfortably above $1.3 per token in the last one month or so.

The daily chart prints approximately $1 per token at the press time. The current price is trading just below the moving average ribbon(EMA20,EMA25,EMA35,EMA40,EMA45,EMA50,EMA55). Once Bitcoin stabilizes, the altcoins are likely to pick up.

The All-Time-High of SRM is $3.78. The one month range is also quite narrow- ($0.79-$1.36). We should not forget that it is relatively a new coin, hardly 5 months old. But the price action is quite impressive. Combining with its utilitarian value and Bitcoin boom, it is one of the best picks for me in the altcoin segment.

Conclusion

In the ocean of Altcoins, it is discerning to pick a coin with informed choice. It is worth noting that the fundamentals and utilitarian values of SRM are quite strong. I have very often observed that during the strong bear move, such coins do not go down much, and during the bull run, they join the rally. So always a win-win situation. At least from the perspective of investors, such coins lower the risk and keep in good standing with a healthy portfolio. SRM is definitely one such coin as per my assessment.

Thank you.

Cc:-

@steemitblog

@steemcurator01

@steemcurator02

DISCLAIMER

This is not financial advice, nor a guarantee or promise in regards to any result that may be obtained from using the above content. So it should not be considered as financial and/or investment advice. No person should make any kind of financial decision without first consulting their financial adviser and/or conducting their research and due diligence.

I have heard a lot about Solana never knew about SRM before reading your post.. I did some research on SOL before I still remember it's really fast and can handle many transactions per second.

I still remember when it was released they had airdrop some amount of SOL to perform some tasks but they were hard though.

That's quite impressive and really better as compared to many other coins which never raises up..

Thank you for sharing information about SRM.

#twopercent #India #affable

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Serum(SRM) is native to both Solana and Etherum. But the DEX is built on the top of Solana for its exceptional scaling capacity. The major selling point of Serum is its decentralized cross-chain swap and decentralized order-book. The scaling it leverages on Solana Blockchain, yet makes it completely interoperable with Bitcoin and Etherum. It solves the generic problem interface of DeFi.

Thanks.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for this information. I understand a lot.. Thank you for this post well detailed post.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

CEX's have a very stronghold in the current marketspace. However, DEX's are the way to go in the future.

One of the most common complaints that I hear from my friends who trade crypto is the trading fee. On DEX, we pay the miners fee to confirm a transaction. Since some of the most popular DEX are based on Ethereum, the fee on such DEX would be higher than the trading fee that one pays to a centralized exchange such as Binance.

With SRM DEX we won't have to deal with this problem due to the negligible miner fee.

As it pairs the traditional order book style exchange with the AMM model, we won't need to worry about liquidity either. This was the first time I am reading about Serum and from what I see, it sounds like an exciting project. Ticks all the right spots that I look out for in a crypto project. Definitely worth looking at!

Thank you.

#twopercent #affable #india

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for taking part in the Bitcoin is Booming Crytpo Challenge.

Keep following @steemitblog for the latest updates.

The Steemit Team

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you so much.

Steem on.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Waooh this is great, I must say this is the first time am hearing about this cryptocurrency called SRM.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Excellent as usual, thank you for sharing 🙏

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You are most welcome my dear friend 😊❤️🙏🇮🇳

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Your post has been upvoted by Steem Sri Lanka community curator.

Join With Our New Concept Contest Series... Try it! It's a puzzel Steem Sri Lanka - Contest Series | Round 02 | Week 01| Two In One Challange

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for your work on steem greeters project.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit