In the ongoing #bitcoinfomoing week, I have already detailed in Part 1: XRP & Part 2: SRM; the potential coins to add to the portfolio. Today I have discovered TOMO as yet another potential coin to add to the portfolio.

TomoChain

Tomo Chain aims to offer a decentralized platform where applications can be built, DeFi services can be rendered with the main focus on easy to use technology, cost-effective business, high-performance infrastructure(better scalability).

It is registered in Singapore with a strong position in South East Asia, Korea, China, Japan. It is strategically partnering with enterprises, extending the blockchain solutions to foster the adoption rate of Blockchain technology, but the main focus is always to extend blockchain technology with better scalability and cost-effectiveness.

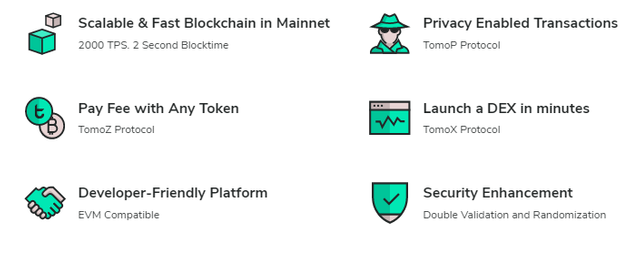

Salient features of TomoChain

- Consensus- Proof-of-Stake Voting

- Native Coin- TOMO

- On-chain Staking & Voting secures the chain and earns rewards.

- Consensus Nodes- Top 150 Masternodes(Voted by Token Holders)

- TomoX Protocol & Relayers- Anyone can build DEX & Lending platforms

- TomoZ- Zero Friction Protocol- Enables the users to pay the fees with the token they are holding.

- TomoP- Privacy protocol- Untraceable and anonymous transaction is possible between two parties.

- Scaling capacity- 2000 tps. Can further be upgraded to 20-30k tps with 2nd layer solutions.

- Double validation by randomization mitigates the risk of a centralized cartel in PoS.

- Block producing time- 2 seconds

- Almost zero transaction fee

Existing state of the DeFi and decentralized services, solution by TomoChain

2020 is the year for DeFi and significant value has been locked up consistently in DeFi all throughout the year. Most of the DeFi projects are concentrated in the Etherum chain. The question is how good Etherum chain in its scaling ability is to offer that frictionless decentralized service to the DeFi projects. So even if they are progressing nicely, it will certainly probe its scaling ability going forward.

In business, time itself is a valuable resource, Considering decentralized services in DeFi, the users always have a wait time (Block confirmation), further they also incur a certain amount of transaction fees charged by the miners. For sustainability that is essential, but how cost-effective that is for the end-users?

So DeFi projects going forward will certainly probe the transaction fee and block confirmation time. Etherum may be a popular Blockchain with most of the DeFi projects. But it lacks to offer that seamless performance when it comes to a near-instant realization of a transaction and negligible transaction fee.

Further, there is always a trade-off between scalability and decentralization. PoW offers a better degree of decentralization, but poor scalability whereas PoS offer better scaling capacity but may lead to centralization to some extent. If PoS will be added with additional security layers, then it can also offer a better degree of decentralization.

TomoChain lowers the barrier by making the transaction fee as low as 1/100 of the ETH fee. It's scaling capacity is 100 times better than Etherum.

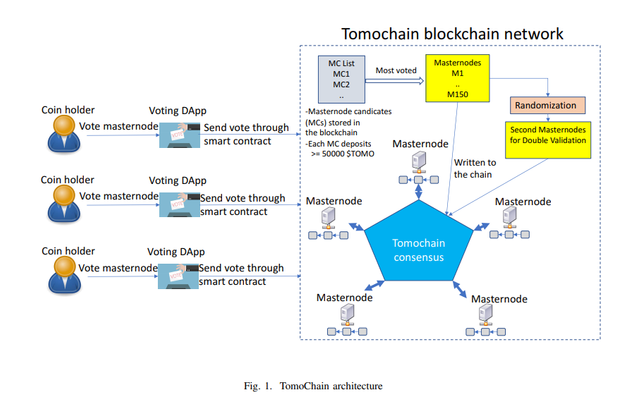

The architecture of TomoChain consists of Masternodes who are voted to the top 150 and then they become a consensus Masternode to produce & validate blocks. To become a Masternode requires 50,000 TOMO to be staked in the voting contract.

To prevent the formation of the centralized cartel in PoS, it employs randomization. First, a masternode will become a block creator and then another randomly selected masternode from the top 150 will become block verifier. That prevents the formation of a centralized cartel in PoS.

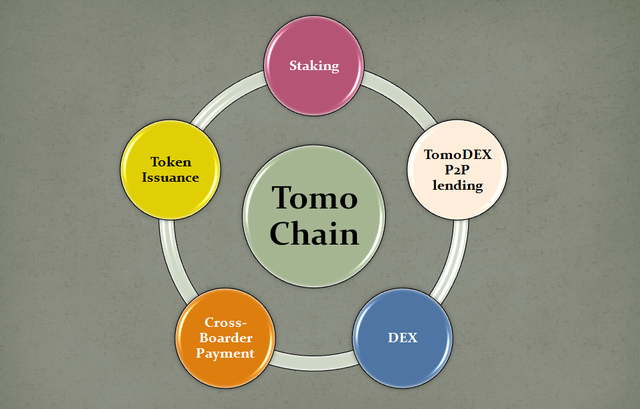

TomoChain insets all types of DeFi

In 2020, we have already observed more dapps springing up with sophisticated DeFi use-cases. TomoChain aims to offer a platform where all types of DeFi dapps & their specified use-cases can be catered.

TomoDEX P2P Lending

It is non-custodial and comes with an off-chain matching engine powered by TomoX protocol. Here the interest rate is determined and set by the participants in a decentralized way and even the lender and borrowers of different relayers can participate. Liquidity is guaranteed by the order-book.

Staking

TomoChain offers on-chain staking via TomoMaster. Here the staking pool is created by Tomo coin holders who vote Masternodes and Master nodes who run the network, validate the Blocks. Tomo Coin holders only need 10 TOMO coins to vote a good Matsernode and that earns them 6.5% APR. The consensus Masternodes earn 26% APR and they require to stake 50,000 TOMO coins.

DEX

TomoX is a DEX protocol of TomoChain. Anyone can build a DEX within minutes and in a cost-effective way with TomoX. It remains completely decentralized, easy-to-use & manages the listing of tokens. All the DEXs that are built through TomoX share the same order-book, which means it creates a network effect, and together with TomoBridge, the traders can connect to the Relayers, paving the way for the cross-chain swap with heterogenous Blockchains such as BTC, ETH, etc.

Cross-Boarder payment

TomoChain extends the decentralized as a service to facilitate the transaction of cross-country goods/services. With high transaction throughput and low fees, it becomes an effective alternative.

Token Issuance

The token standards in TomoChain are TRC20, TRC721(equivalent to the ERC20, ERC721 standards of Etherum). There is another standard TRC21, which further removes the friction by allowing to pay the fees in TRC21, not TOMO. With TomoIssuer, anyone can issue TRC21 tokens without having to know the programming language.

Tokenomics

The native token is TOMO. The total supply of the coin is 100 Million. The current circulating supply is 76.144 Million. Of the total 100Million supply, 55 Million was at the genesis block, 12 Million is reserved for the team(vested over 4 years), 16 Million is for business partnership and building the ecosystem. The remaining 17 million are for Block rewards(for 8 years). After 8 years, Block rewards will come from exchange fees.

The Block rewards also go through a halving schedule:-

- 1st, 2nd year- 4 Million per annum

- 3rd, 4th, 5th year- 2 Million per annum

- 6th, 7th, 8th year- 1 Million per year.

So as such there is no inflation, rather a fixed total supply of 100 Million, which will be achieved over 8 years.

Even if we consider the 17 Million Block rewards as inflation, and linearly project it, then it will be roughly 2.125 Million per year, which 2.125% of the total supply.

So the tokenomics of TOMO is quite clear and very strategic, particularly they don't have any such contour of the end-less inflation rate. They have a fixed schedule of Block rewards over 8 years. That makes a strong case in favor of TOMO.

Coinmarketcap & Rank

The coin market cap of TOMO is 48.35 Million USD and is sitting 148th rank in terms of market cap.

.png)

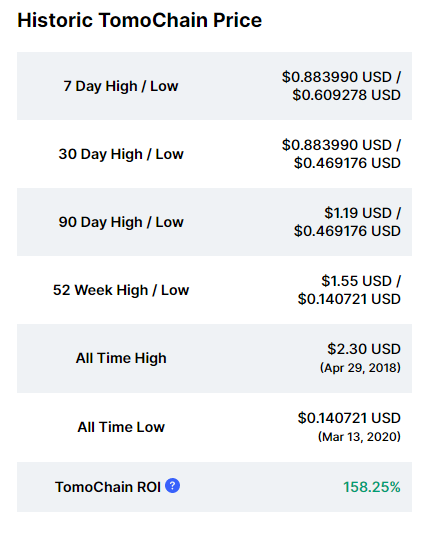

The presale price and ICO price were $0.2 and $0.25 respectively, and right now the value of TOMO is $0.63, and the all-time high is $2.3. This project is hardly 2 years old, but it has gained significantly over two years and most importantly it has sustained those gains.

It is listed in the major exchange platform like Binance and many other DEX and CEX supports this coin.

Recent partnership improving the fundamentals

In a recent development, Vietnam’s Ministry of Education and Training (MOET) will now record the certificates of Vietnam’s high school and higher education students immutably to the public distributed ledger of TomoChain. This is significant as this sort of agreement with institutions foster the adoption and at the same time promote the Blockchain more efficiently, yet passively with the real-world use-case.

Recently, TomoChain acquired Lition’s Enterprise Blockchain Unit. TomoChain has a strong focus in Asia, whereas Lition Blockchain has a European footprint, so now with this acquisition, TomoChain sounds more of a Global player.

Technical Picture

Prior to the recent correction of Bitcoin, TOMO was trading at $0.9 and now it trades around $0.63. The range over the last 7 days is confined within $0.57 and $0.89 level.

.png)

The daily chart prints $0.64 at the press time. Prior to yesterday's correction, it was trading above the moving average ribbon(EMA20,EMA25,EMA35,EMA40,EMA45,EMA50,EMA55). It will be interesting to see the close of the price this month(above or below this MA ribbon). Until then it is likely to trade in that range. If it closes above this ribbon (around $0.69) then it will be a bullish sign. If not it will continue to trade int that range, subject to the strong support around $0.52.

.png)

Conclusion

DeFi is no doubt the booming space in crypto in 2020 and is slated to get stronger beyond 2020. But DeFi is a comprehensive subject. Facilitating the use-cases of DeFi is a kind of diversified strategy for the Blockchain infrastructure now.

DeFi indirectly drives the capital flow from the traditional financial system to the Blockchain sphere. Most importantly when you allocate a certain percentage of the total supply for business partnership and building the ecosystem, then that will spur growth in the long run and that is what Tomo Chain conceptualized right from the start. And their recent partnership is further improving the fundamentals.

A two-year-old coin is well matured in its price action. So TOMO definitely makes the assessment impressive to add to the portfolio.

Thank you.

Cc:-

@steemitblog

@steemcurator01

@steemcurator02

DISCLAIMER

This is not financial advice, nor a guarantee or promise in regards to any result that may be obtained from using the above content. So it should not be considered as financial and/or investment advice. No person should make any kind of financial decision without first consulting their financial adviser and/or conducting their research and due diligence.

Thank you for your sharing, I just saw through your article all the potential that this blockchain project has. The transactions are fast, the number of transactions per second is huge, the partnerships are strong and I have read that the founder of Ethereum regularly shows up with the team.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

TomoChain stemmed from Etherum's DeFi infrastructure and seek to offer a better alternative with a negligible transaction fee and better scalability(near-instant realization) than Etherum.

They are diligently working in business partnerships with leading players of the traditional markets, especially in the South Asia region, Japan, China, Korea, etc.

Thank you.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Never heard about this crypto before but as always you did great work for introduce this project to us. Thank you!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for taking part in the Bitcoin is Booming Crytpo Challenge.

Keep following @steemitblog for the latest updates.

The Steemit Team

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you so much.

Steem on.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit