The 2008 financial crisis, often called the Great Recession, exposed a dangerous web of greed among financial institutions, investors, and even ordinary people. At the heart of the crisis were risky lending practices, particularly subprime mortgages, which were given to borrowers with poor credit histories. Banks, eager to maximize profits, packaged these loans into complex financial products, like mortgage-backed securities, and sold them to investors worldwide. The potential for high returns blinded many to the risks involved.

Major financial institutions, driven by short-term profits, ignored the growing instability of the housing market. Executives earned enormous bonuses based on the success of these risky investments, while regulators turned a blind eye. As the housing bubble burst, the true value of these securities plummeted, leading to widespread financial collapse.

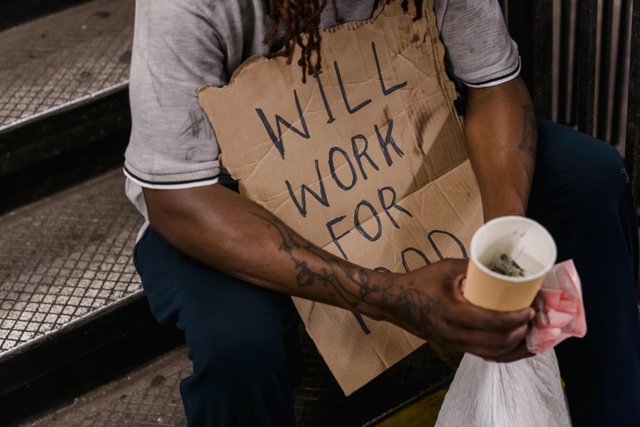

The crisis also highlighted the greed of individuals who took on loans they couldn’t afford, believing housing prices would continue to rise indefinitely. When the bubble burst, millions lost their homes, jobs, and savings, revealing the high cost of unchecked greed at all levels of the financial system.

In the end, the crisis was not just about flawed policies or economic downturns; it was about a culture of excessive risk-taking and profit-chasing at the expense of long-term stability.