When I first started making videos I was doing it as an hobby, something to do after the first real long break I had away from working on the building site. I never expected or planned to make a living from making videos. Until YouTube revealed that they owed me 14000 USD, I never received that money and copy-written music used in the background of my videos was their excuse to not pay up, this lead to me spending months making my own music which is what I use nowadays.

I know I should not have used copy-written music but I only used the same copy-written music as loads of channels were using (most of them received a payment even if SOME of the money did go towards the owners of the music) I received nothing. Since then much of my older videos have been either muted or taken down.

In the mean time I have the JobCentre (financial fascists) telling me that uploading to YouTube while claiming Jobseekers allowance could result in me getting in to trouble with HM Revenue and Customs (other financial fascists and extortionists.)

I am advised by the JobCenter to start a business and instead of claiming £93 per week (claiming for 3 kids at the time) in Jobseekers allowance benefits claim £93 per week in working tax credits, so I do.

And for two years everything was fine, I claimed and got the money plus a little extra that my videos make in DVD sales and through low paying rip off services like Google Adsense.

I was recently forced to alter my claim due to splitting up with my ex (we split up months ago but we were again advised to claim falsely as a couple due to the fact we still shared an house, false information is OK when it suits them. And just because I have split up from my ex does not mean I want to split up from my kids.)

I am unexpectedly told that I need to show all my business information to make sure that I am eligible to claim working tax credit, I phone them up and explain my printer is completely out of ink, ordering the ink cost £30 and was going to take a few days to arrive and it takes HM Revenue and Customs upto 5 weeks to process a claim so I asked if I could possibly email the information to them. HM Revenue and Customs do not accept incoming emails! Why the fuck not? It is 2017 FFS, these go about business as if it 1918 I would have asked if I could send a pigeon but I ain’t got one.

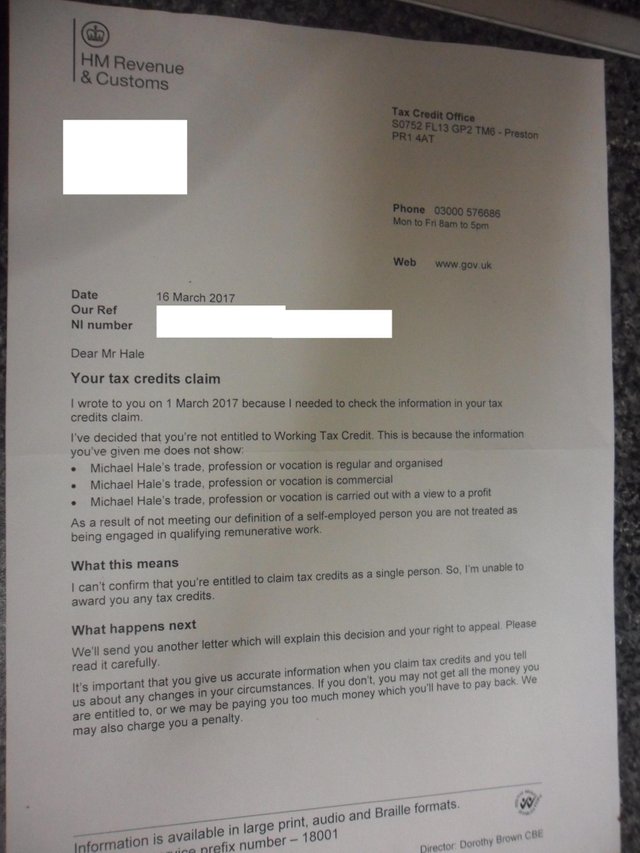

The Working Tax Credit office inform me on the phone Thursday that if I do not receive a letter by Monday the limited amount of information I could send without printing should be enough for them. Saturday I receive the letter below, five days later than they said it would take. They refuse to let my claim continue maybe forcing me back on to Jobseekers allowance where I would be required to go to useless college courses just for the fuck of it and attend interviews whenever they whistle and still only get £53 per week. Obviously this could also mean I would have to stop uploading videos onto YouTube or at least not be able to monetize them.

I have DVDs for sale but Facebook have blocked me on multiple occasions and accounts from actually selling on Facebook so this also slows down my progress massively.

This is how the system is attempting to shut people up, they place obstacles in your way. A confusing tax system where they are giving you money one week and demanding money from you the next. Social media and Internet censorship, false view counts and refusal to pay what they said they owed, its all simply the systems way of oppressing and silencing us.

How have you gotten on since @wolvomann80?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit