My acquaintance, Mr. Summer, had just received 6 units of L3 miners from bitmain.com. He had preordered them 3 months earlier when LTC was at 50$. Now the price was touching 300$. He paid for them in BitCoin Cash (BCH) as bitmain.com demands. As soon as the units arrived in Dubai, he messaged an invite to do the inaugural switch-on of the machines. So, on Saturday I arrived and I knocked on his door. He opened and I was met with a swirl of exhilaration, greed and crypto-hope. And it was highly contagious! But, then I remembered that I had studied economics back in the time when I was wiser and younger, so I put on the Warren Buffet sleeve and asked politely: Very nice, very nice... but is this operation really profitable?

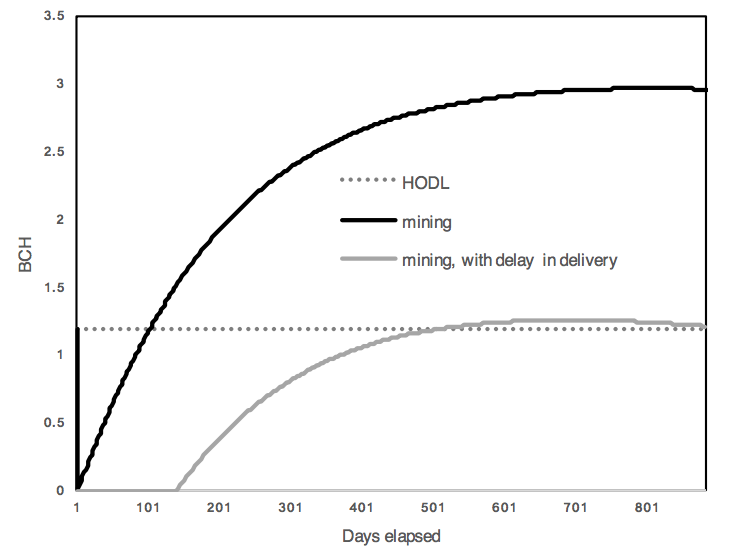

Of course! -- he replied in disbelief, (How dare you!). These machines will pay back their cost in 2 months. What business pays back in 2 months? True. Few biz pay back in 2 months these days... After that, it is pure profit. - He said. In Mr. Summers mind, mining was a no brainer. Then, he added. I have only one regret, I paid for the machines in BCH and BCH went up too. "Up", in this case, meant about 600% in 3 months, which is the appreciation of LTC between the payment of the preorder and the delivery date of the machines. So when you bought the mining machines, the payback time was longer right? Oh, yes -- he replied, but bitmain will adjust the prices of the machines in accordance to the current payback time.

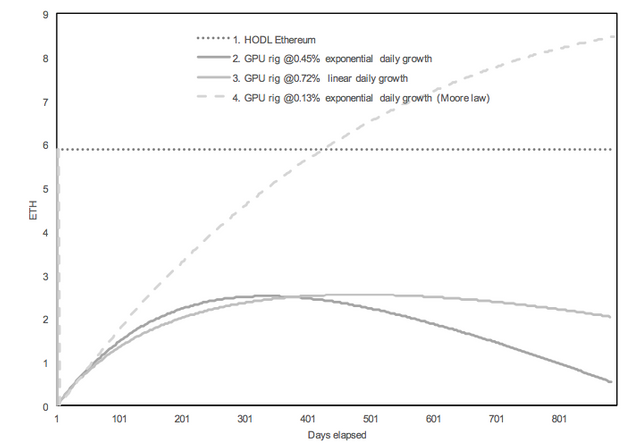

After this, we realized that in times of extreme coin appreciation it is not clear what is more profitable to do. Even if mining seems profitable from a fiat perspective, Hodling might be more profitable if difficulty growth is high and delivery delay is long. Since, both strategies involve the risk of holding the same given crypto it seems logical to not use USD to compare their respective net presents value. That leads us to the concept of net coin value (NCV). When using NCV it is clear that many mining operations have negative ROI in terms of coin. Measuring alternatives in coin value is a way to not let appreciation distort the analysis. Finally, many miners fall in the trap to believe they made a great investment because they just recovery the cost of the machine in a few months. They ignore that profitability decays exponentially due to Moore law AND the mining rush. Below is a screenshot of the profitability of a mining machine taking into account the historical growth in miners in the pat year. The more miners the smaller the pie piece each gets But even if no more miners where to join the game, the decay in profitability would still continue due to Moore Law. A more detailed analysis can be found in this preprint

Congratulations @josh.dubai! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @josh.dubai! You received a personal award!

Click here to view your Board

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit