Hongkong Land Holdings Limited (SGX: H78) is a leading property investment, management and development group with strategic assets located in major cities across Asia. Hongkong Land has a standard listing on the London Stock Exchange (LSE) with secondary listings in the Bermuda Stock Exchange and the Singapore Stock Exchange (SGX). As at 15 December 2017, Hongkong Land’s share price on SGX is US$7.20.

In this post, I will be sharing with you HongKong Land's Business Model, track records and its growth prospect.

- HongKong Land mainly derive its revenue from 2 categories: Property Development and Property Management.

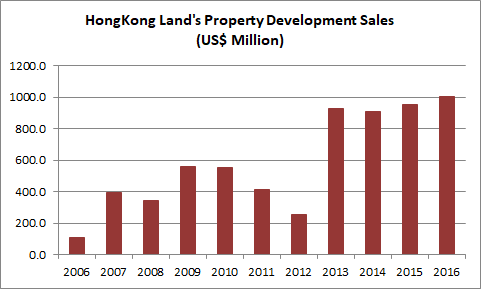

Property Development

HongKong Land recorded US$900 million to US$1,000 million a year in sales from its property development activities over the last four years. It is an improvement from a three-year decline from 2009 to 2012 when property sales dropped from US$558.2 million to US$252.1 million.. The improvement is mainly contributed by sales derived from its development projects located in Chongqing, China and Singapore. They include Yorkville South, Yorkville North, the Bamboo Grove, the New Bamboo Grove, Central Avenue, Landmark Riverside , WE City as well as J Gateway and Lakeville.

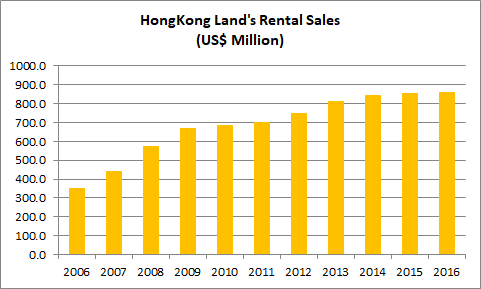

Property Management

HongKong Land is one of the largest landlord, owning a whopping 12 properties in Hong Kong Central. She manages a total of 800,000 square meter of prime property across Asia, with its Hong Kong central portfolio taking up approximately 460,000 square meter.

We can see that HongKong Land rental revenue has been increasing steadily over the years. This is due to the progressively higher rent collected from its HongKong Central portfolio as well as the addition of One Raffles Quay (Singapore) since 2007 and 33% stake in the Marina Bay Financial Centre since 2010 that broadens HongKong Land's recurring revenue base significantly.

Moving forward, following the opening of yet another prime property in Beijing - WF Central, which is located at the heart of Beijing - Wangfujing Street in Dongcheng District, I believe we could see HongKong Land's rental revenue trending upwards.

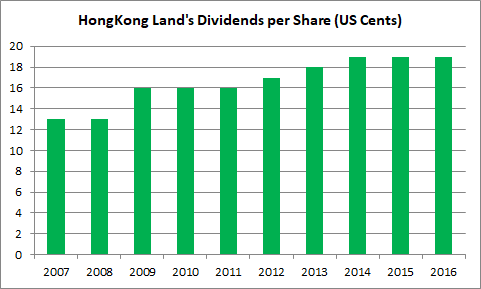

HongKong Land Dividend track record

HongKong Land has proven its ability to reward shareholders handsomely, with its dividend increasing from 13 cents 10 years ago to 19 cents presently.

This shows that HongKong Land has been very resilient over the years and continue to maintain its dividend payout ratio during the Global Financial Crisis in 2008. It is also able to steadily increase its dividend payout, indicating the strong growth potential of HongKong Land.

Hongkong Land has produced stable revenues and underlying profits, and delivered steady dividends to shareholders over the last 10 years.

Presently, approximately 76.5% of its assets are investment properties which will continue to contribute stable recurring income for Hongkong Land. In addition, it has built a pipeline of property development projects which would continue to improve its income visibility in the mid-term. It also has a relatively low-gearing ratio of 0.10 which gives it the option to borrow to finance future acquisitions and pursue joint venture opportunities whenever these they arise.

Congratulations @tanhl! You received a personal award!

Click here to view your Board of Honor

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @tanhl! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit