Introduce

Each of us, when we want to invest or spend a large amount of money on something, we have high demands on its final results and quality. And for a great result, the management must be extremely tight and always under our control. If you are an electronic marketer or your work is related to the electronic market then I am sure that you have a good understanding of Blockchain transparency and clarity.

Metavault Trade Is A Decentralised Spot And Perpetual Exchange With Low Swap Fees And Zero Price Impact Trades. Trading Is Backed By A Multi-Asset Pool Which Is In Turn Supported By Liquidity Providers.

Trading Is Backed By A Multi-Asset Pool Which Is In Turn Supported By Liquidity Providers. Liquidity Providers Receive Rewards From Swap Fees, Market Making, Rebalancing And Leverage Trading. MVX Uses Chainlink Oracles And TWAP Pricing From Large-Volume Decentralized Exchanges For Dynamic Pricing.

The Multi-Asset pool

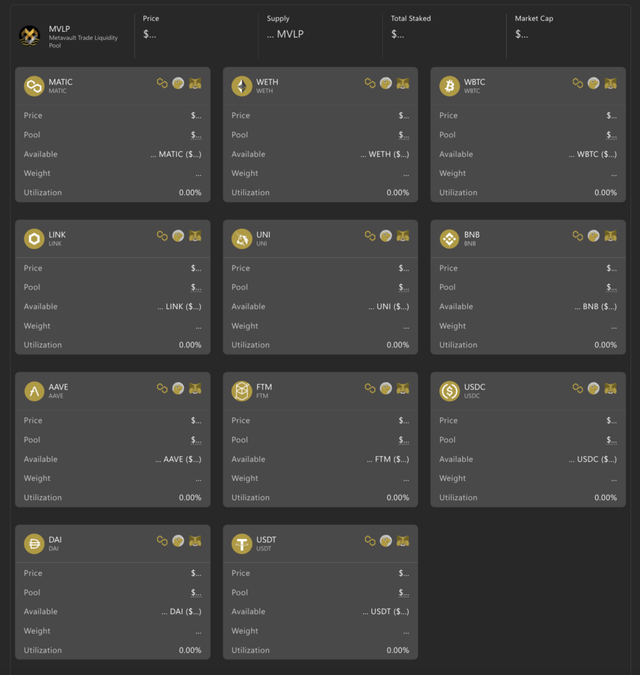

The great innovation at the heart of GMX, and now of Metavault.Trade, is the Multi-Asset pool. All the assets supported by the platform are pooled together and a token called MVLP represents the index of these tokens. The price of MVLP will fluctuate with the prices of the underlying assets in the basket and the Profit and Loss (PnL) of the traders — when they loose on a trade, their losses flow into MVLP.

How does this shared liquidity lead to a reduced price impact swap solution? Let’s say for example that the pool is made up of five assets (BTC, ETH, MATIC, USDC and DAI) in equal proportions in terms of dollar value: 20% of each. If a trader wants to buy 50% of the BTC supply with USDC, they can do so instantly, without any price impact. After the order goes through, the state of the pool will simply become BTC: 10%, USDC: 30% and the rest unchanged. To understand how unique this feature is, I encourage you to check how much price impact you get for a very large order on a CEX with an order book or on a DEX like Uniswap!

At launch, the assets supported on Polygon will be six large caps and three stablecoins:

- BTC, ETH, MATIC, LINK, UNI, AAVE

- USDC, DAI, USDT

Now let’s get back to the pool in the example above. Post-swap, it is unbalanced compared to its initial state. The liquidity providers will be incentivized to deposit BTC and disincentivized to deposit USDC, which will lead to a rebalancing of the pool.

What the Metavault.Trade multi-asset pool could look like — © Metavault.Trade

What the Metavault.Trade multi-asset pool could look like — © Metavault.Trade

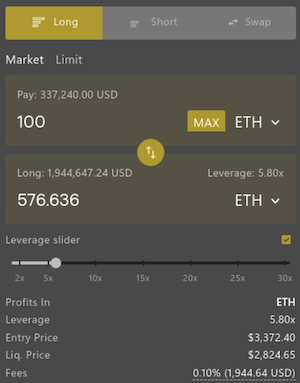

Metavault.Trade will also allow traders to go long or short with up to 30x leverage against any of these assets. The main innovation here is the way the price is set: the platform aggregates Chainlink and Time-Weighted Average Price (TWAP) pricing from major DEXes and CEXes. This greatly reduces the risk of liquidation from the temporary wicks you find on some exchanges. These are sometimes due to big players manipulating the order books on purpose to liquidate the other users. In that case they are called “scam wicks”!

A simple interface to choose to go long, short or just swap your assets — © Metavault.Trade

A simple interface to choose to go long, short or just swap your assets — © Metavault.Trade

The alpha

In my opinion, Metavault.Trade is likely to be adopted by two different types of users:

- Leverage traders on the lookout for decentralized platforms and/or protection from scam wicks.

- Users who need to swap large amounts of assets and will find a better price there than on any other AMM or even CEX.

The general opinion is that decentralized perpetual trading is still massively undervalued as a vertical and that it will grab an ever larger share of crypto trading market — mainly to the detriment of CEXes.

This alone would make it a project worth looking into; furthermore I think one needs to keep in mind what happened with GMX: it has been a huge success for those who were in early, either providing liquidity or buying the utility and governance token of the platform, $GMX.

IMHO, Metavault.Trade gives everyone a chance to be early in a project of the same quality as GMX and with even specific advantages over it:

- It’s built on Polygon, a chain where transactions are fast and cheap and onboarding users is easy. Plus, without entering too much in technical details, there are more Chainlink feeds on Polygon than on the chains GMX is on, and these are crucial for pricing and makes listing new assets easier.

- Its tokenomics allow for more incentives. The history of GMX is a bit complicated, it is a rebrand from the BSC project Gambit, and previous Gambit investors were allocated a large share of the GMX supply. There is no such previous investors with Metavault.Trade and this allows the protocol to reserve a larger proportion of tokens to reward farming when compared with GMX.

- A lively and engaged community. Metavault.Trade is part of a whole ecosystem of blockchain and technology projects under the umbrella of the Metavault DAO. They have an A team of developers and a lot of community members engaged in supporting their ventures.

There are two ways to get involved with Metavault.Trade: the simplest one is to be a liquidity provider and to mint MVLP by providing one of the asset listed on the platform. MVLP holders get a 70% share of platform fees.

One can also choose to hold MVX, the utility and governance platform token of the platform detailed in the last section.

$MVX token

Metavault.Trade will issue a utility and governance token for the platform, ticker $MVX.

The MVX token is particularly well designed in terms of rewards for the stakers. The rewards are simply piled one on top of the other.

MATIC rewards from platform fees

MVX stakers will get 30% of the fees collected from across the platform in the form of MATIC (on Polygon network).

Escrowed MVX

MVX stakers will get Escrowed MVX, esMVX, that can be used in two ways:

- esMVX can be staked, and so earn the holder the same rewards as staked MVX: MATIC rewards from platform fees, more esMVX and multiplier points.

- esMVX can be unstaked and vested to be converted and distributed as MVX. In that case, they stop earning the staking rewards though. Vesting esMVX then unlocks linearly over one year with MVX being distributed to you with each unlocking.

Vesting your esMVX also requires you to lock the average MVX/MVLP that earned you that esMVX in a vault. The MVX/MVLP in this vault cannot be sold, but does still accrue rewards.

The locked MVX/MVLP in the vault can always be withdrawn but this will stop any further vesting of esMVX.

Multiplier points

Staked MVX receives multiplier points that allow the holder to accrue protocol fee rewards: each multiplier point earns the same amount of MATIC as a MVX token.

But unstaking MVX or esMVX will incur a burning of multiplier points. This is a gamified system that rewards you points for staying staked for longer as the only way to acquire multiplier points is through staying for the long haul.

Public sale and IDO Data

Public sale

The public sale IDO of MVX will happen on the 1st of May on Uniswap (v3).

IDO data

- IDO Price: $1

- Total Supply: 10,000,000 MVX

- Initial Market Cap: $1,500,000

- Blockchain Technology: Polygon

References

Social medias

Website: https://metavault.trade

Telegram: https://t.me/MetavaultTrade

Twitter: https://twitter.com/MetavaultDAO

Medium: https://metavault.medium.com

Discord: https://discord.com/invite/b2fPrbmPza

©

©