Hi everybody! How are you doing today? I am introducing an awesome project. Lots of people are joining this endeavor day by day. They are getting so many benefits by investing in this project. If you want to get benefits you must have to participate in this platform. So just join the project and have a bright future.

About Metavault Trade

Decentralized Trading

I guess all my readers know what centralized trading is. It’s the act of buying/selling an asset on a Centralized Exchange (CEX) like Binance, KuCoin or Coinbase. These platforms have pros and cons: they can offer low transaction fees and allow for a lot of flexibility through APIs and bots. But they also require different levels of KYC to use — which is in principle a good thing, until they get hacked and your personal data is out there for every imaginable bad actor to use — and sometimes they freeze your assets for reasons only known to them. Worst case scenario they get hacked and you lose everything you have on their platform. “Not your key, not your crypto!” as the saying goes.

Decentralized Apps (dApps) solve some of these issues by transferring the trading to blockchains like Ethereum and offering decentralized trading solutions. Uniswap is probably the most famous Decentralized Exchange (DEX). No KYC needed, and you can use it from anywhere in the world. But the fees on Ethereum can be 10 to 100 times higher than what they would be for a similar trade on a CEX, especially for those with smaller position sizes. The price of decentralization is high! Metavault.Trade is a new generation DEX that brings many innovations and very low fees.

Futures contracts

When people start trading, they usually begin with “spot trading”, which consists of buying and selling an asset directly on the market. But there are also more sophisticated instruments called futures contracts, or “futures” for short:

A futures contract is an agreement to buy or sell a commodity, currency, or another instrument at a predetermined price at a specified time in the future.

Unlike a traditional spot market, in a futures market, the trades are not ‘settled’ instantly. Instead, two counterparties will trade a contract, that defines the settlement at a future date. Also, a futures market doesn’t allow users to directly purchase or sell the commodity or digital asset. Instead, they are trading a contract representation of those, and the actual trading of assets (or cash) will happen in the future — when the contract is exercised [Ref].

These contracts were invented so that one could hedge against variations of the market, but futures trading also offers more possibilities than spot trading:

- Traders can “go short”: they can bet against an asset without even owning any of it.

- Traders can use leverage: they can enter positions for a multiple of their balance. But by doing so, they run the risk of loosing their entire balance when the market goes the wrong way, even if only by a little. Using high leverage (10x, 20x… 100x!) with large positions is very dangerous and should absolutely be avoided if you’re not an expert trader!

There is one last trading instrument I need to define before talking about Metavault.trade, and that is:

Perpetual futures contracts — “Perp”

A perpetual futures contract, or “perp” is a futures contract that doesn’t have a settlement date. That means you can hold your position for as long as you want.

I won’t enter into the details of how perps work (see Ref for more details) but an important feature is that they are built in a way that ensures their price always remains close to the spot price.

This means one can use perps to trade an asset at its spot price (or very close to it) with the possibilities offered by futures contracts: shorting and leverage.

This versatility makes perps:

the main source of liquidity and trading activity in crypto: volume for BTC and ETH futures are over 10x greater than spot, $2T/month vs. ~$200B/month [Ref].

I must confess I was shocked when I found this out, so let me emphasize it once again: roughly 90% of all BTC and ETH trading is done through perp trading and NOT on spot markets. Now THIS is a large market to tap into! And that’s exactly the purpose of…

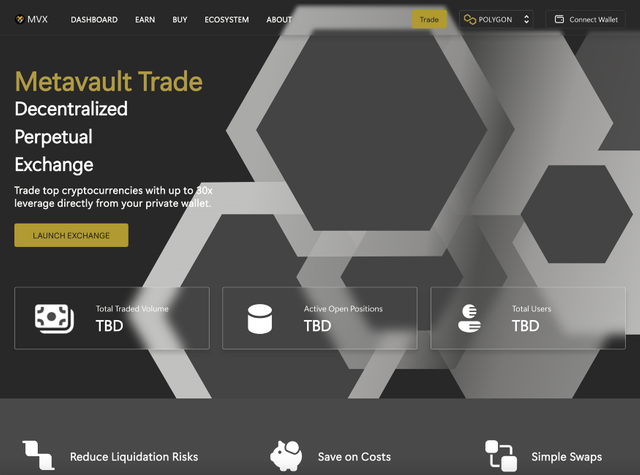

Metavault.Trade — a new player in the largest crypto trading market

Metavault.Trade is a new crypto decentralized exchange for swap and perp trading. There are many DEXes that offer swapping and a few solutions for perp trading as well, so “is a new DEX really needed?” one might ask. What does Metavault.Trade bring in to the space?

Let’s examine the two main uses of Metavault.Trade:

Swap trading

The main DEXes in this category, like Uniswap on Ethereum and Pancakeswap on BSC, are built around an Automated Market Maker (AMMs). By design, this technology has some limitations regarding liquidity. In practice the price you see is NEVER the average price you get for your order, you’ll always pay more! This is because only a little fraction of the tokens are available at the price shown: if you need more, you have to pay a little extra. This is called “price impact” and depending on your order size, it can reach anywhere from a fraction of a percent to a few percent… this has a big influence on the final average price you pay.

Metavault.Trade improves on current AMMs in a huge way by reducing slippage to nearly nothing and offering very deep liquidity. Their technology will allow you to buy “any amount” of a listed token at the exact price shown when you pass the order.

Metavault.Trade also allows one to put limit orders, a feature absent from most AMM DEXes!

Perp trading

The main DEXes in this category are dYdX and GMX. dYdX is the uncontested leader with a daily volume of more than $1B while GMX has been the most successful challenger up to date with a daily volume between $50 and $200 million. dYdX’s interface is based on orderbooks, just like a CEX, while GMX brought an innovation in the form of a multi-asset pool that gives it two unique trader friendly features:

- Very deep liquidity.

- Minimizing liquidation events from “scam wicks”.

While GMX is currently active only on Arbitrum, an Ethereum Layer 2 chain, and on the Avax c-chain, Metavault.trade is an enhanced fork of GMX, that will launch on Polygon (another Ethereum Layer 2, cheaper to transact on than Arbitrum) and on Near protocol soon after. This offers new possibilities for growth compared to GMX and may very well ensure the newcomer grabs a nice share of the perp market. To explain how, we need to detail how Metavault.Trade works, so follow me down the rabbit hole.

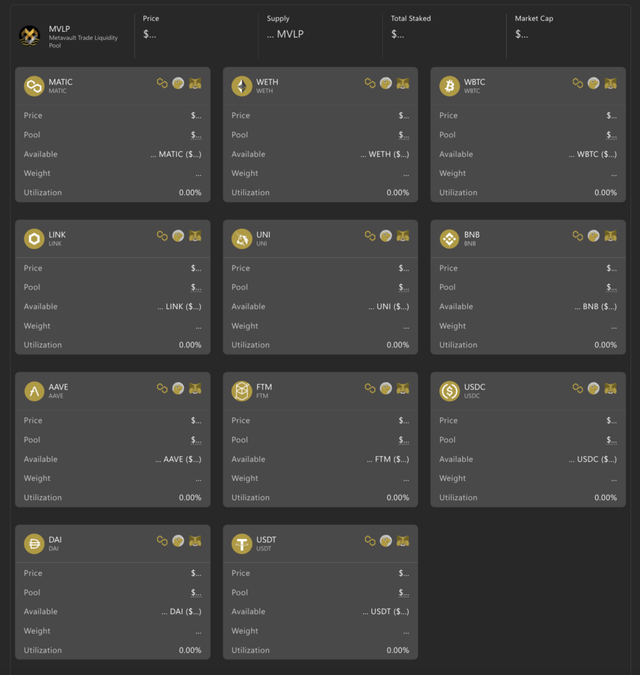

The Multi-Asset pool

The great innovation at the heart of GMX, and now of Metavault.Trade, is the Multi-Asset pool. All the assets supported by the platform are pooled together and a token called MVLP represents the index of these tokens. The price of MVLP will fluctuate with the prices of the underlying assets in the basket and the Profit and Loss (PnL) of the traders — when they loose on a trade, their losses flow into MVLP.

How does this shared liquidity lead to a reduced price impact swap solution? Let’s say for example that the pool is made up of five assets (BTC, ETH, MATIC, USDC and DAI) in equal proportions in terms of dollar value: 20% of each. If a trader wants to buy 50% of the BTC supply with USDC, they can do so instantly, without any price impact. After the order goes through, the state of the pool will simply become BTC: 10%, USDC: 30% and the rest unchanged. To understand how unique this feature is, I encourage you to check how much price impact you get for a very large order on a CEX with an order book or on a DEX like Uniswap!

At launch, the assets supported on Polygon will be six large caps and three stablecoins:

- BTC, ETH, MATIC, LINK, UNI, AAVE

- USDC, DAI, USDT

Now let’s get back to the pool in the example above. Post-swap, it is unbalanced compared to its initial state. The liquidity providers will be incentivized to deposit BTC and disincentivized to deposit USDC, which will lead to a rebalancing of the pool.

What the Metavault.Trade multi-asset pool could look like — © Metavault.Trade

What the Metavault.Trade multi-asset pool could look like — © Metavault.Trade

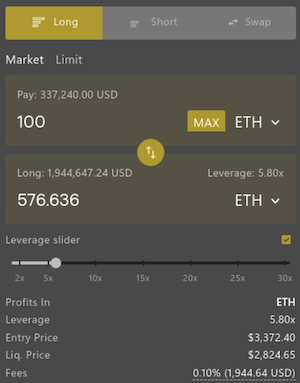

Metavault.Trade will also allow traders to go long or short with up to 30x leverage against any of these assets. The main innovation here is the way the price is set: the platform aggregates Chainlink and Time-Weighted Average Price (TWAP) pricing from major DEXes and CEXes. This greatly reduces the risk of liquidation from the temporary wicks you find on some exchanges. These are sometimes due to big players manipulating the order books on purpose to liquidate the other users. In that case they are called “scam wicks”!

A simple interface to choose to go long, short or just swap your assets — © Metavault.Trade

A simple interface to choose to go long, short or just swap your assets — © Metavault.Trade

The alpha

In my opinion, Metavault.Trade is likely to be adopted by two different types of users:

- Leverage traders on the lookout for decentralized platforms and/or protection from scam wicks.

- Users who need to swap large amounts of assets and will find a better price there than on any other AMM or even CEX.

The general opinion is that decentralized perpetual trading is still massively undervalued as a vertical and that it will grab an ever larger share of crypto trading market — mainly to the detriment of CEXes.

This alone would make it a project worth looking into; furthermore I think one needs to keep in mind what happened with GMX: it has been a huge success for those who were in early, either providing liquidity or buying the utility and governance token of the platform, $GMX.

IMHO, Metavault.Trade gives everyone a chance to be early in a project of the same quality as GMX and with even specific advantages over it:

- It’s built on Polygon, a chain where transactions are fast and cheap and onboarding users is easy. Plus, without entering too much in technical details, there are more Chainlink feeds on Polygon than on the chains GMX is on, and these are crucial for pricing and makes listing new assets easier.

- Its tokenomics allow for more incentives. The history of GMX is a bit complicated, it is a rebrand from the BSC project Gambit, and previous Gambit investors were allocated a large share of the GMX supply. There is no such previous investors with Metavault.Trade and this allows the protocol to reserve a larger proportion of tokens to reward farming when compared with GMX.

- A lively and engaged community. Metavault.Trade is part of a whole ecosystem of blockchain and technology projects under the umbrella of the Metavault DAO. They have an A team of developers and a lot of community members engaged in supporting their ventures.

There are two ways to get involved with Metavault.Trade: the simplest one is to be a liquidity provider and to mint MVLP by providing one of the asset listed on the platform. MVLP holders get a 70% share of platform fees.

One can also choose to hold MVX, the utility and governance platform token of the platform detailed in the last section.

$MVX token

Metavault.Trade will issue a utility and governance token for the platform, ticker $MVX.

The MVX token is particularly well designed in terms of rewards for the stakers. The rewards are simply piled one on top of the other.

MATIC rewards from platform fees

MVX stakers will get 30% of the fees collected from across the platform in the form of MATIC (on Polygon network).

Escrowed MVX

MVX stakers will get Escrowed MVX, esMVX, that can be used in two ways:

- esMVX can be staked, and so earn the holder the same rewards as staked MVX: MATIC rewards from platform fees, more esMVX and multiplier points.

- esMVX can be unstaked and vested to be converted and distributed as MVX. In that case, they stop earning the staking rewards though. Vesting esMVX then unlocks linearly over one year with MVX being distributed to you with each unlocking.

Vesting your esMVX also requires you to lock the average MVX/MVLP that earned you that esMVX in a vault. The MVX/MVLP in this vault cannot be sold, but does still accrue rewards.

The locked MVX/MVLP in the vault can always be withdrawn but this will stop any further vesting of esMVX.

Multiplier points

Staked MVX receives multiplier points that allow the holder to accrue protocol fee rewards: each multiplier point earns the same amount of MATIC as a MVX token.

But unstaking MVX or esMVX will incur a burning of multiplier points. This is a gamified system that rewards you points for staying staked for longer as the only way to acquire multiplier points is through staying for the long haul.

Public sale and IDO Data

Public sale

The public sale IDO of MVX will happen on the 1st of May on Uniswap (v3).

IDO data

- IDO Price: $1

- Total Supply: 10,000,000 MVX

- Initial Market Cap: $1,500,000

- Blockchain Technology: Polygon

Inference :

Metavault Trade is deeply committed to the development of the community. They designed the MVX token for significant use on the metavault platform. The goal is to make MVX the native vehicle for conducting transactions on the platform for users.

This is what I can say in this article. If you need accurate and reliable information, you can visit their official link, which I have provided below:

Website: https://metavault.trade/

Telegram: https://t.me/MetavaultTrade/

Twitter: https://twitter.com/MetavaultTRADE/

Discord: https://discord.com/invite/metavault

#PROOF OF REGISTRATION

Bitcointalk Username: meyer898

Bitcointalk Profile: https://bitcointalk.org/index.php?action=profile;u=2876938

Participated Campaigns: video/Article

wallet : 0xaD9c28728Ec0cc690F2790f5e9d3C18D7F169F8b

©

©  ©

©