What is the Relative Strength Index - RSI

The relative strength index (RSI) is a momentum sign that determines the magnitude of current rate modifications to examine overbought or oversold conditions in the rate of a stock or other possession. The RSI is shown as an oscillator (a line chart that moves in between 2 extremes) and can have a reading from 0 to100 The sign was initially established by J. Welles Wilder and presented in his critical 1978 book, "New Concepts in Technical Trading Systems."

BREAKING DOWN Relative Strength Index - RSI

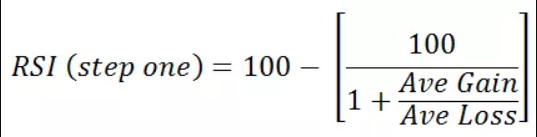

The relative strength index (RSI) is a two-part estimation that begins with the following formula:

The typical gain or loss utilized in the estimation is the typical portion gain or losses throughout a lookback duration. The formula utilizes favorable worths for the typical losses.

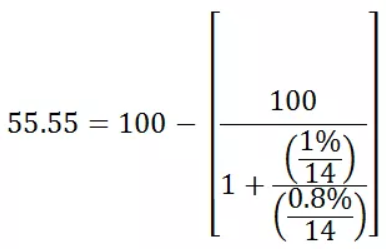

The requirement is to utilize 14 durations to compute the preliminary RSI worth. For instance, picture the marketplace closed greater 7 out of the past 14 days with a typical gain of 1%. The staying 7 days all closed lower with a typical loss of -0.8%. The estimation for the very first part of the RSI would appear like the following broadened estimation:

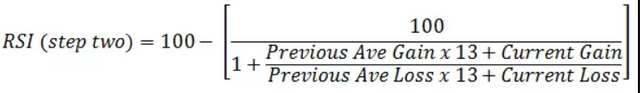

When there are 14 durations of information offered, the 2nd part of the RSI formula can be computed. The 2nd action of the estimation smooths the outcomes.

The RSI will increase as the number and size of favorable closes increase, and it will fall as the number and size of losses increase. The 2nd part of the estimation smooths the outcome, so the RSI will just near 100 or 0 in a highly trending market.

Conventional analysis and use of the RSI is that worths of 70 or above suggest that a security is ending up being overbought or miscalculated and might be primed for a pattern turnaround or restorative pullback in rate. An RSI reading of 30 or listed below suggests an oversold or underestimated condition.

As you can see in the previous chart, the RSI sign can stay in "overbought" area for prolonged durations while a stock remains in an uptrend. The sign can remain in "oversold" area for a very long time while a stock remains in a sag. This can be puzzling for brand-new experts, however finding out to utilize the sign within the context of the dominating pattern will clarify these problems.

Tips for Comprehending Overbought or Oversold Readings on the RSI

The main pattern of the stock or possession is a crucial tool in making certain the sign's readings are correctly comprehended. For instance, popular market specialist Constance Brown, CMT, has actually promoted the concept that an oversold reading on the RSI in an uptrend is likely much greater than 30%, and an overbought reading on the RSI throughout a sag is much lower than the 70% level.

As you can see in the following chart, throughout a sag, the RSI would peak near the 50% level instead of 70%, which might be utilized by financiers to more dependably signal bearish conditions. Lots of financiers will use a horizontal pattern line that is in between 30% or 70% levels when a strong pattern remains in location to much better determine extremes. Customizing overbought or oversold levels when the rate of a stock or possession remains in a long-lasting, horizontal channel is normally unneeded.

An associated principle to utilizing overbought or oversold levels suitable to the pattern is to concentrate on trading signals and strategies that comply with the pattern. Simply put, utilizing bullish signals when the rate remains in a bullish pattern and bearish signals when a stock remains in a bearish pattern will assist to prevent the numerous incorrect alarms the RSI can produce.

Strategies for Utilizing the RSI Indication

Divergences

A bullish divergence happens when the RSI produces an oversold reading followed by a greater low that matches similarly lower lows in the rate. This suggests increasing bullish momentum, and a break above oversold area might be utilized to set off a brand-new long position.

A bearish divergence happens when the RSI produces an overbought reading followed by a lower high that matches corresponding greater highs on the rate.

As you can see in the following chart, a bullish divergence was determined when the RSI formed greater lows as the rate formed lower lows. This was a legitimate signal, however divergences can be uncommon when a stock remains in a steady long-lasting pattern. Utilizing versatile oversold or overbought readings will assist determine more legitimate signals than would otherwise appear.

Swing Rejections

Another trading strategy takes a look at the RSI's habits when it is reappearing from overbought or oversold area. This signal is called a bullish "swing rejection" and has 4 parts:

- RSI falls under oversold area.

- RSI crosses back above 30%.

- RSI forms another dip without crossing back into oversold area.

- RSI then breaks its latest high.

As you can see in the following chart, the RSI sign was oversold, separated through 30% and formed the rejection low that activated the signal when it bounced greater. Utilizing the RSI in this method is extremely comparable to drawing trendlines on a cost chart.

Like divergences, there is a bearish variation of the swing rejection signal that appears like a mirror image of the bullish variation. A bearish swing rejection likewise has 4 parts

- RSI increases into overbought area.

- RSI crosses back listed below 70%.

- RSI forms another high without crossing back into overbought area.

- RSI then breaks its latest low.

The following chart shows the bearish swing rejection signal. Similar to a lot of trading strategies, this signal will be most trusted when it complies with the dominating long-lasting pattern. Bearish signals in unfavorable patterns are less most likely to produce an incorrect alarm.

Relative Strength Index (RSI) Summary

The RSI compares bullish and bearish rate momentum and shows the lead to an oscillator that can be put together with a cost chart. The sign can vary in between 100% and 0% and is thought about overbought when the sign is above 70% and oversold when the sign is listed below 30%. Like a lot of technical indications, its signals are most trusted when they comply with the long-lasting pattern. Real turnaround signals are uncommon and can be hard to separate from incorrect alarms.

Posted from my blogRavi Kash : https://ravikash.com/with-is-relative-strength-index-rsi-how-it-works/

Ho! Ho! Ho! Merry Christmas!!! I've given you an upvote and left you this amazing automated comment!!!!

Vote for my witness nextgencrypto!!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit