INTRODUCTION

When it entails pegging digital property to the charge of precise objects or services, undercollateralized algorithmic stablecoins have always been the holy grail pursued cash through all teams. Fundamentally speaking, the steadiness of these property is really pushed via the market supply and name for mechanism and an cheaper token model. The optimized mixture will due to this fact push the price to a high-quality state.

ABOUT HTCCASH

Huobi Token (HT) is the major asset at the Huobi Ecological Chain (HECO), and with the continuous enchancment of the HECO ecosystem, a digital asset that pegged to HT will necessarily be had to meet the creating name for transactions. On the solely hand, the transaction is completed on HECO. Compared with the immoderate GAS fee at the ETH chain, the transaction charge on HECO is reduce and tempo is faster. On the contrary hand, digital property pegged to the United States dollar and gold will depreciate with the inflation of anchors, and the total volume of HT is constant, so there can also be no devaluation problem.

Here, they advise an experimental current stablecoin assignment: HT ANCHOR CASH, which pegged to HT and is an stepped ahead mannequin of Basis Protocol. The primary enhancements are as follows:

The charge feeding mechanism is specifically primarily based definitely at the 12-hour weighted frequent fee of the HT-HTC shopping for and promoting pair at the decentralized alternate to reduce the hazard of price manipulation;

The time of Rebase is adjusted to as quickly as every 12 hours, at 8:00 and 20:00 SGT respectively;

The more issuance range of tokens for each and every rebase size is adjusted to: 95% of the entire distribution of each and every rebase, and the contrary 5% is going to the treasury in choice to the special a hundred percent on Basis Protocol. The adjustment proper right here ought to make the treasury more rewarding and compulsorily redeem HTB Bonds, even as the charge of HTC is reduce than 1 HT, it is going to greater encourage clients to alternate bonds and maintain balance.

The transaction charge of stablecoins interior a effective minting time reaches 1.1 HT (now no longer the special 1.05), and in addition issuance can be executed to beef up the steadiness of the greater issuance rate;

Extend stablecoin mining time, information greater HRC20 foreign exchange mining, and enhance consensus.

HT ANCHOR CASH TOKENOMICS

There are three(3) patterns of tokens withinside the HT ANCHOR CASH protocol, especially HTC (HT ANCHOR CASH), HTS (HT ANCHOR CASH Share) and HTB (HT ANCHOR CASH Bond). HTC and HTS may also be acquired via presenting liquidity, amongst which HTC is pegged to HT rate to at least 1 HT (HTC:HT=1:1). HTS holders can take phase in board staking to accumulate the pinnacle fee income generated via HTC after inflation. The board of directors can be opened for 4 days after the venture is opened. HTB is a bond issued at the same time as the charge of HTC is a good deal much less than 1 HT and may also be used to repurchase HTC. When charge of HTC exceeds 1.1 HT, HTB holders can alternate HTC once more at ratio of 1:1.

HT ANCHOR CASH STABILIZATION MECHANISM

The HT ANCHOR CASH protocol will set a threshold for token price balance, and the steadiness mechanism can be added about at the same time as it is miles above or beneathneath this threshold.

When HTC is Beneathneath 1 HT

When HTC is traded beneathneath 1 HT, clients can be succesful of purchase HTB at a tremendous good deal to set up the price stability of HTC, with the expectancy of future salary upon redemption.

Each bond ensures the holder exactly 1 HTC quicker or later withinside the future under wonderful conditions. Whenever a client purchases HTC, it is miles burned, inflicting a decrease withinside the circulating cash deliver. Bonds do now no longer have interest payouts, nor do they've maturity or expiration dates. Rather, they may additionally be redeemed on a 1:1 ratio with HTC at the same time as the price rises above 1.1 HT.

Purchased bonds may additionally be redeemed on a 1:1 ratio with cash handiest even as the oracle price of cash is above 1.1 HT. This prevents bondholders from lowering their losses on redemptions and developing vain will amplify in deliver.

When HTC Exceeds 1.1 HT

If the fee of HTC exceeds 1.1 HT, bond redemptions can be delivered about. If the fee of HTC stays traded above 1.1 HT even after bonds are redeemed, new HTC can be minted as a end result of the growing name for and can be extraordinarily disbursed to HTS holders.

The HTC Token Distribution Plan

HTC has no pre-mining, it is miles sincere distribution

HT ANCHOR CASH launches eleven preliminary mining pools, clients can stake HT, HUSD, HBTC, HETH, HLTC, HBCH, HDOT, HBSV, HFIL, (property on Heco)DEX token RAB and algorithmic robust token BAG, a entire of eleven HRC-20 property to take phase in HTC mining.

The typical supply of HTC is 11,000. As a reward, it is moderately disbursed to each mining pool. Each mining pool can mine 1,000 HTC for 10 days, and each mining pool produces 100HTC in accordance to day.

HTS distribution will begin at as soon as after HTC starts offevolved to distribute, totaling 2,100,001, of which 5% willbe dispensed to DAO and early investors, moreover this issue can be used for advertising and marketing and centralized alternate listing, this component can be unlocked in share to the mining output, no pre-mining. 1 HTS due to the fact the preliminary liquidity can be brought to the liquidity pool on DEX, two million HTS are mined and dispensed to 4 mining pools:

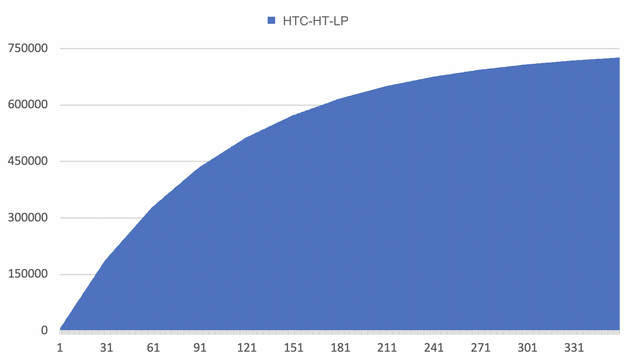

- HTC-HT-LP mining pool: 750,000 HTS

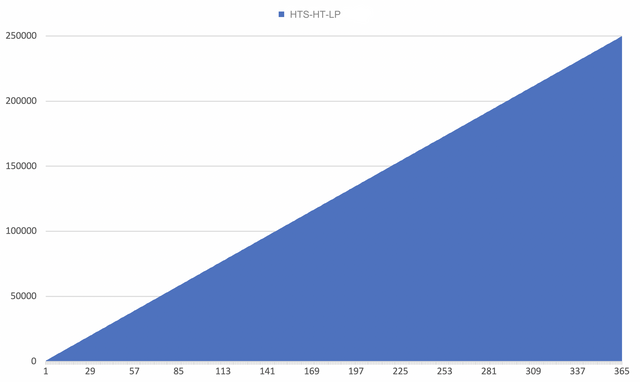

- HTS-HT-LP mining pool: 250,000 HTS

- HTC-HUSD-LP mining pool: 750,000 HTS

- HTS-HUSD-LP mining pool: 250,000 HTS

The HTS-HT-LP mining pool and HTS-HUSD-LP mining pool will distribute the equal range of tokens every day, that is, 684.9315 HTS, to be capable to be launched linearly in a single year.

The HTC-HT-LP mining pool and the HTC-HUSD-LP mining pool every launch 187,500 HTS withinside the predominant 30 days, and decreases 750days

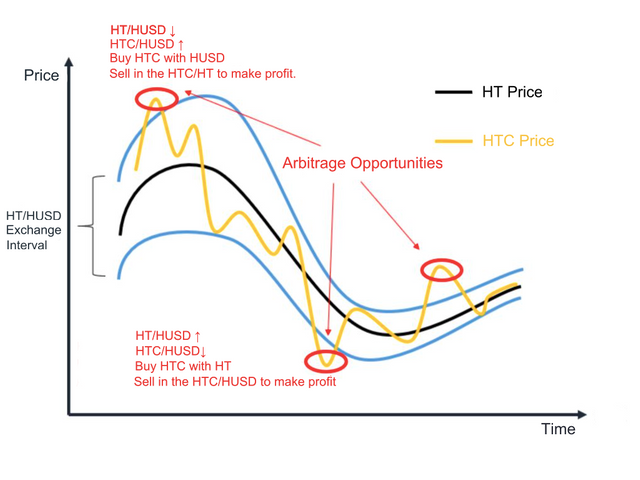

The key aspect of the format graph is to make the price linkage amongst HTC and HT closer, and introduce arbitrage space:

When the alternate ratio of HT to HUSD will increase, the charge of the HTC-HUSD shopping for and promoting pair withinside the decentralized alternate will appear short-time duration low. Users can choose out to keep for HTC with HUSD and promote withinside the HTC/HT to make profit.

When the alternate ratio of HT to HUSD drops, the price of the HTC-HUSD shopping for and promoting pair should have a short-time duration immoderate rate. Users can select out to keep for HTC with HT withinside the HTC-HT shopping for and promoting pair and promote withinside the HTC/HUSD to make profit.

Join The Network and Take Part in Governance

The launch of HT ANCHOR CASH on HECO is a high-quality reputation of HECO’s fundamental position withinside the DeFi industry. Here, they invite every participant and patron in Huobi, HECO and one-of-a-kind DeFi ecosystems to take phase withinside the mining and governance of HT ANCHOR CASH. They will in truth stop up a pivotal participant withinside the DeFi and HECO ecosystem.

Thanks for your reading, for more knowledge about HTCCash, visit

Website: https://www.htc.cash/

Twitter: https://twitter.com/HtcCashofficial

Telegram Group: https://t.me/HTC_CASH

Telegram Channel: https://t.me/HTC_CASH_CHANNEL

Writer's details;

Bitcointalk Username: Cryptolysm

Bitcointalk profile URL: https://bitcointalk.org/index.php?action=profile;u=2822410

Proof of Authentication URL: https://bitcointalk.org/index.php?topic=5308826.msg56110725#msg56110725