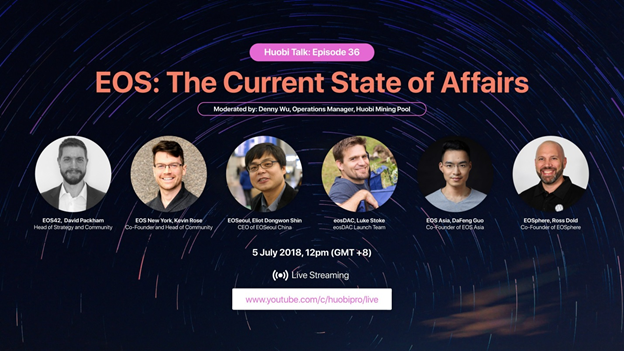

Hi everyone, today I will give you a interesting information about Huobi Talk hosted a panel discussion on EOS technology updates and another hot button issue, which is the frenzy surrounding RAM trading.

Link to interview:

EOS is a blockchain platform for the development of decentralized applications (dapps), similar to Ethereum in function. It makes dapp development easy by providing an operating-system-like set of services and functions that dapps can make use of.

The idea behind EOS is to bring together the best features and promises of the various smart contract technologies out there (e.g. security of Bitcoin, computing support of Ethereum) in one simple to use, massively scalable dapplication platform for the everyday user to empower the impending blockchain economy.

EOS was released on Huobi Exchange paired with USDT, BTC, ETH and HT

If you do not have a Huobi Pro account , you can join the link below to exchange EOS token easily and safely the following link:

https://www.huobi.br.com/en-us/topic/invited/?invite_code=da523

What makes the difference that the EOS platform makes?

It has been converted from PoW, PoS to DPoS

Proof of Work was created almost two decades ago in 1999, by Markus Jakobsson and Ari Juels. The main goal of PoW is to deter denial-of-service attacks (DDOS) by requiring (computational) work to be done before block submission. This means that, in order to mine a Bitcoin block, you have to spend/have computational power/energy.

Proof of Stake (PoS) is another consensus structure, like PoW, but instead of requiring work or computational power, it requires the miner to hold a large amount of the cryptocurrency. Let's say cryptocurrency "Stakeproofcoin (SPC)" relies on Proof of Stake, and that Bob owns 2% of all of the SPC in existence. This means that the probability of Bob mining a proof-of-stake block is 2%. Proof of Stake aims to prevent attacks by having high requirements for such an attack (like PoW) and by lowering incentives dramatically. In order for Bob to attack SPC, he would need to own a majority (51%, let's say) of all SPC coins, which would require a lot of money in the first place. Also, his incentive to attack is very low, since if he does attack SPC he would suffer dramatically from his own attack (because he owns so many SPC).

Delegated Proof of Stake (DPoS) is a newer consensus structure, and is actually behind many cryptocurrencies including Steem. It's somewhat similar to PoS but has different and more "democratic" features that some say make it more efficient and fair.

Users of a DPoS crypto vote for delegates/witnesses to serve on a panel of witnesses. Lots of variables within the network such as transaction sizes and fees are controlled by this witness panel. The witness panel also (deterministically) selects witnesses to "witness" or confirm blocks. Clearly, the network and users place a lot of trust in these elected witnesses to give them such powers, yet if they misbehave, they can easily be voted out of the "witness panel," so there is really no incentive for them to misbehave or upset their voters. PoS has been shown to help maintain decentralization, fend off regulatory interference, and has made cryptos like Steem into world players. This is also why you should take your witness votes on Steem very seriously; the people you vote for are possibly the ones who will be deciding/shaping the future of the network as well. Just like a democracy, the system will work better and be more decentralized/fair if more people participate and are informed.

In conclusion, these three consensus systems are at the heart of many cryptos and exist to keep cryptocurrencies decentralized, hard to attack, and secure.

It’s a consensus mechanism because it is a decentralized protocol with a democratic, self-governing, free-ranging, and inclusive community.

DPoS is more efficient than PoS mechanism. One of the main difference between DPoS and PoS is that in the DPoS consensus system, community members have more administrative rights in the network.

After the research time, I understand that the idea is to create a market in RAM where speculators can trade RAM depending on the popularity of application (Which uses more RAM when there are more users, and less when there are less.). But since ALL applications will require RAM, this makes RAM a commodity like electricity. Since it is a necessary utility, if a group can create a monopoly on RAM, then it will be incredibly profitable

On the EOS network, RAM is mostly used by developers to store the data used in the launching and production of decentralized applications. There are speculations that a new issue is added to the list of other EOS problems. EOS is offering buying and selling of RAM which is another source of guesstimate while the token’s market price is stagnant

When traders “buy” RAM, the trader stakes for it, using EOS, which locks it up while the trader has the RAM. The trader pays a price determined by the system based on the current percentage of RAM in use which is staked for by traders.The trader pays a 1% EOS fee while doing this. Later, when the stake is undone on RAM, the trader pays a 1% fee again after which the account of the trader is either increased or decreased by the differences in the price of EOS from the time of buying to selling.

More infomation in video:

EOS is currently more expensive

EOS is powered entirely by 21 block producers, who are responsible for putting resources like RAM into the system and setting prices for each . At the time of writing, RAM on EOS is going for about 0.65 EOS/KB, or somewhere in the ballpark of US$5 per kilobyte. Actually trying to use the EOS platform for a large scale application is set to cost somewhere in the ballpark of hundreds of millions or billions of dollars at market prices.As it stands, EOS is relatively cheap for users but extraordinary expensive for anyone who actually wants to develop an application for those users. Those users will have to pay the cost of creating an EOS account though, which currently stands somewhere in the field of US$20.

In a nutshell, the current system has block producers paying standard fees to those cloud service providers, then deliberately being a system bottleneck for the purpose of creating artificial scarcity and driving up the price of the system resources they control. These system resources have now spawned a secondary market of their own, and RAM is being traded as a speculative asset.

Anyone who wants to actually use the EOS platform needs to purchase RAM from somewhere, either by cutting a deal directly with block producers or by going through this monumentally expensive secondary market. The only real fear for RAM prices is that block producers might release a lot more into the circulating supply to crash prices, but they know exactly when and how this will happen and have little reason to devalue the asset that they can control

What's the solution?

As EOS Nation said, their goal is to make money not friends, and making money is the only reason to become a block producer in the first place. No amount of cooing about EOS's sense of community can solve this problem. If nothing else, it highlights that block producers cannot be trusted

With EOS's current dire state of being, a rational block producer wants to make as much money as possible as fast as possible, then get out while the thing crashes and burns behind them.

The go-to solution would probably be to amend the EOS constitution again and this time ban speculative hoarding of EOS system resources, but at that point, you're well and truly in a cycle of just trying to slap down one human-made loophole after another. To make matters worse, you can't even amend that constitution without majority approval from the very same block producers who are proving themselves hostile to the system.

Another possible solution is for Block.one to use its majority control of the EOS network to handpick block producers and start running EOS as a centralised entity. But at this point, it's blatantly just a brokerage service with its own token, buying network resources from different providers and then selling it onwards at a profit to gullible users.

A third option is some sort of automated system to enforce fairer RAM prices. It would have to be tamper proof though and free from the influence of hostile block producers. Ideally, it would also be relatively cheap to run. An Ethereum contract could probably do it

At the time of writing, EOS is the number five coin by market cap, with prices up over 15% in the last 24 hours

Over alll of the options above EOS is such a usable platform with the best technology. I’m pretty sure that the provide of this application is complete, it can not be transaction, and not a payment to be able to be done with it. I'm really very expected EOS will be known and used by most of people and become one of the best blockchain platform for the development of decentralized applications in the near future

More information here :

Huobi Pro: https://www.huobi.br.com/en-us/topic/invited/?invite_code=da523

Youtube:

Reference list:

https://medium.com/@bensig/eos-block-producer-faq-8ba0299c2896

https://ambcrypto.com/eos-eos-ram-trading-reddit-discussions-speculations/

If you like this content please like, share and comment

This is just my opinion and not financial advice . Thank you !

Congratulations @loideptrai! You have completed the following achievement on Steemit and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard:

SteemitBoard World Cup Contest - Semi Finals - Day 1

Participate in the SteemitBoard World Cup Contest!

Collect World Cup badges and win free SBD

Support the Gold Sponsors of the contest: @good-karma and @lukestokes

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thank you !

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit