If you own any type of a Universal Life Insurance policy or if you are the beneficiary of a Universal Life policy, this is a cautionary story that needs to be read, understood, and shared with your loved ones.

I came across this article ( http://bit.ly/2E6xnJn) on the web that shares a story very similar to what I’ve encountered over the years when reviewing existing Universal policies for new clients. The article tells the story of a 98 year old woman who purchased a Universal life insurance policy when she was age 67.

If only this woman and her church affiliated agent had better understood how Universal Life policies were designed to work, her current predicament of rapidly decreasing cash values and a death benefit that disappears at age 100 could have been avoided.

Unfortunately, this is not an isolated incident and newer versions of Universal policies such as Variable Universal Life (VUL) and Indexed Universal Life (IUL) can carry the same risk as traditional Universal Life (UL) policies.

When these policies are reviewed many are surprised to discover what they have and what they thought they had are two different things.

The reason why is pretty simple. Most life insurance agents can better explain how they get paid from selling life insurance than how the products they recommend are priced. And who suffers the most? Consumers with a late case of buyers remorse.

If your objective is to have a guaranteed death benefit, you have 2 options.

*Option 1: Buy a Whole Life policy.

I focus on implementing the Infinite Banking Concept (IBC) with IBC designed Whole Life policies in my practice but any Whole Life policy will do. Not only will you have a guaranteed death benefit but with existing Whole Life policies you will also have guaranteed cash values out to age 121. That’s a win-win. (For those with a limited budget, you can even find Final Expense Whole Life policies to cover burial or other end of life services.)

Option 2: Buy a Guaranteed Universal Life to Age 121 (GUL)

You’ll at least have a guaranteed death benefit to specified age but make sure you get a GUL with a guaranteed death benefit to age 121. Some GUL contracts provide guaranteed death benefits to age 85, 90, or 100 in exchange for a lower premium. You could outlive those policies so if financially possible go with a contract that guarantees a death benefit to age 121 even if it means having a lower death benefit.

If you currently own a Universal Life policy, I highly recommend you request a review of your policy. You can visit my calendar to request a time: http://www.cita.com/v/john.montoya

If you would like to understand why Universal policies don’t always work out as intended, please keep reading.

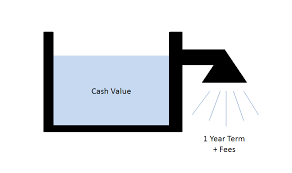

The 98 year old woman from the above article explains that she feels she’s being penalized for living so long because if she lives past 100 years old, her policy will go away without paying a death benefit. This is true because all Universal Life policies have one basic flaw working against consumers whether they realize it or not.

As a person gets older, the rising cost of insurance must come from somewhere. It either gets paid from existing cash values which erodes the savings portion of the policy or it comes out of pocket of the policyholder directly in form of premium. There is no way to avoid this expense because Universal policies use an annual renewable term chassis. Each year the cost goes up.

Only Whole Life policies have a fixed premium guaranteed for life.

It’s a potentially catastrophic design flaw because the risk of the policy not paying a death benefit is assumed entirely by the policyholder which means the life insurance company is off the hook of paying out a death benefit if and when policy lapses due to lack of cash value or ability to keep up with the rising premiums.

Make sure you choose the best life insurance policy that will protect you and your family even if you live to age 121!