Words said long ago, but never have been truer than in this modern, social-media driven world of Perceptions. It is how you appear; rather than who you are, that decides whether the player gets lost in the crowd or stands apart to deliver a performance of a lifetime.

Today, even the dreamers and the builders have to be a salesman first. Because every step on the way is a presentation, a sales pitch. Unfortunately, it’s not just your innovation that an innovator needs to sell, it’s also their own personality.

Imagine walking up to the stage with your idea. An idea that you’ve quit your job for, an idea that has kept you awake at nights, an idea that has caused burns in your eyes because of working on your laptop screen for too long, an idea that made your loved one feel like a second priority.

Your idea. Your brainchild.

You walk up to the stage to present your work in front of influential investors who will sit in their comfy sofas and listen to your 2 years of hard work in a 2-minute “pitch”. And then realizing, they never really liked you and call you nervous, awkward, and speak how cold you are.

Look at what happens to this guy here:

The whole process of fund raising is very subjective. To raise money for your product you just don’t need a rock-solid product, but you also need to be:

- Charismatic

- Well-polished

- Have pedigree– big companies, flashy college degrees on your CV

- Perfect salesman, and

- Not have a sweating problem

No way in hell will a product person, a person who creates revolutionary technology is going to be all that. They will be labeled as ‘introverted geeks’, who need a savvy, corporate sales executive to sell the product.

So, a product inventor — instead of focusing on the product — has to focus on doing marketing gimmicks.

This is because the fund-raising market is a private circle, where only the familiar and the un-maverick ones who follow the rules of the game get in. And hence, a ton of entrepreneurs, genuine hard working radical inventors lose the opportunity to raise money and take their product to the masses.

It was the case.

Until someone broke this little private circle of funding. Until someone democratized fund raising. Until ICOs arrived.

ICOs — or Initial Coin Offerings — are what you would get if a Bitcoin and Crowdfunding had a baby. Just like in an IPO (Initial Public Offering) a company sells its equity shares to the investors, in an ICO an innovative company sells a proprietary cryptocurrency, also known as a Token.

These tokens offered by the company for sale may either:

(1) Represent a form of equity or ownership in the company, with a right to dividend/profit-share

(2) Be promotional money to use the service, for eg: Game coins

(3) Provide access to the services of the product

Case (1) is quite similar to that of an IPO launched by a big company, i.e. sale of equity. Cases (2) and (3) are a ways of selling the underlying product/service itself.

In most cases, the value of the ICO token (or the Coin) would be related to the use and growth in the underlying service itself. This is because the Token powers the underlying working model of the product.

Eg. Consider a hypothetical ID management solution that is built on Blockchain. Let’s call this company Identity Management Pvt Ltd (IMPL). For every personal identity the company saves on its blockchain system, it uses 1 IMP Coin.

Thus, IMP Coins have an inherent demand in the product.

The more the business, the more the product is being used, the more the demand for IMP Coins, and the more the price of IMP Coin — the ‘proxy’ asset indicating how the platform and the company are doing.

In any case, ICOs do something dramatic. They open up avenues for both investors and startups.

Investors:

- Accessibility:

Can you as an individual investor today purchase Uber stocks and invest in Uber? The answer is clearly no, because Uber’s stock is not available for public trading. Only selected private investors — with a large capital and who are in contact with Uber management — can invest privately in Uber.

ICO investors get a chance to invest in the startups with starting amounts that may be as small as $1. It is because Tokens are available to public at large for trading. These tokens are often listed on Cryptocurrency exchanges where hundreds and thousands of trades are made everyday.

- Liquidity:

ICOs are also an innovative way to make private investments public, thereby giving the investors the option to enter or exit the investment any time. E.g. Today a big Uber investor can’t simply sell their stake in the company and get their money back. Not even if they urgently need that money. This is because there is no public market for Uber stocks.

Compare this to a listed Token of a startup, wherein the investor can sell their holdings anytime on the exchange (much like the stock of say “Apple”) and get their investment money back.

- Valuation:

Another problem with private investments is that the value of the investment cannot be determined on a daily basis. This is because there is no buy/sell that happen in the stocks of that company and hence the market does not know the value of the stock. e.g. What will be the impact on the price of Uber stock, when the former CEO Travis resigned?

ICO investors get a real-time picture on the valuation of the company. So, clearly for the investors ICOs are a much better way to invest in startups and innovative ideas than through private VC players.

Founders:

The startup founders on the other hand also find ICOs much more attractive because of the following reasons:

- No Loss of Board Seat:

The private funding route often requires the founders to ‘offer’ a Board seat to one of the representatives of the VC. This often leads to different voices in the decision making process and sometimes results in frictions. This is only natural because the VC and the Founders have different goals most of the times.

In an ICO, the company’s founders have complete freedom to pursue their vision and not get compromised by the commercial intervention of private investors. All the Board seats belong to the founders and the employees of the company — the people who have devoted their blood and sweat to create a revolutionary product.

- Instant Funding:

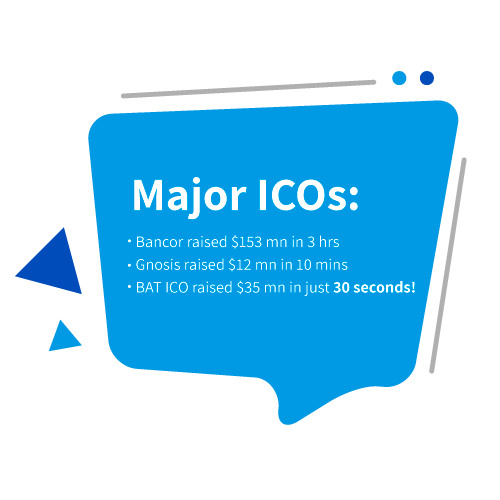

ICOs or Token Sales are a really quick way of getting funded. It does not require the company and the founders to go through the traditional methods of financial statement, legal frameworks, pitching contests, and the likes. In fact the system is completely automated, especially for a blockchain-based startup.

We all know that when startups seek funding it becomes a full-time exercise for the founders, so much so that they have to take focus off their work and dedicate weeks solely to the task of raising money. ICOs allow the product creators to focus on the important tasks, viz. improving and selling the product.

Some successful ICOs have raised money in excess of $10 million in seconds.

- Public Funding aka Captive pool of supporters:

A private fund raising effort requires you to go behind closed doors and have discreet conversation with your potential investors. On the other hand, ICOs come with a public announcement which gives instant publicity to the company and the product.

Furthermore, the number of investors in ICO is much much more than a private funding exercise. So, if you raise $1mn ICO funding at an average investment ticket of $100, you effectively get 1,000 investors.

This means 1,000 supporters, customers, and network contacts for your product instantly. Try beating that Private Funding!

- Real-time indicator of Market Acceptance:

Ever stuck wondering about how will the market perceive Version 2.0 changes in your product. Issuing a coin that is a proxy for the business sentiment of your product gives you an immediate insight on how the public at large perceives your product.

Every change you make to the product will be observed, analyzed, and debated by a large number of expert investors, in real time. This gives you a far better insight on market perception and gives you instant feedback about the product.

Constitution of an ICO:

A normal Token Sale or ICO has the following components:

- Idea:

The core product. The motivation, the raison d’être. Ideally for an ICO offering, there should be an inherent blockchain system in which the token (to be sold) plays a crucial part.

As a matter of fact, simply integrating a blockchain and a tokenized system within your existing business idea would increase the value of your solution dramatically. Needless to say, it’ll also make your innovation will be future-proof and forward looking.

- Technology:

A token would need to be created to be made available for sale. This can be done by creating your own blockchain (like the Bitcoin blockchain) or by riding on an existing and established blockchain (like the Ethereum blockchain).

A vast majority of Token sales involve tokens built on the Ethereum technology. This simply means you add your customization to the Ethereum blockchain.

Ethereum based tokens have publicly available standards (protocols) that are widely accepted by the community and considered safe. ERC 20 and ERC 23 are the most widely used Ethereum based token standards. One can also build a Minereum based coin, which can be deployed in under 5 minutes.

- White paper:

A White Paper is a detailed document that explains everything about the product, the company, the token, and the launch plan. Consider it to be like a pitch book. Some of the key things that should be included in a White Paper are:

Description of Idea

Product working details

Technology details; including Token standards

Team Profile

Valuation of Tokens; including total amount to be raised

Timeline of fundraising efforts

Deployment of funds

Disclaimers, if any

A White Paper can potentially make or break an ICO. The potential investors are looking for a solid working model, an explanation of the valuation of the token, and the future business prospects. A good White Paper explains things at both a simple and a technical level, and ideally contains all the supporting data, charts, and references for a meticulous investor to base their decision on.

- Marketing Collaterals:

A key part of the fundraising is spreading awareness about your product and the Token Sale. Fortunately, marketing an ICO usually does not require a widespread B2C marketing campaign. Most of the investors follow some key websites and blogs to track upcoming ICOs.

The most important of these is an ANN (short for Announcement) thread at BitcoinTalk forum. The ANN thread must be carefully drafted to give a snapshot to the hundreds of cryptocurrency investors who go through the forum. This thread is built using (the traditional) BB Code.

BitcoinTalk ANN thread of your ICO is so crucial that even popular ICO listing websites and exchanges (like Smith & Crown) will ask for the ANN thread link before displaying your ICO on their platform.

In addition to these, a lot of Token Sale offerings deploy what is known as a ‘Bounty Program’. Though completely optional, a bounty program helps to create a buzz around your ICO. It essentially is a reward program for online citizens to complete certain promotional tasks related to your crowd sale. Standard tasks in a Bounty Program include — Publishing blog posts in major Bitcoin forums, Facebook/Twitter activities (Likes, Comments, Shares etc.), Video creation, Managing Reddit and BitcoinTalk Threads, etc.

Bounty program participants are usually compensated by the coins under sale.

Fund Management:

The fund management aspect includes various aspects by which a potential investor can track, invest, and potentially trade in your token for sale. The most important task here is to create a Pay-in link for your investors. Using this link (usually created on the investor’s cold wallet) an investor can purchase the tokens you are selling for Bitcoins, Ethers, etc.

Some ICOs also introduce an Escrow mechanism. Under this arrangement, the funds deposited by the investors are kept in a smart contract based escrow account and moved to the company’s account only when certain conditions (E.g. achieving a set minimum amount of funding) are met.Roadmap:

Usually ICOs are offered in 2 different timelines. One is called as the pre-Sale, which is like a preview sale. A pre-sale usually marks about 10–20% of the total coins for sale, offered at a discount of 10–25% from the sale value. Once, the pre-sale window closes the normal sale window happens, which can last as long as a month.

Summary:

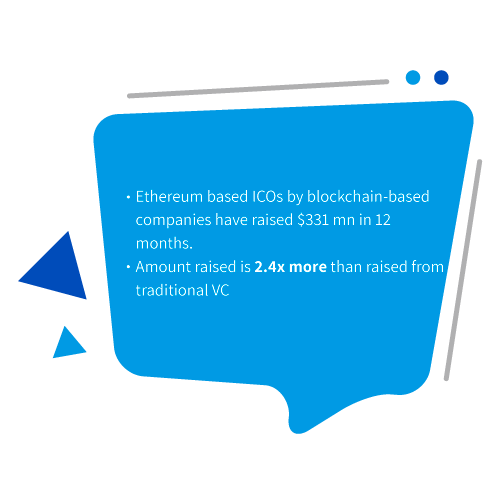

To summarize, ICOs are a modern way of funding which is disrupting how startups raise capital. It is expected that the process and technology highlighted above would become the norm for any fund raising exercise in the future. Private investments; especially for startups, are expected to become a thing of the past.

In 2017, blockchain startups have raised far more money by the ICO route than the traditional VC route. 2018 will be no different. Even marquee VCs and Angels (like Richard Branson and Tim Draper) have stepped in to the ICO game.

It’s time your product spoke for itself now. It’s time, your hard work is not rejected because of superficial reasons. It’s time that the actions speak louder than words.

So be shy, be introverted, be who you are, and –

The article was originally published on Medium. https://medium.com/@anantmendiratta/initial-coin-offering-the-funding-route-that-every-geek-entrepreneur-should-know-about-2514377d163

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://medium.com/@anantmendiratta/initial-coin-offering-the-funding-route-that-every-geek-entrepreneur-should-know-about-2514377d163

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit