This time we will focus on the crucial thing for every Initial Coin Offering – the coin itself.

ICNQ membership token is based on ERC-20 protocol. From 20 million issued tokens, 15 million were available for purchase through the crowd, private and institutional sales. The token itself (ICNQ Club Membership token) is a fuel for the accelerator program.

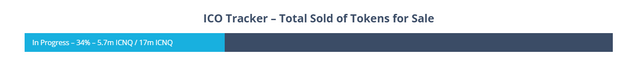

Today, when the ICO has finished the project sold 5,7 million of tokens, which gives 34% of the aimed amount. Although this number can be a bit higher when all payments will be calculated.

What makes a very good result in the actual market situation.

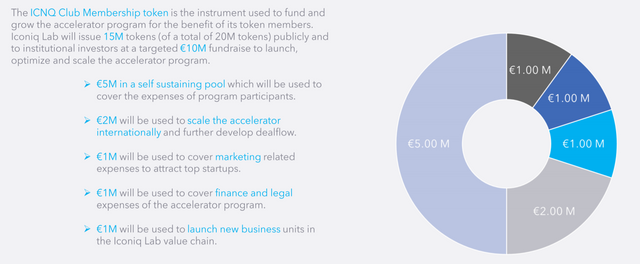

But it means that data of funds allocation is not actual anymore. For our usage lets change millions into the percents. So 50% of the funds is a self-sustaining pool which will be used for covering the participants' expenses. More about the offer for start-ups you can find here: https://steemit.com/ico/@annahare/iconiq-an-ico-hub-fuelled-by-the-blockchain-description

20% will be used to scale the accelerator, 10% for covering the marketing expenses, 10% for covering finance and legal expenses and last 10^% for the new business launching in the Iconiq Lab chain.

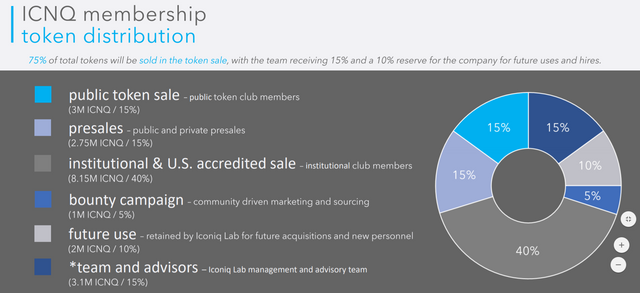

If we talk about the tokens usage. 75% were available during the pre-sale and sale (15% for a presale, 15% for the crowdsale and 40% for the institution sale). 15% will go for a team and 10% will make a reserve fund. 5% will be given for the bounty campaign, 15% goes to the team and advisers and 10% will be kept for the further use.

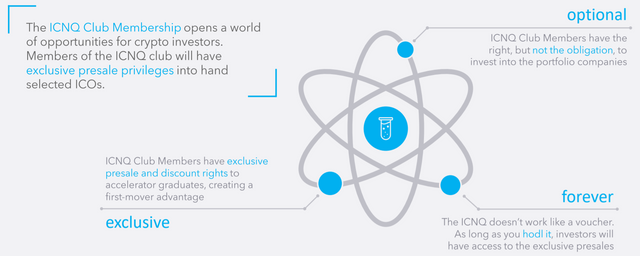

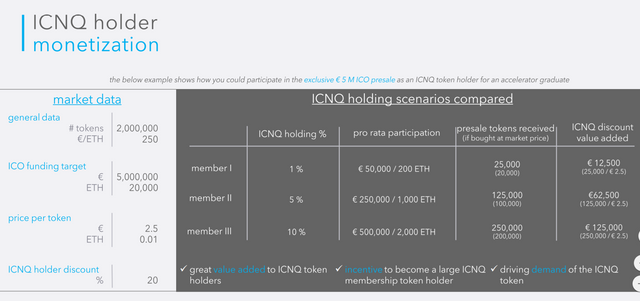

The ICNQ token holders becoming the same ICNQ Club Membership. This is giving them some privileges like the access to the exclusive presales and discount rights, of course until they hold the tokens.

ICONIQ in their Whitepaper pointed out even more benefits:

‘The main benefits of the ICNQ Club can be summarized in the following ways:

- A curated flow of attractive, high potential ICO participation opportunities

- Exclusive access to presales of accelerator graduates

- Exclusive access to extensive information for evaluating ICO participation opportunities

- Extensive transparency with detailed, standardized reporting on uses of funds, financial performance and milestone achievement.

- Market-based valuation for their ICNQ and accelerator token holdings through due diligence performed and liquid exchanges.’

Below you can see how the discount scheme is going to work.

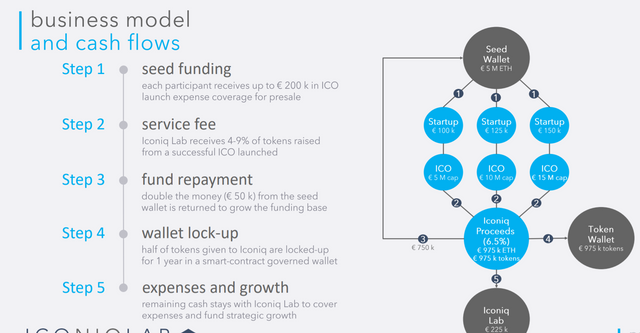

I already wrote in one article that ICONIQ reminds the skyscraper in suburbia. Indeed the whole complexity of this project is amazing. One of the reasons for me to think so it the cash flow model.

Below, in 5 steps scheme, you can see this clockwork mechanism.

If we talk about the money it will be in a good manner to tell you who stands behind the tokens. ICONIQ Lab Holding and ICONIQ Lab Accelerator are officially working companies with the registration address in Germany.

The main partner for the ICONIQ is Finlab, which made a strategic investment into the ICONIQlab.

Check the links below if you want to learn more:

Website:

https://iconiqlab.com/

Whitepaper:

https://iconiqlab.com/wp-content/uploads/2018/04/20180423_Iconiq-White-Paper.pdf

Presentation/ color paper:

https://iconiqlab.com/wp-content/uploads/2018/05/20180523_Iconiq-Lab-Color-Paper.pdf

ICONIQ ICO is over, but you can always purchase their tokens on the stock in the nearest future: https://token.iconiqlab.com/icnq-club-members/

Follow the social media channels to not miss any investing opportunities:

FB: https://www.facebook.com/iconiqlab/

Twitter: https://twitter.com/iconiqlab

Telegram: https://t.me/iconiqlabchat

Disclaimer: this is NOT investment advice. This is purely my opinion, based on facts found on the project website, whitepaper, social media and etc. Please do your own research and decide if it qualifies with your risk profile.

Anna Hare

You can find me here:

https://bitcointalk.org/index.php?action=profile;u=1754481

Twitter: @44_crypto

FB: anna.hare.353

http://ruth.news/ru/team