INTRODUCTION

It is difficult to imagine the modern world without an electronic payment

system. The idea of prepaid cards appeared at the end of XIX century

and was revived in the second half of XX century in USA, entering into

the everyday life of each human. It was during this period that Diners

Club issued the world’s first payment card, which was not universal,

what restricted its use greatly. Nevertheless, the precedent proved to

be successful, and as early as in 1958 the Bank of America issued the

world’s first universal bank card, which was called BankAmericaCard

and became known worldwide as Visa.

Convenience of non-cash transactions today led to the formation of a

significant number of electronic payment systems in the world. Digital

money has penetrated into routine life: we can secure any operation,

from payment of utilities to a currency contract. However, the growth

of popularity of payment services did not allow ensuring security of

electronic payment properly. Such a process inevitably caused new

regulatory norms of payment intermediaries and a significant increase

in the cost of their services.

We are not always able to make instant transactions with our own

funds, sometimes we have to wait for the bank or another payment

service participant to perform its validation. In this case, often, the cost

of electronic operation is not comparable with its convenience. And,

as a result, there is a need for universal systems with instant payments

and low prime cost.

Crypto-currency, technologically based on blockchain, is a special

case of electronic money. It ensures accuracy and consistency of

the data, and a lot of money is spent in the fiat system for that. The

decentralized mechanism of crypto-currency excludes the necessity of

any intermediary controlling payment data during an operation, what

lowers its cost.

At the same time, the absence of legislative support for cryptocurrencies

in some countries and infrastructural solutions that ensure

conversion to financial funds does not allow crypto-currencies gaining

a completely legal status at the international level. In turn, this causes a

lack of tools to integrate the crypto-currency sector and traditional fiat

monetary system.

What can affect this situation? In the next few years, the occurrence

and development of standards for remote connection to banking

services will enhance the role of technologies in the financial sector.

This will be a big step forward for both private payment resources that

will be able to get more comfortable conditions for their development

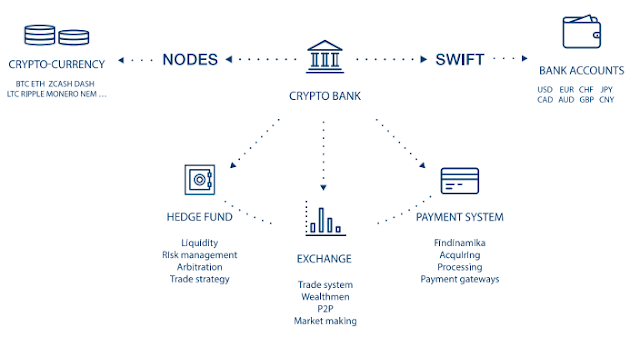

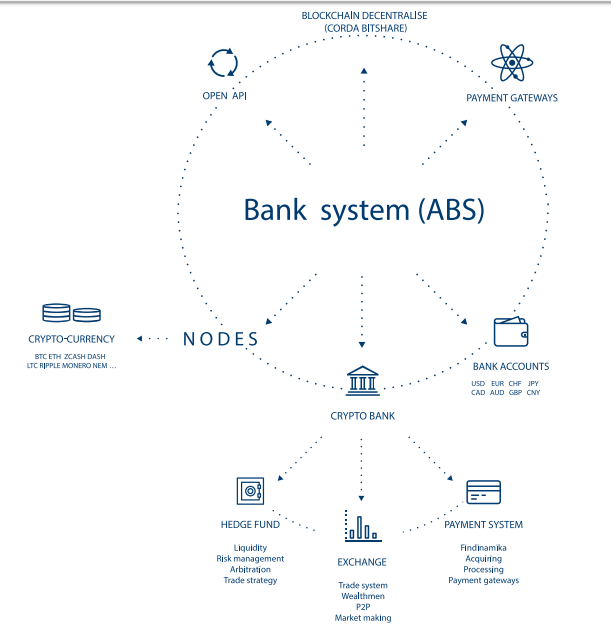

Zodiaq currently owns its home Bank, has a license for account opening and provides any operation (account management, transactions) both in crypto and in fiat currency, as well as its own cryptocurrency exchange.

Zodiaq plans to realize its own flexible platform based on open APIs and to debug solutions in the context of compatibility with its home bank. The goal of this process - to provide ready-made solutions for other banking sector players, whose implementation will require minimal resources, enables high-tech companies to become an independent link in daily transactions of Zodiaq customers to create their own infrastructure solutions without the need for development from the beginning. The use of blockchain technology in the heart of the system will increase the credibility of the service. The function of this technology without centralized management, therefore, is not subject to the cost and terms of the transaction.

Zodiaq's strategic objective is the establishment of a new financial infrastructure, which will replace the classical bank as a management service for the implementation of transactions between its counterparties.

Due to the widely developed infrastructure relationship with a large number of financial services and the formation of its own foreign exchange reserves, post-trade consumer processing services will be launched in the core business unit of the Zodiaq system. This mechanism will enable instant cash transfers in ZOD local currency for counter liability between users and companies for goods sold and shipped, financial instruments and services performed, based on opening in ecosystem contours.

What is Zodiaq?

Zodiaq, found online at Zodiaq.io, is a financial ecosystem aimed at making cryptocurrency management easier for everyone. This is a registered crypto bank in Comoros, a small island nation off the east coast of Africa.

Key features of Zodiaq include hedge funds managed by artificial intelligence, payment platforms capable of processing fiat and cryptocurrency, and payment cards paired with smart physical wallets.

Currently, Zodiaq seems to be in the early stages of launch, and there is limited information about projects available online.

Let's take a closer look at how Zodiaq works and how he plans to differentiate himself from other cryptocurrency banks.

How Does Zodiaq Work?

Zodiaq is a financial ecosystem consisting of several core features and functions, including all of the following:

Payment system

Zodiaq will have a payment gateway for merchants and individuals, allowing you to pay using a currency or fiat currency. Traders can use Zodiaq's payment system to receive crypto currency, for example, while paying a small commission. Zodiaq payment system is also connected to Zodiaq card.

Zodiaq Card

Zodiaq will have a payment card that lets you pay wherever you want - for example, wherever a bank or traditional credit card is accepted. You can withdraw money via ATM. You save fiat and cryptocurrency in your Zodiaq account, then choose whether your card will use fiat or cryptocurrency funds. You can change your funding source anytime via the Zodiaq mobile app or web app.

Smart purse Smart wallet

Zodiaq serves as a cool wallet, which allows storage of your cryptocurrency savings. You can tie a third party bank card with a smart wallet while enjoying a smooth payment option. You can connect your Zodiaq wallet to your card, for example, and manage your fiat and cryptocurrency via the wallet app. The Zodiaq smart wallet is a physical device - similar to cool storage wallets like Trezor or Nano. This wallet is equipped with e-ink screen, Wi-Fi, Bluetooth, and GSM module. Can connect to your PC or Mac via USB.

Crypto Exchange

Zodiaq will have a cryptocurrency currency exchange offering an easy UI, various financial instruments, and various financial assets available for trading. Exchange users will enjoy instant deposit and withdrawal options, including withdrawals and deposits via Zodiaq bank card.

Hedge Fund

Zodiaq will have a hedge fund with AI-based asset management system. The Zodiaq AI will use large data analysis and machine learning to implement successful investment strategies and scenarios. The hedge fund trading algorithm is currently being tested on Poloniex, where it is reported to have achieved a 100% profit over a 20 day testing period.

PRODUCTS OF THE SYSTEM

Stage 1. The current state of the system

Classic bank ecosystem is the first step that moves us. In this version, all operations will be implemented in a typical centralized banking information system (BIS). At this time, the personal account of each bank user uses logging and performs the following general actions:

. create accounts in fiat currency: USD and EUR

. create wallet: BTC and ETH

. transfers in currency between users (P2P)

. transfers in crypto currency between users (P2P)

. exchange p2p crypto-fiat between users

. purchase and sale of crypto-currency for users

. credit and debit fiat currency

. credit and debit crypto

At this time, the personal account of bank users has applied the opportunity to register and perform the following general actions:

. Creating accounts in USD and EUR

. Create a wallet: BTC and ETH

. Transfer in currency between users (P2P)

. Transfer in crypto currency between users (P2P) • P2P crypto-fiat exchange between users.

. Shipping and selling of crypto currency.

. Setting and returning fiat money back.

. Deposit and withdraw from the crypto currency

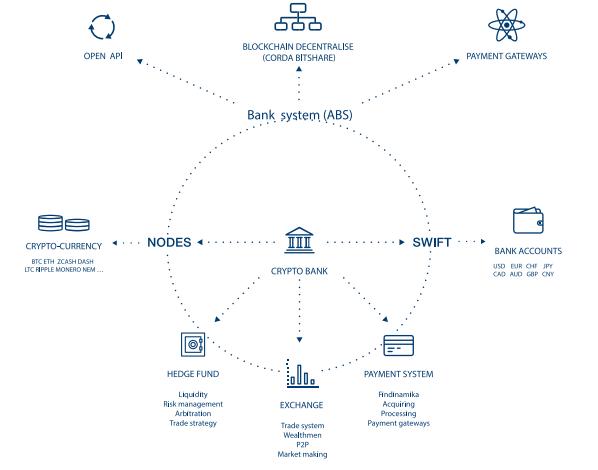

Stage 2. Platform with API connection

In the next phase of the project, ZODIAQ, for example the second payment terms of the European Union (PSD2), will unify representatives of the banking segment. The two main tools of the new platform: Payment Service Initiation Provider (PISP) and Accounting Information Service Provider (AISP), will be developed and introduced. The API service functions are as follows:

. image, certification and transfer of orders for funds transfer;

. analyzing data and providing information about the client's personal finances, excellence for more effective management, etc.;

. provide information to third parties (for example, to assess the solvency of the borrower).

By using the services of its own banking services, which will be actively developed at this time, ZODIAQ will be one of the first in the world to conduct operational assessments that can be formalized PSD2 and introduced new protocols.

Stage 3. Payment of blockchain platform

The world banking system and, in particular, the ZODIAQ team. At this stage of implementation, the core of the bank becomes digital and becomes online. Banks become decentralized. Fluid, any payment starts with each other. Blockchain platforms, banks and payment services can be examples of such agents. At this stage, the various blockchain platforms are decentralized into APIs. The core of the bank for payment with various payments. In addition, both individuals and legal entities can become client platforms. In this implementation process, block-platform can wait completely SWIFT completely. However, it is clear that SWIFT will remain a major player in the financial markets for a long time,

Crypto / Fiat Bank

The overall objective of Zodiaq is to function as a bank for cryptocurrency currencies and fiat currencies. Zodiaq will have a fully licensed and legal bank in the heart of its ecosystem. The bank will allow you to manage cryptocurrency currencies and fiat currencies across separate accounts from a single dashboard. You can enjoy instant money transfers and make deposits in fiat currency or cryptocurrency currencies.

Zodiaq Token Distribution

Zodiaq will distribute 80% of tokens to investors, 10% to founders and teams, 3% for prizes, and 7% for partners.

ROADMAP

2017

Acquisition of the trust fund

Establishment of Zodiaq Blockchain Corp

Financial Institute:

• acquisition of the trust fund;

• opening an account in wells fargo;

• receiving SWIFT, fatca and aml.

Cryptobank:

• registration and obtaining a banking license;

• development of personal cabinet;

• crypto-currency wallets;

• Internet bank.

Crypto-currency Zodiaq Exchange:

• development of the bidding system interface;

• launch of the exchange on test nodes.

Hedge Fund:

• opening accounts and legal structuring;

• development of infrastructure for storing, validating and accumulating stock exchange information:

• formation and accumulation of a database of price data;

• storage and accumulation of the base of fundamental news and indicators for further processing;

• storage and processing of non-price information related to crypto-currencies and tokens;

• development and backtesting of the investment strategy (smart beta);

• development of the execution unit for the long-term investment strategy (Automated Long Term Investment

System, ALTIS).

Payment system:

• Integration with payment systems;

• commencement of mutual settlements in cash through banks;

• launch of mobile application Zodiaq Pay;

• cross-border cash transfers.

2018

Cryptobank:

• obtaining SWIFT, FATCA, AML Certificate, etc.;

• deployment of Automated Banking System (ABS) software;

• authorization with payment systems and gateways;

• development and launch of mobile bank Zodiaq Pay.

Crypto-currency Zodiaq Exchange:

• launch of exchange in real mode on real nodes;

• creation of legal infrastructure and opening accounts;

• attestation at the regulator’s office;

• integration with international payment systems;

• adding new coins;

• formation of own liquidity;

• integration with mobile application Zodiaq Pay;

• authorization with other exchanges;

• application with open API.

Hedge Fund:

• preparation and creation of Offering Memorandum;

• SEC, compliance;

• development and backtesting of the investment strategy (smart beta) with rebalancing once a month;

• development of a group of short-term/medium-term strategies (AI-driven smart alpha):

• training the neural network on the accumulated price and non-price data;

• creation of infrastructure for execution of transactions;

• development of HFT-ARB strategies;

• development of ICO screening system.

Payment system:

• expansion of service geography (Indonesia, Philippines, China, India, Malaysia, Sri Lanka, Bangladesh,

Vietnam, Nepal, Pakistan, Myanmar, Thailand and Cambodia);

• PCI DSS attestation;

• launching a multi-currency plastic card;

• development of software for processing payments and launching crypto-currency acquiring.

ZODIAQ ECO System:

• launching currency of the project;

• withdrawal of the project currency to external exchanges;

• formation of strategic partnerships;

• launching tools for processing tokens;

• development of own blockchain.

Financial indicators

The gross turnover of the system is 50,000,000 USD.

The number of the customer base is 500 000 users.

The revenue is 3,000,000 USD.

2019

Cryptobank:

• authorization of SWIFT/SEPA;

• VISA/MC membership;

• issue of cards;

• development of an open API.

Currency Exchange:

• increase of the working capital;

• launching the decentralization module;

• introduction of margin trading;

• Authorization with other exchanges;

• development of investment accounts;

• expansion of service geography.

ZEST Foundation:

• development of algorithms for bidding strategies;

• invested strategies;

• venture investing;

• microcrediting;

• providing margin liquidity.

Payment system:

• acquiring;

• POS-terminals for receiving crypto-currencies in retail outlets;

• installation of cryptonates;

• launching of cross-border money transfers.

ZODIAQ ECO System:

• transfer of the system to its own blockchain;

• connecting third-party banks to ZODIAQ platform;

• SEC attestation;

• legal structuring.

Financial indicators

The gross turnover of the system is 300,000,000 USD.

The number of the customer base is 10 000 000 users.

The revenue is 10,000,000 USD.

2020

ZODIAQ ECO System:

• business scaling;

• implementation of hardware wallet

• increasing the customer base to 300 000 000 users;

Financial indicators

The gross turnover of the system is 1,500,000,000 USD.

The number of the customer base is 300 000 000 users.

Revenue is 400,000,000 USD.

2021

ZODIAQ ECO System:

• business scaling;

• increasing the customer base to 300 000 000 users;

Financial indicators

The gross turnover of the system is 1,500,000,000 USD.

The number of the customer base is 300 000 000 users.

Revenue is 400,000,000 USD.

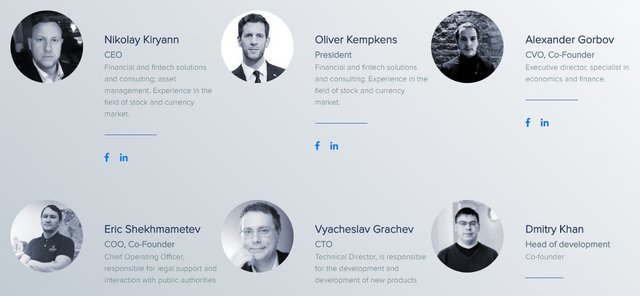

OUR TEAM

ADVISORS

So that's the explanation of Zodiaq. For more information, please visit some of the official links below ...

Website: https://www.zodiaq.io/

Whitepaper: https://zodiaq.io/file/ZODIAQ_WP.pdf

Facebook: https://www.facebook.com/ZodiaqCorp/

Twitter: https://twitter.com/zodiaq_io

Bitcointalk: https://bitcointalk.org/index.php?topic=3411516.0

Media: https://medium.com/zodiaq

Telegram: https://t.me/zodiaq_group

Bitcointalk profile

https://bitcointalk.org/index.php?action=profile;u=2011722

ETH anddres

0x221a4FE79De3696d1Cf5445147E4088Ad11755C7