As promised, the second part of the Viva Network project review will be devoted to what exactly problems, difficulties and barriers have arisen in the field of mortgage lending for the purchase of real estate objects, despite the long history of the existence of this loan instrument, and how Viva Network founders decided to solve them.

In the first article, we found out that Viva Network is a decentralized platform that uses blocking technology, smart contracts and Viva Tokens tokens to unite real estate buyers wanting to get a home or another real estate object in a mortgage loan and private investors who agree to finance this mortgage.

Thus, a platform will be created that will become the basis for decentralized financing of mortgage loans, thanks to which some users will be able to receive funds to buy their own housing on credit, while others will earn by providing the same funds.

Problems and solutions

When we talk about blocking technology and various projects that build solutions based on it, we often hear about how smart contracts can eliminate intermediaries in the processes of interaction between different kinds of parties, and it does not matter in which sphere this decision is. Viva Network is no exception.

The fact is that different kinds of intermediaries, for example, banks or any other financial institutions, in the process of any lending, including mortgage, become a big problem for many participants who want to buy housing on credit.

Any intermediary is an additional interest to the interest rate of the loan, in connection with which many can not afford to take housing in a mortgage, because afterwards they will have to pay a lot. Another related problem is the difference in interest rates in different banks and, even more so, in different countries.

So, for example, in order to take housing in a mortgage loan in Bermuda, the client of the bank will have to repay the loan debt at an interest rate of 6% for 20 years. And if the same user wants to buy real estate at the same cost in the UK, the British bank will put the terms only at 2%. By the way, it was with this situation that one of the Viva Network team members collided, which was the basis for creating the platform.

The mortgage market is one of the largest in the world, totaling about $ 31 trillion, but its participants from the number of buyers of real estate, at the same time, are not in the best credit terms. That's why the creators of Viva Network and offer their solutions to the current problems in this area.

Any intermediaries in the form of banks, any other financial institutions or even states are eliminated together with higher interest rates on the purchase of housing in a mortgage loan due to the fact that the Viva Network platform unites its participants directly, ensuring their interaction and meeting all conditions and obligations with the help of smart -contracts Ethereum.

Interest rates and all other terms of the loan are discussed by the parties in advance, when the buyer publishes information about the collection of funds to finance mortgages, due to which all parties are in the most favorable position.

At the same time, buyers of real estate and investors who finance a mortgage loan can be calm for fulfilling all obligations, because, firstly, their interaction is ensured by smart contracts, and secondly, by a credit rating system and verification procedures allowing each participant to be identified .

From request to purchase

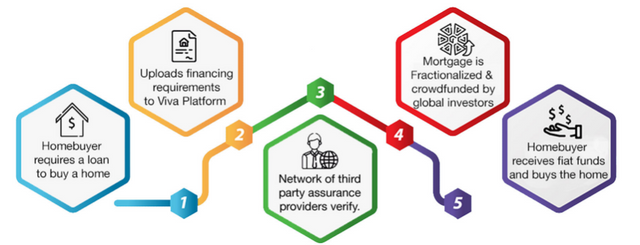

Participation in the process of mortgage lending by the buyer of the property is as follows. First of all, the buyer must leave a request for a loan for the purchase of housing or any other real estate, which will eventually respond to investors who want to finance such a loan in order to subsequently benefit from this.

After the buyer puts forward the terms of the loan, he passes the verification procedure, after which investors finance his loan. On the other hand, it reminds the ICO, only the participants invest not in the implementation of the project, but to buy real estate, buying not the project tokens, but FMS - Fractionalized Mortgage Shares.

As a result, the buyer of real estate receives fiat funds, acquires housing or any other object and monthly pays mortgage debt, which is distributed among investors. In the next, final article, let's see how, at the same time, the interface of the web platform and mobile application Viva Network will look .

| WEBSITE | WHITEPAPER | ANN THREAD | TWITTER | FACEBOOK | TELEGRAM | MEDIUM | REDDIT | GITHUB |

baksosuper

Profil link : https://bitcointalk.org/index.php?action=profile;u=2361818

ETH : 0x9FE2d477B58493E88935d071838a190826DeC2E9