Investing in ICOs is all the rage with the wave of enthusiasm continuing unabated.

Until now though the vast majority of ICOs have issued ‘Utility’ tokens, which are now attracting the attention of regulators, whose intervention is both inevitable and very positive for the industry.

Utility tokens, by their very nature, are priced by market demand for the perceived value of the product or service they can be used to purchase. The majority of Utility tokens are sold even though a product or service is still not developed, and as such the token is primarily speculative and often very risky.

Change is coming.

Regulators are concerned with the lack of investor protection and the fact that many Utility tokens may be structured as a ruse to circumvent securities laws. A better and clearer regulated market could facilitate the entry of institutional investment, bringing greater liquidity and stimulating user adoption of cryptocurrency. This has to be good news for both issuers and investors.

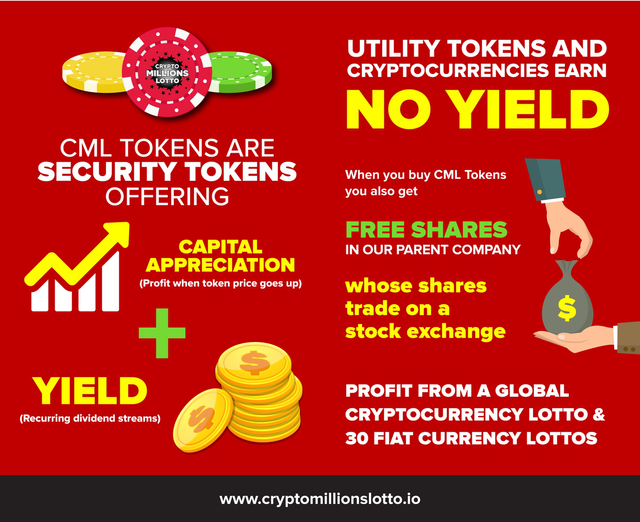

Utility tokens are simply another coin, and just like cryptocurrencies have a single and highly volatile element of return for investors: If the price of the token or coin rises, you win; if it falls, you lose. It is as simple as that. In a market that is subject to wild swings and speculative pressures, volatility leads to significant uncertainty with regard to investment returns. This problem is compounded further by the fact that liquidity for many Utility tokens can be limited.

The widely reported trend towards the issue of ‘Security’ tokens during 2018 could be a precursor of change. Security tokens, similar to shares, are subject to a far higher degree of regulatory compliance, providing higher standards of investor protection.

Significantly, unlike Utility tokens, they offer investors an important, additional source of stable returns beyond the underlying token price. Security tokens pay out dividends directly related to the performance of the business, completely independent of the vagaries of market price for the token. Therefore, investors receive a regular yield from holding tokens. The higher the dividend yield, the more favourable the impact on the token price. In other words, real business performance will influence and underpin the token price beyond speculative demand.

Blockchain is perfect for Security tokens, providing investors with full transparency as to the company’s performance so that dividends based on revenues can be readily assessed. This is even better than traditional shares where dividend payments and frequencies are at the discretion of the Board of Directors. Blockchain permits dividends to be paid automatically on pre-established and fully disclosed criteria.

The advent of Security tokens within a clearer regulatory environment can only be positive news for investors and for the cryptocurrency community in reaching its more ambitious adoption goals.

CryptoMillionsLotto's CML Tokens are structured as Security tokens to enable investors to receive automatic quarterly dividends based on revenues fully verifiable on the blockchain, so that investors can enjoy the fruits of capital appreciation plus a regular income stream.

Find out more about CryptoMillionsLotto and our ICO/STO at www.cryptomillionslotto.io

-Sulim Malook

CEO