Today's topic is related to hedge funds, FX trade, and arbitrage. It's widely discussed how cryptocurrencies are volatile with their sudden peaks and dips that keep all the investors on edge all the time. When I studied pension fund related blockchain solutions, I read one of the commentators on Reddit remarking that with the current situation pensions won't be the problem, because the majority of crypto-investors just will never reach that age due to high blood pressure, nervous breakdowns, and suicides. But anyway. Cryptocurrencies are volatile. While it might be not so good for investment and trade, this condition creates different kinds of financial opportunities. One of them is arbitrage. Arbitrage is a well known and established practice on FX markets. In a nutshell, it's taking advantage of either a difference between currency exchange rates on different markets, or discrepancies between exchange rates of two pairs of currencies, (triangular arbitrage) allowing through a sequence of exchanges, including those three currencies, to gain profit. The most simple and straightforward example of arbitrage can be that: I see that on one market apple price is $1 per kilo and on another, it's $2 per kilo. So I can buy apples on the first market and sell them on the second, gaining a $1 profit from each kilo. Not taking into consideration the cost of my commute from one market to another and other logistical expenses, the whole scheme is pretty simple. Actually, the similar situation sometimes takes place on FX markets, though it's always not as simple as aforementioned example. The thing is, currencies are volatile, but not that volatile. Discrepancies in prices on different markets occur, but they usually last no longer than fractions of a second, plus it doesn't happen very often. So in order to seize a fleeting opportunity and make a profit on arbitrage, one needs to receive a constant low-latency stream of information regarding market dynamics, and be able to react quickly. As a result, currency trade is an extremely active and highly automated process. Algorithms constantly keep track of the prices and immediately detect any anomalies that can be used to gain profit.

Now, speaking of cryptocurrencies. Compared to the traditional FX market, cryptocurrency market dynamics are pretty wild with high peaks and deep plunges that occur almost every day. If on the FX markets with relatively low volatility, arbitrage is something accessible only to highly qualified and experienced traders, on crypto exchanges probably every second participant tries to take advantage of price dynamics in one way or another. One of the popular approaches is tracking price discrepancies on different crypto exchanges. (Like in my example with apples) Due to frequent price swings and delays, with which new information reaches the markets, sometimes cryptocurrency prices vary significantly on markets in different regions. Additionally, this situation is complicated by the fact that in different countries prices for crypto are set in local currencies, which exchange rates can also fluctuate in relation to dollar and euro. As an example, this winter on exchanges in India and Zimbabwe the price of Bitcoin was roughly $5,000 higher than on exchanges in Europe. Naturally, a lot of people try to take advantage of that and make a profit, applying self-written or bought trade automating algorithms. Exchanges are overpopulated with trading bots, competing with each other in sophistication at tracking and predicting price changes in the shortest possible time. It's natural that this field began to attract the interest of investment organizations and hedge funds, specializing in FX trade and arbitrage.

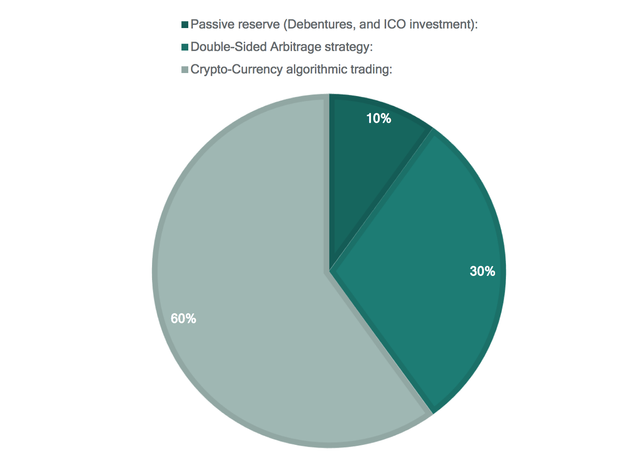

Countinghouse is a hedge fund with ten years of experience in trading on FX markets. It started as Dawson Pomery Pogacic (DPP) Company, which specialized on currency price differences and arbitrage. One of the first things the fund did was including algorithmic trade in its operations. The company uses Wisper connect services to survey markets and predict price dynamics. It proved to be effective on FX markets, despite their low volatility, making arbitrage more difficult. At some point, Countinghouse project's team started testing their algorithms on cryptocurrency markets, and the results they achieved during about twelve months of tests were highly encouraging. The thing is, natural volatility of cryptocurrency creates particularly favorable conditions for profitable arbitrage. While it may be more difficult for individual traders, financial enterprises and hedge funds have an advantage, wielding more resources and experience. Particularly Countinghouse project's team uses practices and experience, accumulated during their work on FX markets, and has a set of advanced tools, allowing to analyze market situation in general, assess risks, and predict potential outcomes of specific moves. One of the fund's methods is detecting negatively correlated currency pairs. This correlation can be used to minimize risks in situations when market dynamic is impossible to predict. In this case, one of the currencies serves as a compensatory mechanism in case the price of the second suddenly plunges for example. Also, Countinghouse keeps track of the situation on markets in general, having capabilities to reveal any anomalies and possible shifts on their early stages. This early alert system allows to predict events and make moves ahead of other players, which is especially important when dealing with price differences since actions of traders, taking advantage of the situation, quickly bring the market back to equilibrium. Countinghouse conducts trade in cryptocurrency pairs as well as crypto-fiat pairs, leveraging both cryptocurrency price fluctuations in relation to fiat, and discrepancies between prices of crypto in relation to local fiat currencies, and the exchange rate of fiat currencies themselves. All this requires quick reaction, perfect timing, and calculated moves. Something a hedge fund is perfectly equipped to do.

All in all, volatility of crypto is not going to end any time soon. As long as it exists, cryptomarkets will hold potential for traders to make profits on arbitrage trading. As risky as such practices might be, experienced traders and hedge funds, deeply understanding the terrain and rules of the game, can minimize risks and maximize their investors' profits. So, hedge funds, working on crypto markets, is a very sensible and viable development, and such projects definitely have a potential derived from the potential of a turbulent crypto ecosystem to bring profit to the most sophisticated and smart traders.

Currently, Countinghouse is conducting an ICO, which ends on June 12, 2018. The project aims to distribute 50,000,000 CHT tokens.

This post was resteemed by @steemvote and received a 62.6% Upvote. Send 0.5 SBD or STEEM to @steemvote

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Для меня Forex всегда был чем-то непонятным и сложным для понимания в плане торговли. Если есть возможность заработать на инвестициях без активного участия то это интересно. Лично я за здоровую конкуренцию. Вполне возможно что буду пользоваться.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is my @originalworks

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This post has received a 0.09 % upvote from @drotto thanks to: @cryptotaofficial.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit