Company: RxEAL

Website: https://rxeal.com/

Token: RXL

ICO Date: Jan 15th, 2018 @ 12UTC

Pre-Sale Cap: 7200 ETH

Tokens for Pre-Sale: 5760000 RXL

Total Supply: 96000000 RXL

Basics:

RxEAL is a company looking to disrupt the way security deposits and fees work in the real-estate and car rental industries. The idea is lessees are expected to front large sums of money as a security deposit when renting, and who can blame the lessor for being cautious of their property. There’s no doubt that damage and loss of security deposit are major headaches for all parties involved in the rental industry.

Concept:

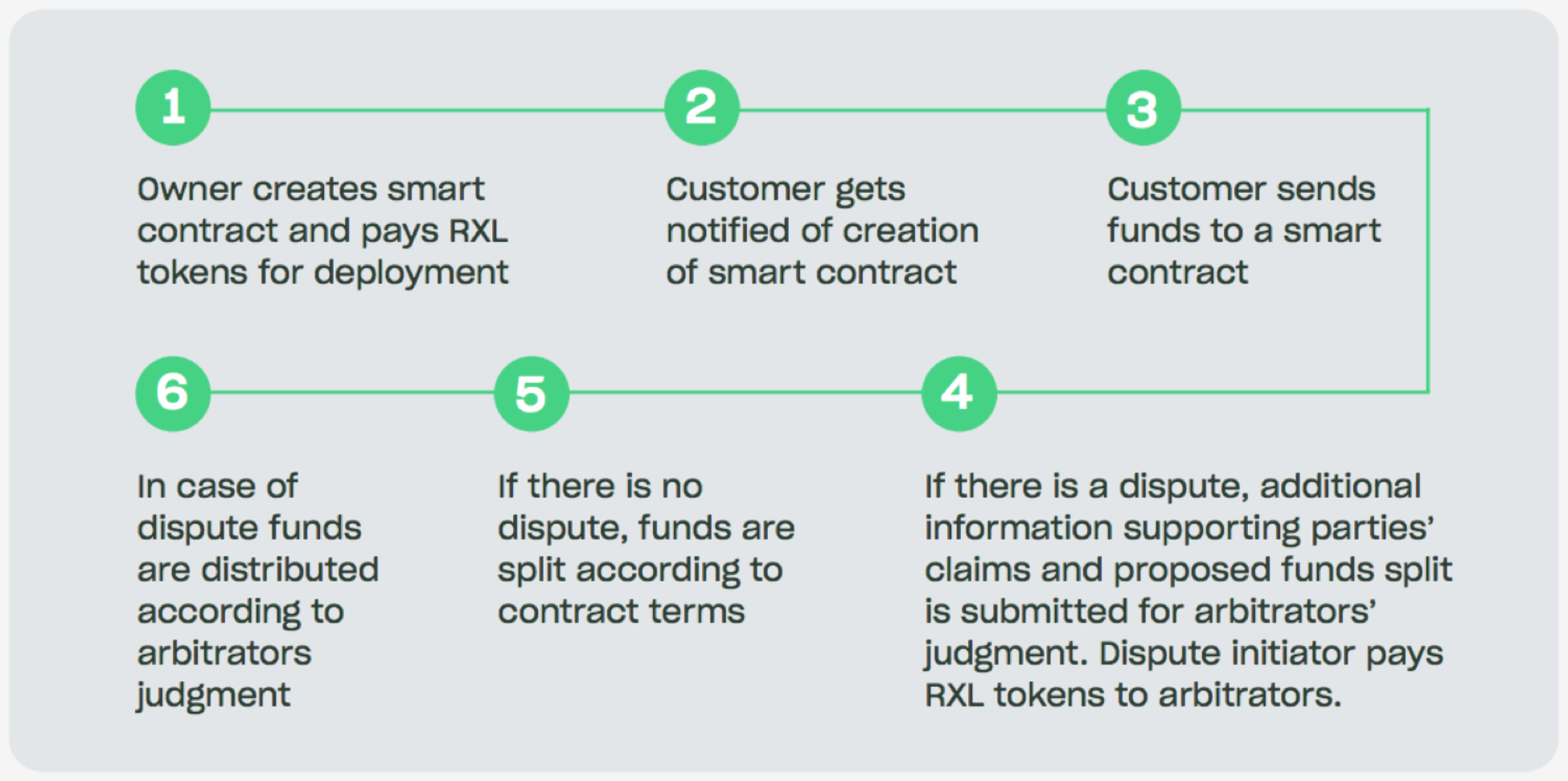

This is where RxEAL looks to use Ethereum network smart contracts to disrupt the current model which relies solely on having an honest lessor. The security deposit is put into a smart contract which acts as an escrow account for the money. At the end of the rental period, both parties will reassess the agreed upon terms and decide where the money will be allotted. If the parties do not come to a consensus the platform will provide a decentralized and independent arbitrage conducted by qualified members who earn RXL tokens for resolving the dispute. RxEAL claims this occurs between 2% and 15% of the time in well-regulated countries, and up to 40% of the time in less regulated countries.

This graphic gives the gist of how the platform works.

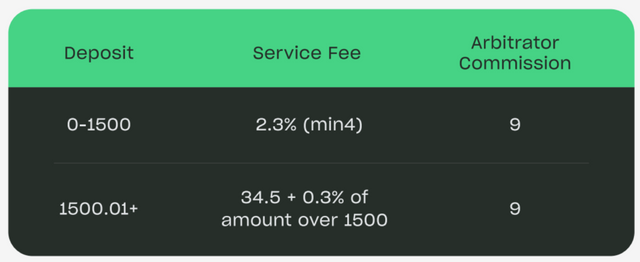

This graphic shows the proposed fee structure:

There is currently an app demo on their website that shows how the platform would work for each type of user: lessor, lessee, arbitrator. I would highly suggest looking at this when doing your own research as it gives a good feel of what the final product will be like.

Coin Value:

RxEAL will solve the problem of coin volatility by substituting the initial security deposit of ETH with DAI, a stablecoin that closely matches the US Dollar. This means that the amount fronted by the tenant will not drastically decrease in value at the end of the contract.

The RXL token will be a limited quantity token, capped at 96000000 RXL. Because the token allows exclusive access to the RxEAL platform, an increase in the use of the platform leads to an increase in the value of RXL.

The initial value of the token will be 1/400 ETH.

Team:

The team consists of seven seemingly successful people with diverse experience, as well as four advisors in different fields such as real estate and legal.

Timeline:

Company launch was in Q2 of 2017.

ICO is in Q1 of 2018.

Final product release is scheduled for Q3 of 2018.

Conclusion:

While I will not give a recommendation, they do seem to have a solution to a real problem and a real use case for blockchain technology that is better than the legacy solution. This same escrow-like solution would be far too expensive without the use of blockchain.

The question to me lies with the arbitrators. If the platform does not see widespread use, then the value of the token will remain low. If the value of the token remains low, it may be hard to find people willing to travel to a property to make a decision on the outcome of the security deposit. The other major issue I see that the people who would be adopting this technology would likely be the landlords, and those are the ones who currently have all the power over the security deposit. This is essentially asking them to voluntarily give up all the power for the advantage of not going to court on the slight chance of a dispute.

If you would like a specific Whitepaper analyzed please leave the coin in the comments!

MEW: 0x9A76A935a38062D5D91D1Eb6D86a93b47c6f9432

Disclaimer:

As with everything, I suggest you read the Whitepaper yourself and make your own conclusions before investing. I have no affiliation with the companies involved, and in many cases am not investing even after my research. I am simply interpreting the Whitepapers as I come across them and offering my analysis.