Have you known a decentralized system for fascinating venture capital? This is about it. EQUI Captial, or EQUI.capital, aims to transform the venture capital industry using an innovative digital token. EQUI is a digital token that aims to connect the cryptocurrency community with the traditional world of venture capital fundraising. One of the core goals of the project is to open the world of venture capital fundraising to ordinary investors. Today’s venture capital industry leads to enormous moneymaking opportunities and powerful investments. However, it’s restricted to a small number of firms and individuals. EQUI wants to combine the benefits of traditional venture capital fundraising with the power of blockchain technology and digital tokens. The pre-sale for EQUI tokens begins on March 1, 2018, with an ICO beginning on March 8.

What is EQUI?

EQUI is a new investment platform with crypto currency, designed to open this closed shop. The platform will provide investors with access to proven high-tech technology companies at an early stage and allow companies to access vital assets. In addition, the crypto-currency provides a mechanism that makes participation in venture capital accessible to a much broader part of the investor community.

Now nonprofessional professionals have a chance to support the next hot investment opportunity along with other funds. This is a unique chance to be on the first level in a new powerful investment movement.

Based on the Ethereum block chain , participants are encouraged to use EQUItokens to acquire a share in the projects. Each project is evaluated according to its individual merits, and those that provide financing from EQUIwill cover specific attributes. The focus will be on the early stages, when the business offers a significant market opportunity.

The value of the token is reinforced by the effectiveness of the underlying investment portfolio. This provides a reliable and stable basis for market value and the differentiation of EQUItokens from many other crypto-conversions . This is a measure of real utility, because it directly depends on the quality of the basic investment projects. EQUI is a game changer in the crypto space , where projects are traditionally evaluated based on hype, rather than asset values.

The companies on the platform were selected manually by a team of well-known venture capitalists. These companies benefit from the leadership of an experienced team, including two of the most successful business people in the UK.

Vision EQUI

En utilisant cette technologie Blockchain et en la combinant avec le modèle de capital-risque traditionnel, EQUI est une offre unique qui perturbera la pensée habituelle dans cet espace. EQUI surveille la règle des entrepreneurs prospères et prévoyants, utilise un vaste réseau mondial pour identifier les pionniers innovants et la recherche. une entreprise qui diffère des injections n’est pas seulement financière, mais aussi opérationnelle et stratégique. Notre vision sera réalisée à travers la plateforme d’investissement EQUI. La plate-forme présentera des opportunités d’évaluation permettant aux investisseurs de participer à la prochaine génération d’entreprises prospères.

Transformation

EQUI provides advice, resources, operational support and strategic advice to facilitate the success and growth of ambitious companies. This invaluable contribution helps transform big ideas into reality; building thriving companies that generate capital gains for all stakeholders in the sector.

Locking chain

EQUI believes that block chain technology will be a revolution for tomorrow’s businesses and lifestyles. Using block-chain technology, the EQUI platform will expose these opportunities and enable investors to participate in the next generation of successful enterprises.

How this works

Investors

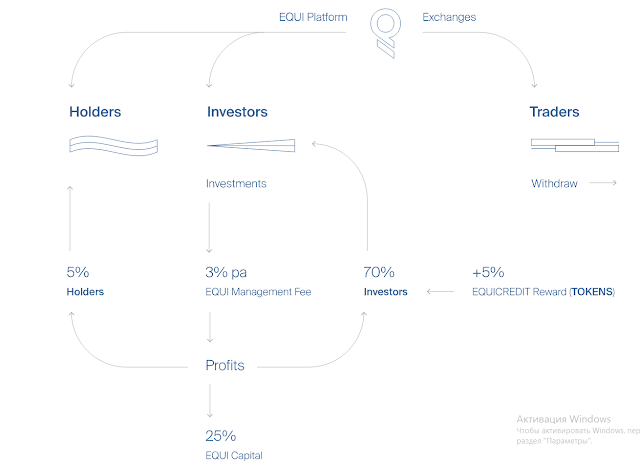

They are the ones who dedicate themselves to EQUItokens for the EQUI platform and place their cards in the projects. The commitment is fully adaptable and subject to the investor’s wish for a particular project. Researchers will receive 75% (pro-rat) of the net results generated by the companies in which they invest.

Also, as a new reward mechanism, investors will be involved in the EQUItoken loyalty programme. This involves the annual issuance of bonds to investors and holders.

EQUItokens will be sold to the investment firm in order to increase the selling price to the final consumer. The exchange rate shall be calculated at the same day market rate of the investment. After the sale of this investment, the results will be returned in ETH to the investor’s EQUI portfolio.

The Holders

Holders are participants in the EQUI ecosystem who choose to hold their tokens on the EQUI platform without committing to projects. Holders receive 5% (pro-rata) of profits generated from projects. This is similar to staking.

The Traders

Traders are participants who choose to remove their tokens from the EQUI platform, which means they benefit only from enhancements in the token price. As an EQUItoken holder, you can access the platform and review an evolving selection of investment projects. All investment projects will be assessed and evaluated by the EQUI Investment Team prior to publication. 75% of all profits are returned to investors and holders, with the remaining 25% going to the EQUI Investment Team as a performance reward.

What is venture capital?

Venture capital is a form of financing provided by individuals, firms or institutions to small, early stages, developing companies that are believed to have high growth potential but do not have access to equity markets. Such investments are usually classified as dangerous, as they are illiquid, but can provide an impressive return on investment in the right company. There are different stages of venture investment

Within the space of venture capital, the two most commonly used structures are capital and convertible debt. Capital issues ordinary shares or preferred shares.

Once invested, the capital is owned directly, until there is an event of sale or liquidity of the company. Unlike debt, equity does not require repayment, but is invested in exchange for a percentage stake in the company.

Convertible debt is a loan facility that technically implements a maturity date and may require repayment at some point in the future. However, it is common practice for complex debt investors in venture capital to treat their investments close to equity participation and is ready at some point in the future to convert their debt position into a company’s share capital.

Investment Strategies and Returns

Thanks to the unique compensation structure, every EQUItoken owner will benefit from the profits from the implemented projects, ensuring that all interests remain consistent throughout the life of the project. EQUI seeks to reward participants who share our vision by offering an improved incentive structure for those who invest their EQUItokens in the basic investment projects presented on the EQUI platform .

.png)

Investors who provide EQUItokens opportunities on the EQUI platform will receive 70% of the profits.

There are no restrictions on the number of projects that have been selected for investment.

As an additional reward, Investors will receive an additional distribution of EQUItokens through theEQUIcredits loyalty system , which is calculated as 5% of the number of EQUItokens investments .

Owners who purchase EQUItokens and keep them on the EQUI platform without participation will receive a5% return on the portfolio of realized investments. This provision of tokens is carried out within 3 months prior to distribution .

Traders who buy EQUItokens and buy and sell them on third-party exchanges are getting an improvement in the price of tokens

Strategy Scheme

.png)

75% of all profits are returned to Investors and Holders . The remaining 25% are sent to the EQUIinvestment group as a reward for execution.

This structure was designed to ensure that the interests of all parties are still agreed at any time, providing maximum value to all stakeholders .

Supports

In case a chip holder chooses to keep his EQUI chips on the EQUI platform, he will receive rewards for his loyalty in the form of ETH. In order to obtain rewards, holders cannot operate or move EQUI from the platform. The supply of tokens will be increased by 5% annually in order to facilitate the loyalty programme.

Road Map

.png)

About Token.

NAME OF THE Token: EQUI

TOTAL PRODUCT SUPPLY: 250 million EQUItokens

PRICE IN USD: 0.50

PAYABLE IN: Bitcoins (BTC), Ether (ETH), Litecoins (LTC), Ripple (XRP)

EQUI will launch an ICO for early adopters who wish to support our vision. Our symbolic sale will enable us to accelerate technical development and all other aspects of the business, including infrastructure and additional staff.

The pre-sale will take place from March 1 to March 15,2018. A minimum investment level of $100,000 is required to participate in pre-sale.

The public ICO will be held from March 15 to April 12,2018. A minimum investment level of $100 will be applied to the public ICO, subject to participants complying with regulatory standards on our website.

Payment Acceptance

Pre-sale payments are accepted in USD, GBP, EUR and Bitcoins. In the public ICO, EQUI can only be purchased with Bitcoins (BTC), Ethereum (ETH), Litecoins (LTC) and Ripple (XRP). The base currency crypt will be Ethereum. Other crypto coins will be redeemed through the API Shapeshift API.

The Team:

Founders

DOUG BARROWMAN — Main Founder

BARONESS MONE DE MAYFAIR, OBE — Co-founder

Investment team

TIM EVE — Investment Manager

LUKE WEBSTER — Investment Manager

MARK LYONS — Investment Manager

ANDREW BARROWMAN — Investment Manager

Project Team

ANDREI KARPUSHONAK — Development Manager

NERYS ROBERTS — Marketing Director

NICHOLAS GRAHAM — Customer Service Manager

SIM SINGH-LANDA — Project Manager

ANTHONY PAGE — Trustee

DUNCAN POLES

Advisory Team — Entrepreneurs

MARK PEARSON

DEADLY TONNESEN

Advisory Team — Crypto

JONAS KARLBERG

JOHN CALDWELL

DUNCAN CAMERON

Link of Interest:

Sitio Web https://www.equi.capital/

Whitepaper https://www.equi.capital/whitepaper/EQUI_Whitepaper_050218.pdf

ANN https://bitcointalk.org/index.php?topic=2888110

Telegram https://t.me/equicapital

Twitter https://www.twitter.com/equi_capital

Facebook https://www.facebook.com/equi.capital

Reddit https://www.reddit.com/r/EQUIcapital/

Author : Galih Arisuta

Profil : https://bitcointalk.org/index.php?action=profile;u=1718886;sa=summary