The fund’s team believes the promising venture investment format can reach wider adoption in the near future, thus democratizing the current market.

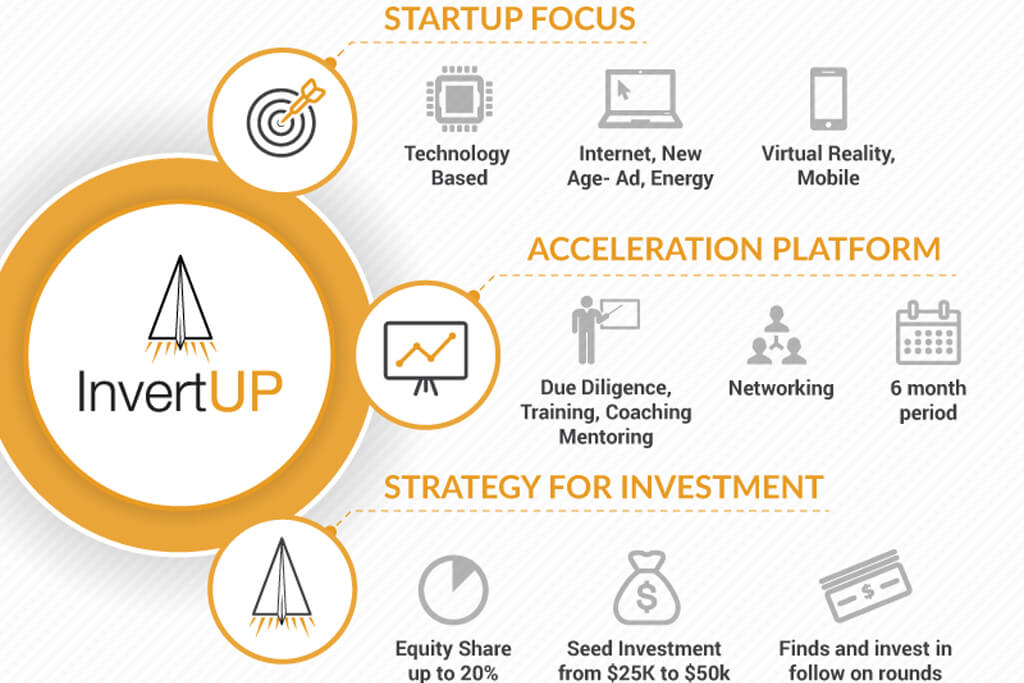

InvertUP is one of the first blockchain-based projects in the VC sector designed to help tech startups expand their business, raise finances and prepare to enter the global market. The Latin American seed capital fund offers an alternative approach to traditional venture investment format, allowing investors to finance projects and exit at any stage of their implementation.

Thanks to a collaboration with Mango Startups, InvertUP now allows everybody to take part in venture deals via an ICO opportunity. The fund is listed in the National Stock Exchange of Costa Rica, which ensures compliance with corporate governance regulations international best practices.

In a traditional VC format, you have to make a major investment and wait for a long time until any returns are generated. Earlier, it was impossible to make such an investment without having at least $100,000 or even $1 million on your bank account. Besides, there was no way for investors to diversify their portfolio without big money incoming at some point in the future.

With the creation of the ICO, smart contracts let investors to make investments with $10,000 or even less sum of money. InvertUp allows users to invest relatively small amount of funds and generate a portfolio at lower investment risk. Besides, investors can exit with their earnings at any point.

The mechanism it uses offers a range of other benefits, including complete transparency of the process and maintained market liquidity. With InvertUP, investors can choose their strategy: accumulate tokens from outstanding startups’ profits, wait for an exit or make decisions based on the token’s secondary market.

The first thing InvertUP looks at when evaluating the new project is the potential of the team behind it and its ability to reach goals. The company conducts multiple interviews to learn how good people know the industry and whether they are ready to listen to others. Other factors the company looks at are the market potential and scaling opportunities of the project.

To minimize risks, InvertUP requires startups to graduate from one of the accelerator programs and keep a positive cash flow during at least six months. The project’s Accelerator Network (RETEI) now has a pool of over 1,000 startups from Latin America. Such accelerators as CIE, FIDE, and ParqueTec, from Argentina, Chile, Costa Rica, and other countries serve as a pipeline for talent.

InvertUP plans to release up to 30 million tokens in an Initial Coin Offering (ICO) through its SPV, Mango Startups, with the nominal cost of tokens totaling $0.10. The pre-sale will be launched on January 10, 2018.

The managing partner and co-founder of InvertUP Seed Capital Fund, Marcelo Lebendiker , believes the project’s VC model should be used by more venture funds.

ICOs, he says, are a real threat to the traditional VC model, as they have a lot of benefits over traditional fundraising processes, such as shorter time to market, scalability, no liquidity clauses, and others. Such funds as InvertUP make it even easier for new startups to gain capital while reducing the risk for investors.

According to Lebendiker, we will likely see more VCs in the near future eager to be a part of this new financial sector.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.coinspeaker.com/2018/01/06/seed-capital-fund-invertup-run-ico-campaign-latin-america/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit