Over the years, the growth of the digital market has been tremendous and this can be seen by the increase of the number of projects going through ICOs in hope to provide a better solution for many of the existing market problems. Despite all this, there remains fear surrounding around every investors and project owners regarding trust, transparency and efficiency of investments.

For investors, it is not inevitable to fear the failure of any investments, be it small or big. As for project owners, the need to have a platform that they can fully make use to guarantee seamless actualization of project milestones will greatly give their project a clear view of how well they are doing and what’s next to do.

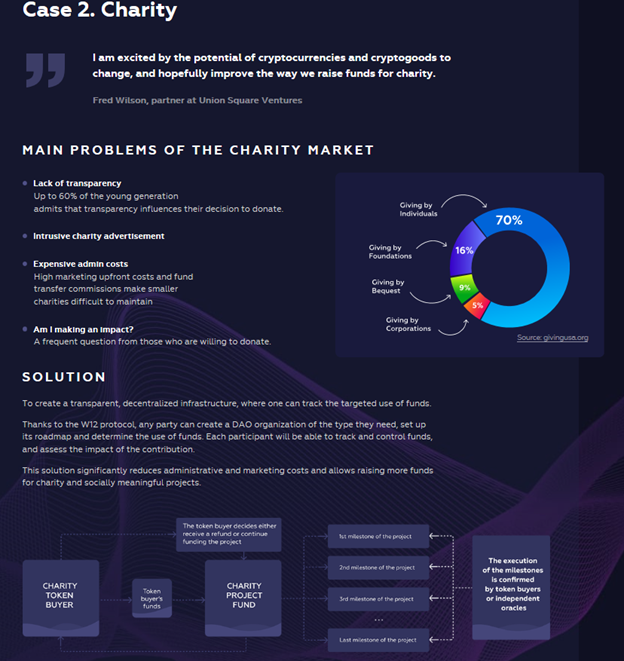

Fundraising campaigns need to be transparent and trust-worthy by all means. This attracts more investors who are willing to support and take risks for them, and more investors mean better chances of getting the project done. This is what W12 is all about, to protect users’ investments and improve existing ICO processes and eliminate fear surrounding fundraising initiatives.

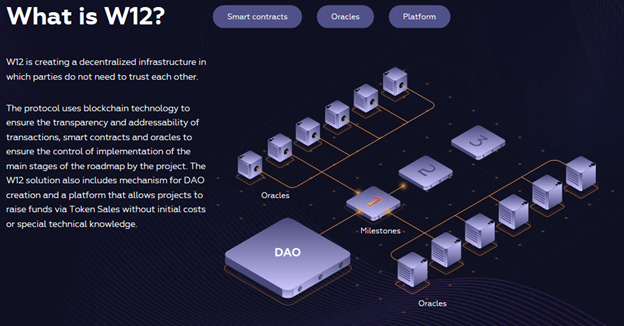

W12 is a decentralized infrastructure where trust is automatically built among parties. Questions of trust and integrity will no longer surface and is automatically affirmed and utilized by its members. By being an open protocol for various types of DAO creation, W12 hope to protect users from scam or unperceived failure of projects as investments, reduce costs and risks, build transparency and trust between project owners and token holders or investors.

W12 offers Smart Contracts, DAO Management Protocols and a Decentralized Oracle Network that looks over every success of every project milestones laid on any fundraising campaigns. W12 supports fundraising campaigns of various types such as Charity and Social Projects, ICOs and all Crowdfunding endeavors.

With W12’s protocol, trust is not required between project owners and investors. In cases when disputes happen, W12’s resolution process makes everything fair between the two parties and resolved quickly, transparently and efficiently.

Problems Solved

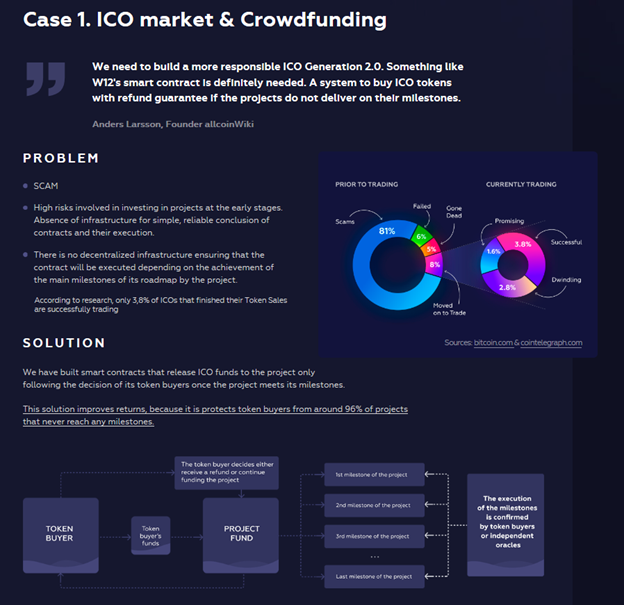

Investors are constantly looking for many business-worthy projects. However, many of such projects often die out during its early investment stage due to the lack of funding. The low survivability rate of startups makes it hard for investors to see such worthy projects because of the lack of a trust-worthy and effective platform that showcases such projects.

Occasionally, investors are compelled to trust institution to carry over their investment transactions without transparency. This fear makes the digital market at a loss once not addressed. And because there is already a huge pool of projects laid, more and more scams are arising while going with the current trend. This is one good reason why having an established, strong, trust-worthy and efficient platform can help improve the traditional.

In cases of disputes, with the traditional, one party is almost always at loss. This creates another fear among investors and project owners from entering the digital market.

But with W12, Smart Contracts easily improves transparency and trust of every investment, a decentralized oracle network will confirm the execution and success of every project milestones, users can benefit from a secured and transparent fund transfer scheme and the DAO management to organize campaigns within the W12 platform.

With W12 bridging the gap between the crypto community and the traditional economy, the whole world can now gain access to the benefits and power of Blockchain technologies.

How W12 Works

Based on the simplified image above, W12’s platform is composed of DAO, Smart Contract Protocol and the Oracle Network.

The Smart Contract facilitates the automatic transfer of project funds once project milestones successfully meet a passing criteria. This process eliminates the need to manually transfer funds which are prone to errors and decision biases. This places both project owners and investors at a safe and secured place where both are confident how the project is doing and where the investments are going.

As project starts planning how their token sales, they can choose a project fund out of three types offered by W12 that best suits their needs.

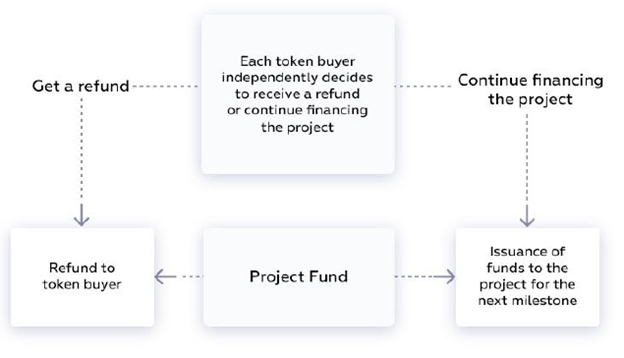

Project funds algorithms dictates whether projects have successfully completed a project milestone and whether or not investors would like to continue funding the project.

The first type of project fund allows token buyers to confirm the execution of a project milestone. During every project milestone, token buyers can decide whether they wish to continue funding the project or withdraw their investments.

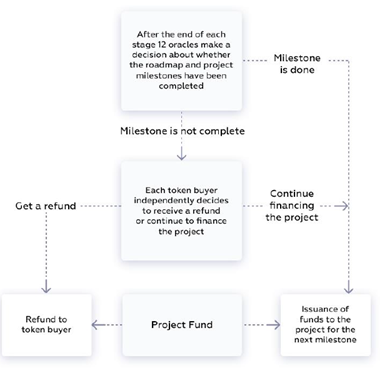

The second type allows the independent Oracle Network to decide the execution of a milestone. Once the Oracle dictates the a milestone was not able to meet the criteria, they can suspend the release of fund until the milestone successfully carries over the remaining criteria. In this type, token holders get to choose whether to withdraw or continue funding the said project.

The Oracle Network or Oracles are individuals who gets information as basis to confirm the execution of criteria stated in smart contracts. As project owners create Smart Contracts, they get to choose the number of oracles they wish to have for the confirmation of Smart Contract scenarios and criteria. Oracles are randomly selected based on the specified criteria by the project owners and all oracles undergo KYC and identity verification and gets to assign their rates in W12 Tokens as compensation for their labor. In their personal area, Oracles get to display their ratings and the number and quality of their decisions.

Oracles carry the job to get to decide the execution of project milestones and judge them according to specified conditions and scenarios.

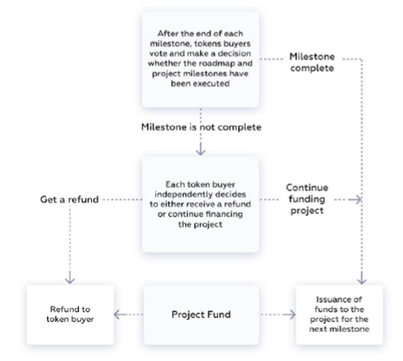

The third type grants 51% of token buyers get to decide the execution of a project milestone. The weight of voice is proportional to the number of owned tokens. To suspend release of fund, at least 20% of the token buyers should cast their votes for funds suspension.

W12 Use Cases

W12 can be used in offering ICOs and any types of Crowdfunding. W12 can also be used to facilitate Charity Campaigns.

Wherever account, credit, funds and project management is present, W12 can be a viable solution to facilitate the overall project process.

W12 Token Sale Details

Token: W12

Price: 1 W12 = 0.00035 ETH

Hard cap: 22500 ETH

To get the latest updates on this ICO, visit their official social media pages and view their website and whitepaper.

Website: https://tokensale.w12.io

Whitepaper: https://tokensale.w12.io/W12-en.pdf

ANN Thread: https://bitcointalk.org/index.php?topic=3220425

Twitter: https://twitter.com/w12_io

Facebook: https://www.facebook.com/w12.io/

Telegram: https://t.me/w12io

Medium: https://medium.com/@w12_io

Reddit: https://www.reddit.com/user/W12io/

LinkedIn: https://www.linkedin.com/company/w12io/

Author: Hypervira

Author Link: https://bitcointalk.org/index.php?action=profile;u=1419911