Satoshi Nakamoto’s seminal Bitcoin white paper proposed a revolutionary new digital

currency. But it was based on its predecessor Hashcash and the proof-of-work concept was

originally proposed by Dwork and Naor in 19921

as a means of combatting junk email.

1.1. The success of Bitcoin

So why did Bitcoin achieve such explosive economic value while its predecessors were mostly

of academic interest only?

1.2. Real Implementation

More than just a white paper, “Satoshi” released the open source reference implementation in

- Because Bitcoin itself was more than just a ***white paper, but an actual working system,

it was able to capture the imagination of developers and leverage the paradigm of open source

software development to quickly iterate and improve into a global-class financial

infrastructure.

1.3. Open Governance

More importantly, Bitcoin is an open system that allows for evolution through forking and as

such provides an assurance of its long term trustworthiness. If stakeholders ever get upset with

the direction of Bitcoin, they can and already have produced forks that users and miners can

migrate to if they see fit.

1.4. The Problems of Bitcoin

The biggest problem with Bitcoin at the moment is that it has not broken out into mainstream

adoption. One study pegs the number of active cryptocurrency users to between 2.9 and 5.8

million2

.

This paper proposes a solution for adding a billion users to the cryptocurrency movement by

adding two key elements missing in order to provide significant adoption by mainstream users.

The next billion users have not yet entered cryptocurrency for two main reasons:

1.5. Too complicate

Cryptocurrency suffers from complexity for the average user. Managing private keys, public

keys, blockchain concepts—it’s all vastly out of the reach of the average user. In some cases

the next Billion users may even barely be able to operate a smartphone.

The Next Billion Crypto Users

Pundi X will help to generate demand for new and old, as well as big and small

cryptocurrencies. No other online cryptocurrency exchange can bring in new cryptocurrency

users from this segment and in the same number, thanks to our powerful focus on attracting the

consumer market.

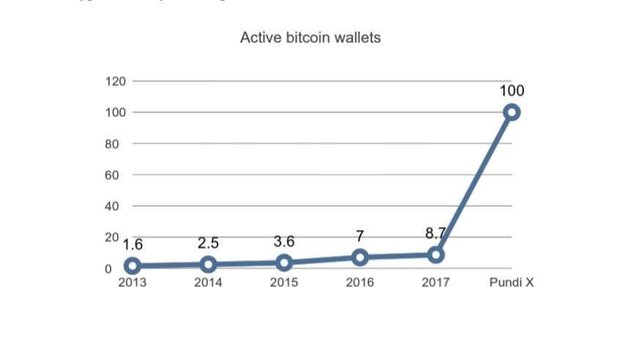

From 9 million to 100 million

With future growth in mind, let’s look at some relevant statistics as of October 2017:

- Bitcoin price is approximately USD 6,000

- Bitcoin market capitalization is approximately USD 100 billion

- Trading frequency is 250,000 times

- Trade volume is USD 900 million.

With trading volume accounting for 1.1% of total volume, the reason bitcoin had such

respectable numbers is because there may be as many as 5.8 and 11.5 million - an average of

8.7 million - active wallets. However, the global bitcoin wallet ownership numbers do not

even reach 2% of the population of South East Asia.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.pundix.com/pdf/PundiX_WhitePaper_EN_FinalVer1.pdf

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit