THE GREEN ENERGY MARKET

This market covers renewable energy production and has continued to grow at a steady rate in terms of capacity. For instance, in 2007, the world produced 99 Gigawatts (GW) of renewaable energy. However, by the year 2016, production skyrocketed to a record high 2011.3 GW. What this means is that green energy sources contributed 24% of the total electricity produced in 2016 mostly consisting of hydro power which was closely followed by wind and solar energy.

Although a very significant milestone has been achieved, policies of the governments have been very supportive in pushing for innovation and increase in capacity. Multiple cities which include Las Vegas have made the switched a 100% renewable energy supply with others making frantic efforts to achieve the same feat. Many countries across the world have set goals that agree with the Paris agreement and are consistently and persistently funding numerous green energy projects. For example, Germany has set a target to switch totally to renewable energy sources in 2050. Clearly, the demand for green energy has been on the rise among countries.

WHY DEMAND FOR GREEN ENERGY IS HIGH

- High production Capacity at Lower Cost: As stated above, as of 2016, roughly 2011.3 GW of green energy was produced by renewable sources. This accounts for nealy 25% of all electricity consumed across the world. Solar power produced 47% of newly added renewable power while wind contributed 34% and hydro power 15.5%. The green energy market continuously experiences rapid growth and increase in demand. A general trend can be observed. The production of fossil fuel and nuclear energy are on the decline while that of green energy continues to climb at an average rate of 4.7%. As countries phase out their old energy sources, we continue to record a drop in energy produced in non renewable sources.

- Supportive Policy of Governments: The driving force behind the remarkable growth in the green energy sector is the policies of government. In a global trend, nations have been providing tax incentives and appealing funding incentives. As a result, significant improvements have been put forth in renewable energy technology.

- Expanding Global Funding: In 2016, global investment in new renewable energy was $241.6bn. It marked the fifth year in a row that investment in new renewable power capacity was roughly double that of fossil fuel. The International Energy Agency has estimated that a global investment in green energy would need a total $730bn by 2035 to achieve global targets. As current investment is about $225bn per year, the global market would have to triple to meet energy demand.

- Bright Future: The future of green energy is certainly promising. With adverse effects of climate change thrusting the industry forward, these projects pose minimal risk and very exciting returns.

CHALLENGES OF GREEN ENERGY

Despite having significant potentials, the green energy market currently faces multiple problems. Institutional investors, individual investors, and green energy developers all faces different challenges when participate in this market.

Green Energy Developers

- Face difficulties raising raising funds due to financial market limitations.

- Have low negotiation power when dealing with large investors.

- Slow fund release causes delay in constructions.

Institutional Investors

- Must bear large exposure due to high stake of free energy projects.

- Have difficulties finding projects due to geographical limitations.

Individual Investors

- Cannot invest with little capital

- Do not have resources to conduct proper due diligence

- Have concerns regarding privacy protection

GREENX SOLUTION

To overcome the challenges mentioned above for both investors and developers, Green X’s mission is to build an ecosystem that consists of two global marketplaces – the GreenX Capital Market and the GreenX Global Exchange. The GreenX Capital Market is a crowdfunding platform built on blockchain technology, while the GreenX Global Exchange is a global energy investment marketplace that operates 24/7 globally.

GreenX is a blockchain ecosystem that allows individual and institutional investors to find and invest in profitable, low-risk renewable energy projects worldwide. GreenX is a blockchain ecosystem that allows individual investors and institutions to find and invest in low-risk renewable energy projects that benefit the world over. Developers of renewable energy projects often find it difficult to raise funds for their projects because these projects are generally capital intensive and require large capital investments. On the other hand, institutional investors in renewable energy projects often face substantial risks by having to invest in one to several mega projects due to liquidity constraints with their investment funds due to the long development time of these projects. The Green Energy market includes the production of renewable energy and grows at a stable level in terms of investment and capacity. In 2007, the world only produced 99 Gigawatt (GW) of renewable energy. However, in 2016, production reached a record high 2011.3 GW. Green Energy sources contribute 24% of the electricity generated by 2016, mostly consisting of hydro power, followed by wind and solar. Although much has been achieved, government policy continues to drive innovation and capacity building. Some cities like Las Vegas have turned to 100% renewable energy supply and others are trying to achieve the same goal. Various countries have set goals that are in line with the Paris agreement and actively fund various Green Energy projects. Germany, for example, has set a target to switch completely to renewable energy sources by 2050. Clearly, demand for Green Energy is high among governments.

The GreenX Capital Market is a crowdfunding platform built with blockchain technology, while GreenX Global Exchange is an energy investment market that operates globally. Recording at GreenX Capital Market is subject to an independent due diligence process along with AI-based comparative risk analysis. Furthermore, GreenX is amis to bridge the gap between the crypto platform and the real world by setting up a registered GreenX subsidiary in each project country along with a cash account along with the developer, where all their investments and returns are channeled. On the other hand, GreenX Global Exchange allows investors to buy shares from ready-to-invest projects and ready to be developed soon where they do not want to wait during the project development period.

THE GREENX ECOSYSTEM

The ecosystem is designed to take advantage of cryptocurrency efficiency and speed, while eliminating counter-party risks through rigid due diligence processes and implementations of artificial intelligence applications.

GREENX ARCHITECTURE

- GreenX focuses on building decentralized applications on top of blockchain platforms.

- GreenX systems are built on a three-layer architecture, including a user interface, a decentralized engine, and blockchain platform infrastructure. This model allows GreenX to quickly and flexibly tokenize and process green energy projects.

- The contract scripting layer, mezzanine layer, and multichain bridge engine are three sub-components of the GreenX Decentralized Engine. Their functionality gives GreenX independency of the blockchain infrastructure, and the flexibility to accommodate business usage.

ADVANTAGES OF GREEN ENERGY

For Developers

- Easily tap into global pool of funds.

- Normal legal procedure just like a normal JV contract.

- All investments are paid upfront by investors and are available for immediate development. No risk of delay.

- Streamlined due to diligence process, preventing leakage of sensitive information.

For Investors

- Allowing small investors participate.

- Rights and economic interests are protected by smart contracts. GreenX takes care of all legal proceedings.

- Have access to professional due diligence reports as well as AI-generated project statement.

- Have access to the secondary GreenX Global Exchange for liquidity.

- The crypto-backed platform allows capitalists to invest any where in the world without giving up their privacy.

TOKEN AND ICO DETAILS

- Total GEX token offer: 375 million GEX

- Total GEX tokens allocated for token sales: 60% of total token supply

- Target Funding: $ 30,000,000

- Soft Cap: 2,500 Ethereum

- Contribution received: Ethereum

- Token Price: 1 GREENX = $ 0.20

Terms of Sale Token

GreenX Token is sold through smart contract. To participate in a token sale event, an investor must first register at our token sales portal at https://ico.greenx.network and complete the KYC / AML check. Upon signing up, contributors can easily send Ethereum from a supported wallet to the GreenX smart contract address to claim the GEX tokens.

The Early Bird Sale starts on the 15th of May, while the main ICO is scheduled for 15th of June. Total of 225,000,000 tokens are devoted to be distributed among token buyers and investors. The initial exchange rate is set at $0.2 for 1 GREENX token. They want to devote 80% of raised funds to the development of the ecosystem, as well as marketing and operation costs. Within 2 weeks after the successful coin offering, they aim to be listed on few exchanges.

GreenX aims to build a sustainable business. Therefore, we always try to comply with all compliance rules and instructions. There are some restrictions on individuals wishing to participate in the sale of our tokens.

Token Distribution

GreenX sells 60% of all token supplies during the token sales round. Tokens sold to the public will be locked during the ICO period. After ICO is completed on July 31st, all tokens will be opened and become transferable.

- 16% of GEX's total supply is allocated to GreenX Founders, Core Team, and team backup. These coins are locked by a smart contract for 12 months after the ICO ends.

- 7% of GEX's total supply is allocated to GreenX's advisors and business partners. This token also includes a backup for future business partnerships.

- 10% of GEX's total supply is the token ordered. This token is provided for referral bonuses, gift programs, and many people's sales rewards.

- GreenX also allocated a 4% bonus fund. These funds are to attract future employees and allocate for future community programs.

- GreenX reserves 2% of our token supply total for rewards program, and 1% additional airdrop for our community.

Budget allocation

Funds gained during the sale of GreenX tokens will be used to increase the benefit of the GEX token holders. ICO results are used to build sustainable businesses that will continue to bring exciting projects to the ecosystem, increase the use and value of GreenX. We therefore allocate ICO funds as follows, to create not only short-term but long-term value to all stakeholders.

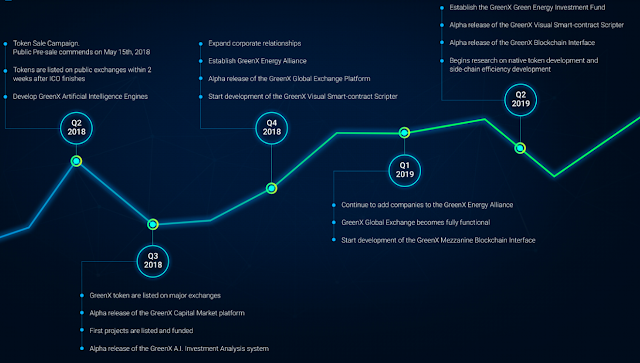

ROAD MAP

TEAM

For more information, please visit:

Website: https://greenx.network/

WhitePaper: https://drive.google.com/file/d/1rNMpBTW6VyuF6isuZt_FHUR5NdXcKwSI/view

ANN Bitcointalk Thread: https://bitcointalk.org/index.php?topic=3336435.0

Telegram: https://t.me/GreenXOfficial

Twitter: https://twitter.com/GreenXOfficial

Facebook: https://www.facebook.com/GreenXOfficial/

Author: JigaMola

Bitcointalk profile: https://bitcointalk.org/index.php?action=profile;u=1847143