Hello ... If you are interested in joining a Laccoin project or you are interested in joining a Laccoin project, it is a good idea to read that can help you find information that might help you in seeing their vision and mission during the Laccoin project.

INTRODUCTION

Background Story

The global fi nancial crisis of 2007, better known as the great recession, exposed major weaknesses within the global monetary system. The chaotic atmosphere gave rise to blockchain technology, which in turn, has birthed cryptocurrencies. During the same period, a drastic reduction took place in the total values of remittances sent to locations within the Latin American and Caribbean region, where individuals and families are highly dependent on fi nancial support. The values of these remittances were further reduced because of the high fees charged by traditional banks.

In Latin America and the Caribbean the total amount of remittances amounts to 7.5% of the GDPs11 of these nations. This is compounded by the fact that payments sent acrossinternational borders through the traditional banks are still very complex, slow-moving and expensive.

The average amount transmitted to each dependant through the traditional bank or remittance agency is $222 at regular intervals 13 times a year.2 At the height of the global recession, remittance fees in the LAC region climbed to nearly 8.75%3 of the GDP. The total remittances sent to the LAC region in 2016 totaled just over 69.4 billion, which represents an average percentage remittance of slightly above 6%.4 These totals plus the cost of fund transfers are staggering. But, if Laccoin had been the issuer, it would have put back 4.6 billion into the hands of the needy people of the LAC region.5

What Is LACCoin

Laccoin is an Ethereum-backed cryptocurrency that uses a mobile wallet. Individual users will have the option of exchanging their cryptocurrencies and LAC tokens with one another through their mobile wallet or of spending their LAC tokens or other cryptocurrencies through their Laccoin prepaid debit card. The scope and range of Laccoin will make it the first cryptocurrency or token to bring Latin America and the Caribbean under a single monetary jurisdiction.

Laccoin wallet will be available for download via IOS or the Android marketplace. With the use of the LAC card, individuals and businesses will be able to operate in the new Latin American and Caribbean digital economy from their mobile device. However, the full benefits of Laccoin will only be apparent once a person can use the token in the same way that he uses other fiat currencies or fiat back debit cards for everyday payments.

Our intention is not to go head-to-head with the traditional banking services but to ease the burdens of individuals and businesses that do not have easy access to traditional banking services in the LAC region.

NEW LAC ECONOMY

The New Latin American and Caribbean economy

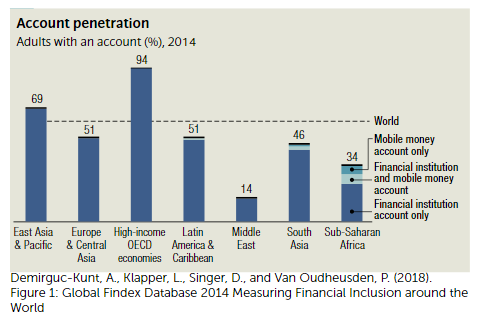

Even though conventional banks in the LAC region have done an excellent job of trying to include everyone in their respective economies, there still remains a massive inclusion gap. Banks in the LAC region have a penetration percentage of only 51% as seen in Figure 1 below.

By contrast, a considerable number of individuals within the region have access to mobile devices. Looking at unique subscribers, that is, users who subscribe to mobile services at the end of a period, the unique subscriber penetration rate for mobiles stands at 65%, corresponding to a total of 414.4 million individuals.1 By 2020 the penetration rate will rise to 78%, a total of 524 million individuals. 2 In addition, 70% of the population would have adapted to smartphones by 2020.3

It follows that people are looking for more convenient and better ways to send money to the LAC region. A recent survey showed that 42% of respondents said that they were looking for ways to send cash through the internet. 4 By and large, cryptocurrencies have outpaced the current methods of transmitting and receiving money as well as paying for items.

Another advantage of cryptocurrency over existing fiat currencies is the speed of transactions. Sending money to a relative in another country through the existing banking system takes considerable time and money. Transactions sent through Western Union, MoneyGram, RIA, Xoom, Dolex, Sigue, Intermex, Barri, Viamericas, and Wells Fargo – handle 90% of the 14million transfers to the LAC region.5 While these transactions can take days, they can be executed in a matter of minutes using Laccoin cryptocurrencies.

LAC CRYPTO ECONOMY

The materialization of blockchain technology has created a paradigm shift in which older legacy systems are being challenged by digital trading systems, where transactions are made person-to-person and do away with the middleman or institutions. While blockchain and distributed ledger technology have been in existence for already a decade, banks have been slow to adopt cryptocurrencies and provide the much-needed infrastructure service for the unbanked and underbanked.

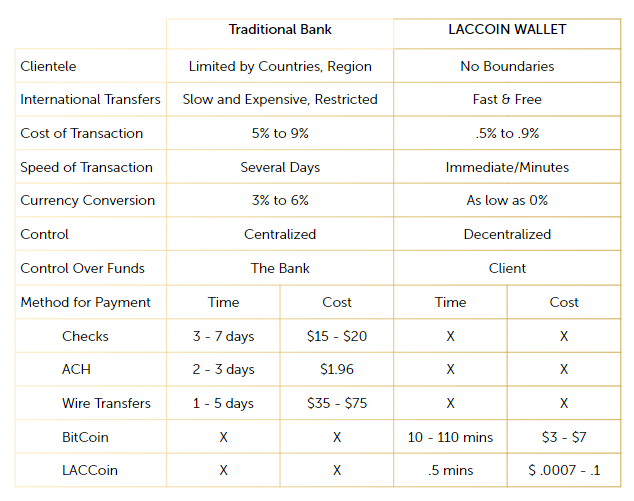

Below is a comparison of the structures of the cryptocurrency wallets and Traditional Banks.

Table 1: Comparison of structure of cryptocurrency wallets and Traditional Banks.

Our Vision

We believe that, with the use of the Laccoin ecosystem, we can provide people within the LAC region with easy access to funds. Many of these people would normally be unreached within by the present system. Blockchain technology, which is it is cheaper, faster and safer, is an excellent way to reach out to and include everyone within the region to participate whether within the traditional economy or the new digital economy of the future.

Our vision is to create a viable ecosystem for monetary transactions which will be a viable alternative to the existing banking system.

LACCOIN USES

Laccoin has many uses but will primarily be used to focus on the $70 Billion remittance market for covering the LAC region. It addresses the following key problems faced by the poorer sector:

A. Problem(s): Costly remittance systems o Solutions: Laccoin is an easy way to send international remittances to other Laccoin wallet holders.

B. Problem(s): Reaching the Underbanked o Solutions: Access to current banking services and the new cryptocurrency card payments system through the use of mobile devices which will have result in a more significant penetration rate than banks.

C. Problem(s): International and domestic aid to LAC regiono Solution: The speed of aid is essential in critical situations. With widespread mobilepenetration, aid can be received effi ciently.

D. Problem(s): Inability to invest or spend within the LAC regiono Solution: To enable and empower citizens in the area to become a part of the new digital economy through the use of LAC tokens within the LAC region.

E. Problem(s): Inability to access loans through traditional financing mechanisms to start business projects or personal projects.o Solution: To enable and empower citizens in the region to access micro-fi nance \through nontraditional means by creating a credit score through their Laccoin wallet.

F. Problem(s): Unbanked and underbanked do not have access to complex fi nancial vehicles to help build wealth. o Solution(s): An Union Wealth Fund will be open solely to LAC token holders.

The Union Wealth Fund will hold highly liquid cryptocurrencies that are managed to ensure a robust portfolio that meets the needs of LAC ecosystem.

ECOSYSTEM

Products

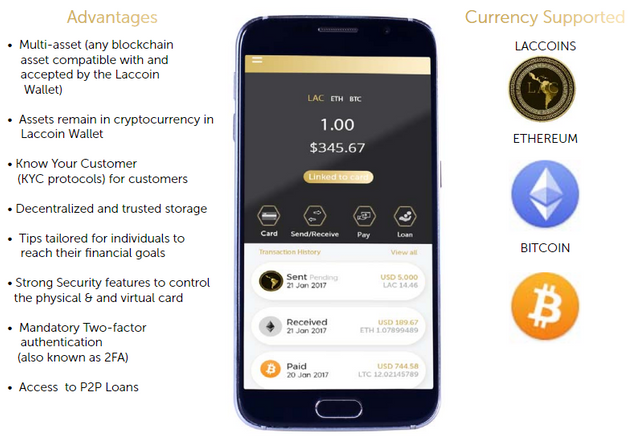

LACCOIN Wallet

The LAC Wallet is the answer to the lack of fund mobility and other fi nancial limitations described earlier. Through the use of the smartphone, users will be able to send money freely to other individuals and businesses across the LAC region. Given a choice of debit cards, users will have the facility to not only pay through their wallets or a QPR code, but also to purchase items at millions of points of acceptance online and at crypto-friendly stores. They will be able to use either LAC tokens with their wallets or other multi-currencies that the wallet will support.

Debit Cards

Laccoin Debit Card

Each Laccoin wallet user has the option of applying for a Laccoin debit card that works in conjunction with the wallet. Since physical prepaid debit cards are more accessible to people in the LAC region as opposed to virtual debit cards, the emphasis will be on physical debit cards. Moreover, users will have the option to lock or unlock their debit cards, as an additional security measure not found in current debit cards.

The symbiotic link between the wallet and the Laccoin Debit or Virtual cards gives the user access to certain blockchain assets: ER20 backed Ethereum, Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Laccoin (LAC) or other public ledger assets that are in demand. The Laccoin wallet can be funded through the bank. In addition, unbanked and underbanked users can use kiosks and deposit machines to load their wallets, from which funds can be further transferred to their Laccoin wallet. Laccoin will work directly with Visa and Mastercard to supply the best available options for LAC debit card users.

Debit Cards

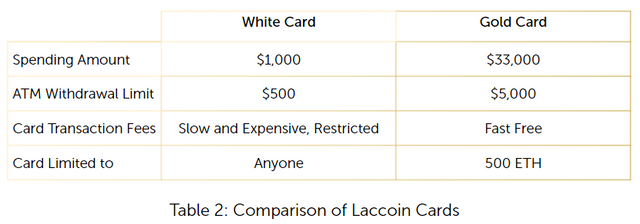

LAC WHITE CARD

The Laccoin White Card is a standard edition card for all the Laccoin wallet holders. Every users can gain qualify for the white card as long as they pass KYC protocols. Users have a daily spending limit of US $1,000 and withdrawal limit of US $500. Fees apply to the white card.1

LAC GOLD CARD

The Laccoin Gold Card is a limited edition card for holders who invest 500 ETH or more in the wallet. The card comes with a daily spending limit of US $33,000 and a withdrawal limit of US $5,000. There are multiple additional rewards for the Laccoin token holder. Fees that apply to the white card do not apply to the gold card.2

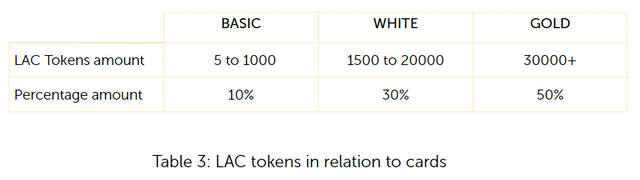

Reward Program

The reward program is designed to create brand awareness and a sense of community with LAC token holders. As we grow as a community of users, we want members of the LAC token community to grow with us. The more LAC tokens users hold or spend with their debit card, the greater their rewards.

The goal of Laccoin is to acquire a category (A) banking license. With this, we will be on the issuing side of the equation. So far, we have formed strategic partnerships with issuers.

The way the debit card works is simple. Let’s say a person in an LAC region uses their LAC debit card and swipes it at a store for a total transaction of $1000. Once the card has been swiped, the issuing bank as well as Visa or MasterCard will take a percentage of the purchase.

To illustrate, let’s say 4% of the purchase is held back. The issuing bank takes its commission which is $10 dollars, and Visa or MasterCard take their commission which $15. Out of the $40, $15 is left. The issuer receives another $5.

So now we have $10 dollars left, which goes to Laccoin. Out of that $10, we would take $5 and split it into three diff erent categories. 10% goes to Level 1 token holders, 30% to level 2 token holders 50% to level 3 token holders. At the end of every month we would go into the open market (See Section 5.3 Liquidity/Elasticity Reserves)and purchase the token equivalent for one of the three levels and distribute it to the respective groups. We take an-other $2.5 and send it to the LAC Union Wealth Fund where token holders would have another means of getting long-term benefi ts.(See Section 4.5 LAC Union Wealth Fund)

Microfi nance ( Future )

Laccoin will further develop a platform whereby individuals will be able to make small peer-to-peer (P2P) loans to individ-uals through the use of LAC tokens. Loans will be issued by an individual or a group of individuals that hold LAC tokens. This surmounts the usual barrierspeople face when applying for credit from traditional banks.

One reason for lack of access to credit is the diffi culty for loan offi cers to get enough information from the unbanked to determine their creditworthiness. With Laccoin, however, the system will automatically determine a LAC holder’s creditworthiness through their public ledger of transactions on the blockchain. By this means, together with an uploaded picture, KYC protocols and access to data on their social media accounts, Laccoin will be able to produce a credit score. As an LAC wallet holder’s transactional history is available in the ledger, his credit and income histories will not need to be searched by a third party, and entail more bureaucratic procedures and processing fees.

The history of Microfinance shows that it has had a positive tremendous impact on people that who require access to loans. McIntosh et al. (2008) examined data from 1,672 rural households accessing micro-credit in Guatemala, India, and Ghana.1 Using certain econometric mod-els, they found that, after the credit was provided to members in the village, the probability of investing in housing improvements and making business investments increased two and three-fold. Even though the same high percentages cannot easily be duplicated, the benefits that the loans can yield, particularly the P2P loans given by Laccoin, will have a positive impact on the individuals who desperately need the funds.

CRYPTOCURRENCY

LAC Union Wealth Fund

The very nature of blockchain technology itself has changed things in astonishing new ways, itwill and now is defi ning how our society operates. It is disrupting the old conventional modelsof fi nance and opening up doors that were restricted before to High net worth individuals(HNWI).

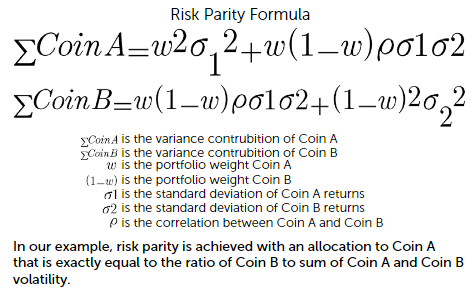

To ensure that LAC token holders get the most out of the LAC tokens, Laccoin will launch anUnion Wealth Fund to complete its ecosystem. LAC token holders will receive the utmost pri-ority for being expected in the fund. LAC-holders will have access to a regulated, diversifi ed, well managed and monitored cryptocurrency portfolio. Individuals who subscribe to units in the Fund in LAC will enjoy discounted fees and receive lower redemption fees, receive bonuses and will have priority over others to access the units in the LAC Fund. The LAC fund will play a critical role in supporting LAC Ecosystem. The Fund will undertake semi-annual re-balancing to ensure optimal performance and risk mitigation. A quarterly analysis will be conducted to main-tain a robust portfolio. Risk and volatility are the prime concerns for a fund of this nature as the total size of the cryptocurrency space is equal to roughly 400 Billion in assets.1 The size of the market means that it is susceptible to an increased likelihood of market swings as opposed to the 66 Trillion dollar stock market that can absorb great deals of volatility.2 The construction of the portfolio will likely be one that takes risk and volatility into account when beginning con-structed.

If a person had $100 to invest in two cryptocurrencies, you woulddivide that money between the two coins based on their volatility.Higher up and down swing in the price which is volatility equals higher risk. So, if Coin A were three times as volatile as Coin B, then to keep the risk of each coin at parity(the same risk level). One would put three times as much in Coin B as you would in Coin A. Meaning, you’d put $25 intocoin A and $75 into coin B.

Overview

Laccoin will use the Ethereum blockchain technology as its backbone. Our developers could have made our blockchain however, the security issues arising from forming a new blockchain would have hampered eff orts to get Laccoin underway in the region. A trusted blockchain such as Ethereum with established protocols would better allow for future expansion and scalability without comprising security. However, it is not outside the realm of possibility for our team to develop our own blockchain in the future.

Part of our mission statement is becoming the de facto currency for the Latin American and Caribbean region which is home to approximately 628,924,400 million. The population projec-tion for the year 2020 is around 700,000,000 million.

Another fact is that technology and numbers are widely aff ected by people’s perceptions. The decimal places of existing cryptocurrencies put users of that currency in a position where it is entirely possible to see someone getting paid a weekly wage equal to 0. However, when further broken down into decimals, the fi gure could actually be .00043306. The psychology of getting paid less than one unit has a dramatic eff ect on how people will perceive themselves in relation to the new currency and the chances of it being adopted or being trusted. For this reason, the supply will be set at 700,000,000 million coins with the coins having two decimal places.

ERC20

ERC-20 has six standard functions that smart contracts on the Ethereum network can easilyrecognize and understand. These functions dictate the functionality of the tokens and how a user can access data about the tokens. The features of the smart contract to be drawn up by Laccoin will range from special rights, token destruction, and voting rights. ER20 tokens are transferred to other ER20 wallet holders with the use of a nominal fee called “gas” which is paid for in ER20 tokens. Essentially, this means that if one wanted to send laccoins to another Laccoin wallet holder, one would just have to pay the gas of 33 cents or less used.1

Liquidity/Elasticity Reserve

Volatility is a signifi cant concern for cryptocurrencies as it hampers the rate of adoption. It im-pedes the trust factor! Volatility either upside or downside creates an unstable value for the end user of LAC tokens. LACCOIN will buy tokens in the open market for rewards (See Section 4.3 LAC Union Wealth Fund) for its user base of LAC tokens but will hold reserves in the company by adjusting to the supply of the means of payment that are in line with transaction demands. We will be able to do so in high frequencies, in particular during times of market stress but also during times of normalcy. The Elasticity Reserve will also take into account the unsold coins from the public ICO and shift them towards the elasticity reserve. The elasticity reserve within the company shall be able to hold up to 12% of total supply for liquidity and elasticity demands. The higher the rate that LAC token gets adopted, the less likely that LACCOIN will have to hold sub-stantial reserves as the increase in usage will create stability.

LACCOIN TOKEN

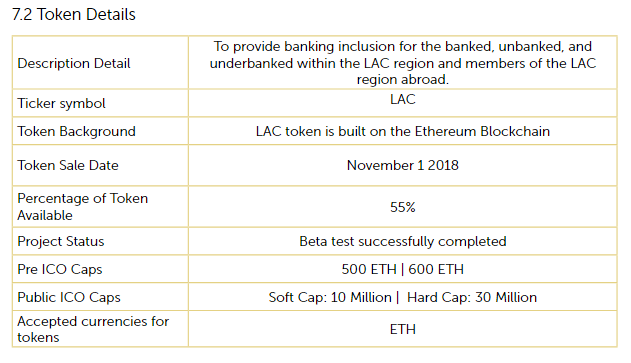

ICO Details

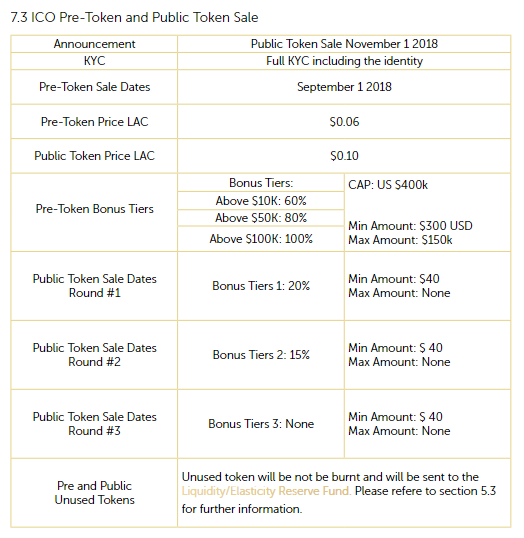

ICO – PreRounds

Before we open the ICOs to the public, we want to give prospective investors the chance to meet and plan with key investors who intend to buy Laccoin. We want to allocate exclusive bonus pools of laccoins to these investors who see the vision and have been committed to Laccoin from the initial stage. Please refer to ICO Chart for details.

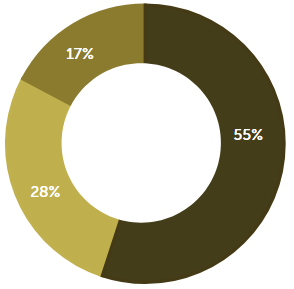

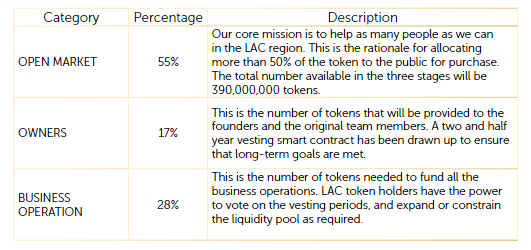

ICO – Public - Stage 1

Laccoin will have an initial supply of 390,000,000 coins, 55% of which will be released to the public in three diff erent stages. The first phase will have 33% of the total allocated tokens for sale to the public. Diff erent bonus tiers will also be off ered.

ICO – Public - Stage 2

The second stage of the ICO Public campaign will see an allotted 20% of coins being distributed to the public, of which 20% will be reserved for bonus allocation.

ICO – Public - Stage 3

The third stage of the ICO Public campaign will see an allotted 10% of coins being distributed to the public, while none will be handed out for bonus distribution.

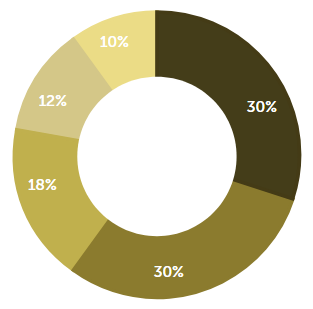

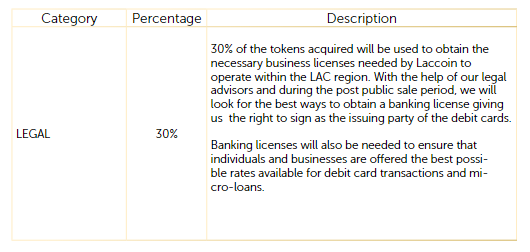

Token Distribution

Token Proceeds Spent

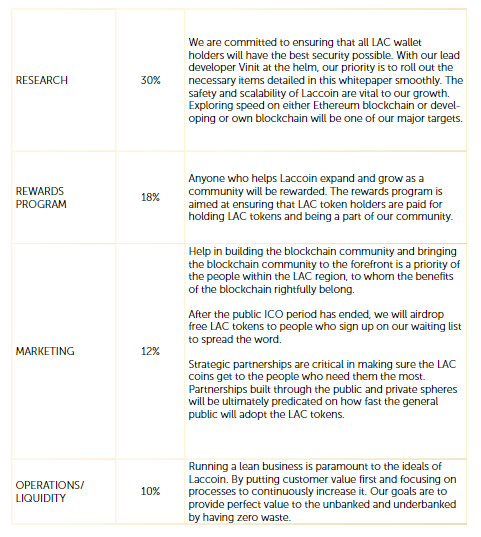

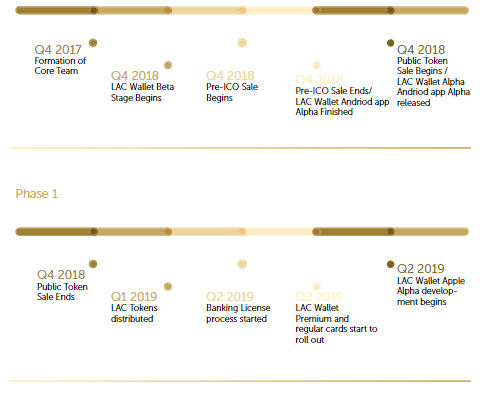

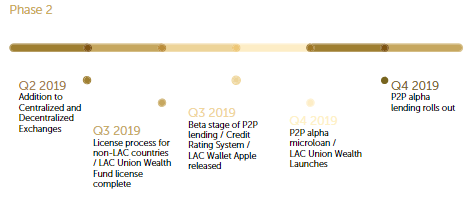

Roadmap

LACCOIN TEAM

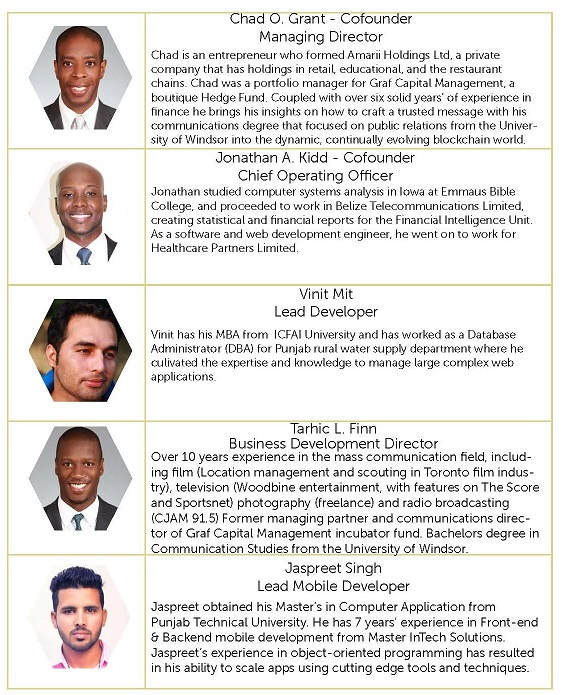

Our Team

Our team is a well-balanced mix of professionals in the private and public sector, who can navigate through the various levels of decision-making, including specifi c legal matters relevant to the LAC region, and be ready to cooperate with governments to expedite authorizations.

Here is the information that I present to you in finding information and knowing the Laccoin project currently being run by their team, if there is any error in explaining this article, do not worry, I have written to get accurate information. Information and of course you will be able to speak directly with or their team, at the link.

For more information and join Laccoin social media today please follow these guidelines:

WEBSITE: https://laccoin.io/

WHITEPAPER: https://app.box.com/s/phidkwdzjwf1399qvt5v8vo7uaqtbtml

TELEGRAM: https://t.me/LaccoinEnglish

FACEBOOK: https://www.facebook.com/Laccoin

TWITTER: https://twitter.com/LACCOIN

One Pager English: https://app.box.com/s/ahi78m41cphgcywrayk8d1qcpha258yz

One Pager Spanish: https://app.box.com/s/ralt5s7a8p0ydci1q0nw2fg2ot9095k0

One Pager French: https://app.box.com/s/zicih8tav93nrf7ccv7d9dn3b6qxhvjd

One Page Japanese: https://app.box.com/s/zicih8tav93nrf7ccv7d9dn3b6qxhvjd

Username: JUBAH84

Profile: https://bitcointalk.org/index.php?action=profile;u=1964710

Eth: 0x1C4Be60BDd042eB62d145BB1A02c011F7aA3DC1F