I welcome all readers in my blog, my name is Julia and today I want to talk again about'd project Distributed Credit Chain. After the first rather brief review, I was very interested in two questions: first, how the crediting process works through blockchain, and how securely the personal data in this system is stored. Shed some light on these questions I want in this article.

The first stage of the system is data entry, which is carried out with the help of a special system Submitting data Validation (SDV). Through this system, credit companies bring customer data into the risk assessment system. In addition, the data can be entered by the client itself, and companies receive them already in the SDV.

The result of SDV is the decision to issue or surrender the loan.

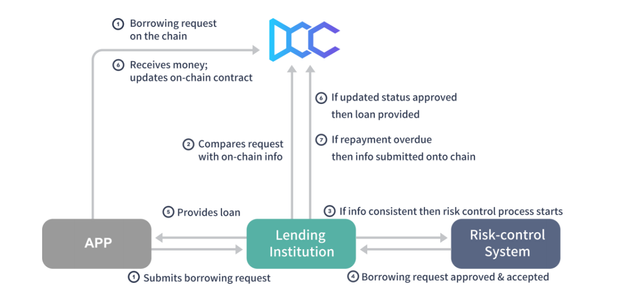

The schematic process of lending from the application to the receipt of money is shown in the following diagram:

One of the most important components of the system is the reports on credit operations.

Immediately after the client's first treatment, a credit history index is created in the system, which tracks all the client's activities in the area of credit throughout his life. In fact, it is a personal credit history, which includes all loans ever taken, the presence of arrears, bad debts and so on.

The main feature of this system is both total security of personal data of clients and availability of a number of useful functions for credit organizations:

- First, all data is stored in an encrypted format. In addition, the system is designed so that the data as such is stored only by the client and the company, the system itself stores only the index assignment of these operations. Therefore, even having this index value, the third party will not be able to get the data itself. In addition, we are currently developing a system in which all personal data will be processed locally without going into the network;

- Mechanisms of index credit history, and also Submitting Data Validation are extremely inexpensive and are accessible to any type of organizations;

- Finally, the decentralized nature of the system will allow to get rid of intermediaries, that is, on the one hand to increase the income of credit institutions, and on the other hand, and significantly reduce interest rates.

Resume

As we can see, the developers have managed to create an elegant crediting system, simple for both clients and companies. Plus take care of your personal data is not necessary, because the architecture DSS built in such a way that the intruders or any other third party have little chance of getting information about you.

I have been following this system for several months, and I advise you to look at it more closely! And you can do it by links:

the future of the banking industry is goint to be on the blockchain 100%.

maybe DCC will help clean the mess there in in conventional banks? we will see @juliasto

Also follow me for a follow back

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I agree with you, @fabyflavour

Thank you for attention!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit