Introduction

A business which grows without any external help from the government is one of the most stable businesses in the market. It no longer needs the incentive and support from the system to grow itself. Most of the businesses which provide the stability to the economy of a country are the small businesses, they are the silent workers who keep doing their job without much noise, unlike the big corporates. The world economy is based on their development and growth. All the government understand their importance in the economy yet they provide very less formal support in form of credit for their survival and growth. According to World Bank, almost 70% of small businesses lack access to credit. This creates an opportunity for the private investors to play their part.

Small and medium-sized enterprise financing is an issue faced by every country in the world. Many reasons contribute to this growing problem, and the biggest reason is the banks. They have failed in their duty to support the most stable industry in the world. They are guilty of selective financing of the businesses, which are less risky and traditional. What banks could not achieve has to supported by the alternative financing industry, which includes P2P lending, crowdfunding, balance sheet lending, invoice trading and supply chain finance. They support the small businesses in their tough times providing credit for growth and survival. The alternative financing industry has become the new standard for the financing the new projects, and as World Bank reports that the alternative financing market could be $90 billion in 2020.

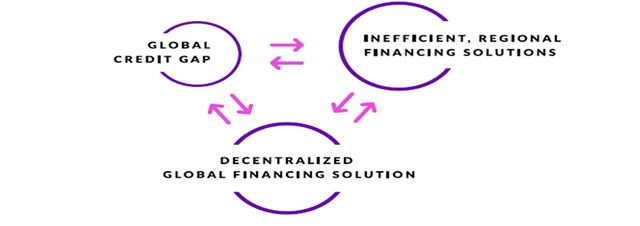

The alternate financing enables a direct meeting between the creditors and investors without any third party invention. The Blockchain technology can play a big role in the decentralisation of the financing industry. The solution to fix this credit gap involves a transparent, secure and supportive framework. The inefficiency in the current banking and financing industry can be solved using the blockchain technology.

The requirement for a platform, which provides decentralised financing solution for small and medium enterprises has become a necessity in today's world. A platform for easy credit with a transparent and secure framework to support the small businesses.

Solution Offered

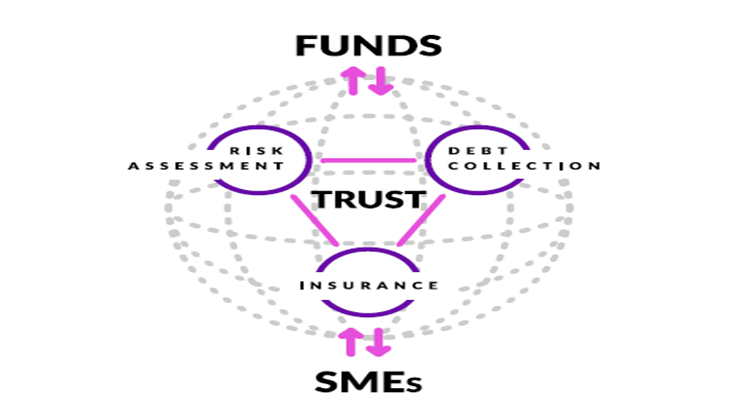

DEBITUM Network offers the perfect solution to fix the trust issue in the lending business. The trust factor is one of the most important elements of the network.

The Network is based on three pillars which will solve the credit issue of the small business.

- True Decentralisation: The financing service providers can be part of the decentralised community, which connects investors and companies all over the world on the DEBITUM Network. Community management is the key concept on the network. The community leaders take responsibility for the management of the community.

2.The hybrid connection of crypto and fiat currency: The cryptocurrency is still not the recognised currency by many countries in the world. The Fiat currency is used and it can be converted into cryptocurrency, and vice versa.

3.Trust-Based Approach: Smart contract is used to solve the problem of trust between lenders and borrowers. The strength of repaying the loan is based on the Trust between Financers and companies.

DEBITUM Network works to support the entire framework for the smooth operation of the lending process based on the Smart contract and Blockchain technology.

ICO Information & Team

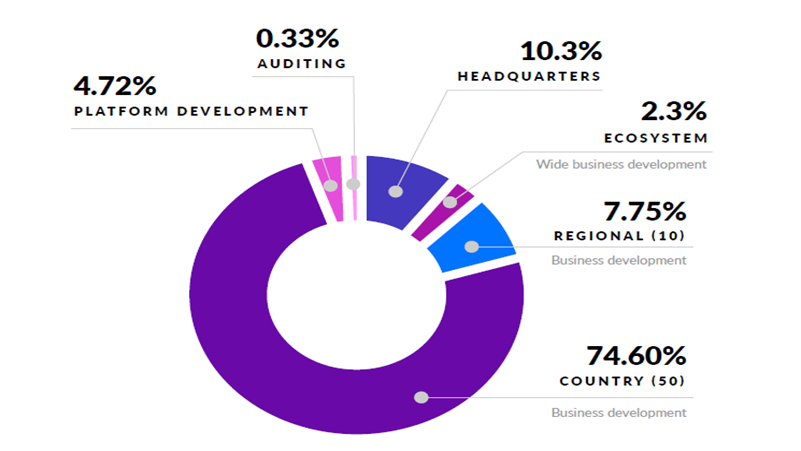

DEBITUM Token (DEB) is the medium of exchange on the DEBITUM Network, and it has the intrinsic value of value exchange on the platform. To develop their project, they are asking people to join them on their ICO. They have divided the countries of the world into different groups for the stepwise launch of their program.

The team consists experienced professionals from the financing and banking industry. They are a motivated group of people who have decided to solve one of the biggest problems of Small Enterprises.

Conclusion

DEBITUM Network has employed the blockchain technology to solve the trust issue between lenders and business. The important element is the lack of trust between the lender and borrower to successfully complete a transaction. DEBITUM Network aims to create a self-governing financial ecosystem which benefits the small and medium enterprises. We can be the biggest contributor to their mission to solve the age-old issue of lack of credit.

To know more visit:

Website : https://debitum.network/

Whitepaper : https://debitum.network/whitepaper

Published by: Kishan748

Btalk profile: https://bitcointalk.org/index.php?action=profile;u=1108165