In my last article, I dove into the basic issues that the mortgage industry faces. Today, we'll be looking at the benefits of using a platform like Homelend.

With all the actors and documents involved in the mortgage fulfillment process, there are two common factors underlying the industry. There's a need to A) gather information and B) analyze information. With recent technological advancements, the system still isn't modernized, and both these factors increase the overall cost. That is unless blockchain technology successfully integrates, and right now it's showing huge potential to fix both of these problems.

Being distributed in nature, the blockchain ledger has the ability to considerably smoothen the access to and transfer of information for every party involved in the mortgage value chain. That’s not all! With its exceptional capability to enhance trust, transparency, and prevent data alteration, the blockchain ledger is a valuable attempt towards digitization for mortgage documentation, as well as other associated business processes.

What Homelend is offering the Mortgage Market

Blockchain is often seen as a Mutually Distributed Ledger (MDL) where records are saved in different locations, without any entity or organization having control over it or having the ability to modify it. Traditionally, databases are under the control of a single entity. Take a bank as an example, records of transactions are stored but can be hacked and modified by someone, and they would be able to steal a large amount of money.

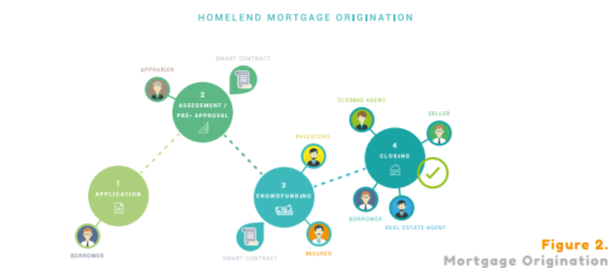

Just as we've previously discussed, the mortgage lending process involves a lot of entities, documents, and steps. Parties involved must be able to access, analyse, and authenticate information provided when applying for a mortgage. What this means is that with a distributed ledger that is accessible by all parties, reliability, efficiency, and transparency can be fostered during mortgage origination.

With Homelend, inconsistencies in the information accessible by every party would be reduced to zero. This is because all the documentations will be stored in an immutable and equally accessible distributed database.

Source: Homelend Whitepaper

Aside from its ability to store information from past documents in a consistent and unalterable manner, blockchain technology enables processing of transactions and the generation of immutable and accessible records.

Look at the closing of the mortgage loan for instance, as well as the signature and consequent issuance of the mortgage deed and promissory note; all of these can be done in the blockchain where a digital document, marked with a unique hash identifier and other metadata, will be developed.

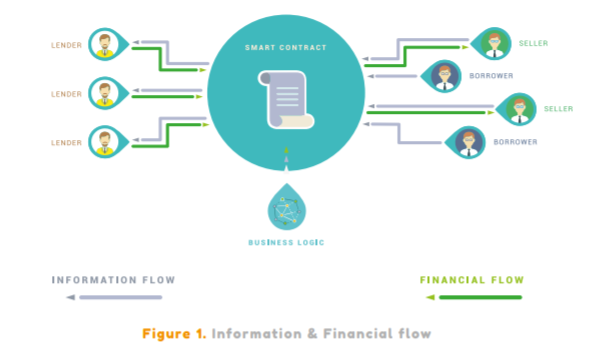

One other thing blockchain technology offers the mortgage market is its smart contract feature. This allows agreements and transactions between different parties to be carried out without the influence of an external enforcement mechanism, legal system, or central authority, making transactions traceable, irreversible, and transparent.

Source: Homelend Whitepaper

Collectively, Blockchain and smart contracts have been reported to have the potential of saving the mortgage industry between $3 billion and $11 billion.

With blockchain infiltrating the mortgage market, there will be significant increase in the efficiency of the mortgage value chain. Information created will be stored privately and will only be accessible to the parties involved in the mortgage origination process.

Luckily, a platform known as Homelend is looking to transform mortgage origination into a fair, more efficient, and simpler process, which would bridge the gap between lenders and borrowers in a unique way. For more information on the Homelend platform, be sure to check out their website

Disclaimer: As with all investments, you should do your own research. The information provided in this article is focused primarily on bringing the facts out of the white paper to supplement your due diligence. Please do your own research and make up your own mind.

Links:

Homelend Website

Follow Homelend's Twitter

Join the Homelend Telegram Group

Follow the official Homelend Blog

Read the Homelend Whitepaper

Author BTT Profile

ANN Thread

Want a FREE RESTEEM?

Follow Me & Will resteem your blog for free !!

Do not forget to provide your blog link which you want to resteem.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit