Hi Crypto Network,

Thank you for all the great comments and feedback to my team about our last article on the Top 3 Altcoins under $1! It’s clear you are all interested in value and not just looking to Buy & Hodl for the long run.

Before I get into the main topic of today’s article, I wanted to spend a moment to share something I created last week and discussed on our weekly crypto-video on ‘the mindset of a new crypto investor’, as I think it’s a very pertinent issue that I keep coming across. I want all my readers to take a second and digest the difference, and if anyone needs any support with their portfolio – Get in touch.

HOLDING VS TRADING

CRYPTOS ARE DOWN, BUT ICOS ARE BOOMING

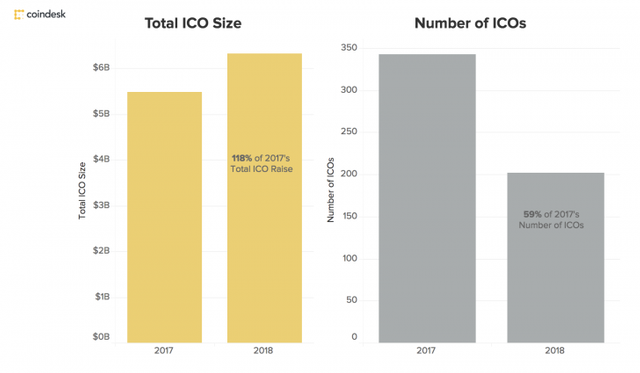

So to explore the title of this article I wanted to share with you that Initial coin offerings (ICOs) raised more money in the first three months of 2018 than they did in the whole of 2017.

At $6.3 billion, ICO funding in the first quarter was 118% of the grand total for 2017,

Before we discuss the possibilities as to why now is a great time to be looking at ICOs, let’s discuss exactly what an ICO is.

WHAT IS AN ICO

ICO stands for Initial Coin Offering. You can look at ICOs as an alternative form of crowdfunding to the release of a new cryptocurrency.

ICOs are one of the most efficient and easiest ways for an individual or company to fund their projects and, at the same time, have other individuals and companies investing in them. Usually, before a new cryptocurrency emerges, the individual or company will need to raise money for all the technical development that is needed. So, they usually sell tokens in exchange for more established cryptocurrencies like Ethereum (ETH).

ETHEREUM (ETH)

ETH, being the most popular cryptocurrency to work with emerging coins, has recently been scrutinised by the SEC. Confirmation that ETH is not a security in its current form has been announced. This should open up the path to futures on ETH pretty soon, which could bring in a lot of retail money because you can then buy the ETF just like you buy a share.

The importance of this in relation to ICOs is that William Hinman (head of the Division of Corporation Finance at the SEC) also acknowledged that some digital assets could be structured more like a consumer item than a security, particularly if the asset is purchased for personal use and not intended as an investment. He seemed to imply that these types of offerings — an investment in a book club, or a golf club membership, for example — were likely not securities.

However, we have also seen clear direction and classification of what a security is and what is required. This is a great step in the right direction as ICOs looking to utilise the regulatory approach and the security style setup can be implemented. Earlier this month, supporting this view, Lithuania’s Ministry of Finance issued guidelines on Initial Coin Offerings (ICOs), outlining when cryptographic tokens would be viewed as securities and how each aspect of a token sale should be regulated by different laws in the country. Again, this is a great opportunity for the industry to be more transparent so that ICOs can grow in a regulated environment, thus attracting more investment from retail audiences as well as the Whale and Institutional involvement.

ICOS ARE GETTING STRONGER AND STRONGER

Nowadays ICO crowdfunds end up with an average of $20,000,000USD, in some extreme cases going north of $100 million. Now compare it to the market cap of the tokens that are already being traded. $5 million barely places you in the TOP 100 where we can still find some coins from Generation 1, Coins like the DOGECOIN! Some are known to be completely worthless and don’t have the promise of a successful project. Often projects introduced as ICO are in a far more advanced state of development than the ones already sitting in exchanges, as well as offering a 2nd/3rd Gen level of technology and ideology.

TOP 3 TIP ON ICO INVESTING

WHAT THE PROJECT IS ALL ABOUT

The first step in recognising a potential high performer is to look into what the business model, goals, and plan of action is. The best way to get all this information efficiently is by taking a look at the ICO’s Whitepaper. This is a document that outlines everything potential investors need to know about the asset. Don’t even look twice at an ICO that doesn’t have a whitepaper easily available.

TRANSPARENCY AND THE TEAM

You need to know and trust the people you’re handing over your hard-earned cash to. Don’t bother with anonymous ICO teams, that’s a good way to lose your money. You want to see a team with a proven track record in the tech and finance industries, solid education and/or experience, as well as the confidence to openly reveal their identities on the company whitepaper and ICO website.

COMMUNICATION AND ENGAGEMENT

A well-grounded and reliable ICO will make it easy to interact with them, ask questions, and find information about every aspect of their operation. Social media, online forums, blog posts and the like are some of the favoured methods sincere ICO developers utilize to keep potential investors in the loop.

FINAL REMARKS

WHAT THE PROJECT IS ALL ABOUT

The first step in recognising a potential high performer is to look into what the business model, goals, and plan of action is. The best way to get all this information efficiently is by taking a look at the ICO’s Whitepaper. This is a document that outlines everything potential investors need to know about the asset. Don’t even look twice at an ICO that doesn’t have a whitepaper easily available.

TRANSPARENCY AND THE TEAM

You need to know and trust the people you’re handing over your hard-earned cash to. Don’t bother with anonymous ICO teams, that’s a good way to lose your money. You want to see a team with a proven track record in the tech and finance industries, solid education and/or experience, as well as the confidence to openly reveal their identities on the company whitepaper and ICO website.

COMMUNICATION AND ENGAGEMENT

A well-grounded and reliable ICO will make it easy to interact with them, ask questions, and find information about every aspect of their operation. Social media, online forums, blog posts and the like are some of the favoured methods sincere ICO developers utilize to keep potential investors in the loop.

If you’re looking to not only trade but invest in the cryptocurrency world, you may wish to consider taking another look at the ICO world in more detail. There are many top projects out there that can return 10x, 20x and even 50x or more of your initial investment, so having the skill set and the knowledge to take advantage of this is well worth it. If you want to learn more about selecting and trading ICOs book a time with our ICO specialist and he will talk you through the top ICOs we are looking at this week.

BOOK AN APPOINTMENT WITH A CRYPTO TRADER TODAY!

WHERE PLATINUM CRYPTO ACADEMY COMES IN

Platinum Crypto Academy is here to support traders of all levels, so if you need some advice on your portfolio, or if you’re just looking to get started in cryptos, we are here to help. If you haven’t heard much about cryptocurrencies, here’s the brief version from an investing point of view. Over the last 18 months, the cryptocurrency market was the single highest rising market in the world.

It beats out Gold, Silver, Aim stocks, the FTSE, anything you can name. It out-performed small caps by 80 times! How and why this happened, and why even this enormous growth could be DWARFED over the next 2-5 years? Spend some time with a Platinum Crypto Trader and you will see just what is possible.

If you’ve booked your session above, we look forward to speaking to you soon!

Hopefully, you have enjoyed today’s article. Thanks for reading!

Have a fantastic day!

Richard Baker

Live from the Platinum Crypto Trading Floor.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit