Cryptocurrency and the blockchain created a new source of wealth for many and also made possible the advancement of different real-life practices in the various sectors via it's disruptive and immutable potentials. A lot of people all over the world now either owns, had own or plans to own a cryptocurrency. This, of course, is fueled by the immensely significant financial gains that come with it.

Everyone wants financial freedom no doubt and since cryptocurrency can guarantee that, it's only right and logical to participate. A cryptocurrency that functions uniquely or been used for a unique purpose, increases the tendency in which a holder holds and accumulates such assets because he knows there would surely be a significant growth in value.

But they should be considered more as a currency rather than an asset. It's more effective as a payment method to purchase goods and services than just been an asset. But what if it can be used as a currency and also serve as an asset? What if you can hold onto your cryptocurrency and spend on necessary purchases at the same time? What if you can borrow Fiat and use your cryptocurrency as collateral? All these would really justify and uphold the purpose of cryptocurrency and cause increased adoption and acceptance.

Fortunately, the answers to the questions above are all yes. I present to you MoneyToken, a Blockchain-based Financial Ecosystem focused on cryptocurrency-backed lending and crypto assets leveraging. It’s impossible to acquire a loan from a bank using crypto-assets as collateral and even using real assets also are bound by strict rules and verification processes.

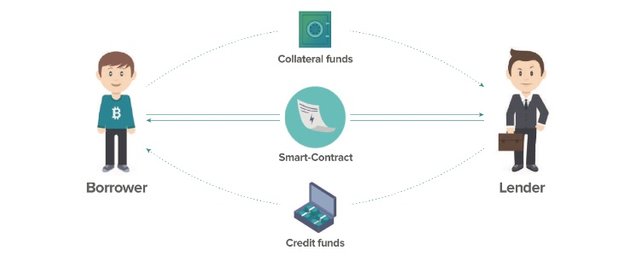

But in this blockchain-based credit system, none of those rules or restrictions are essential as all conditions/details of the loan at any moment are transparent and the value of the assets publi which can be seen in the smart contract. Therefore, no intermediaries are needed besides the link ensuring the completion of the transaction and the smart contract and the cost of a loan lowered. This service is highly beneficial to the crypto holders, traders, miners, ICOs, and exchanges.

As a borrower, You don't have to be worried about the safety of your token as the conditions of the deal are captured in Ethereum-based contracts. The Collateral funds are kept in a wallet that is protected by a multi-signature. To gain access to the wallet, 3⁄4 signatures are required. First one of them belongs to the borrower, second to the lender, and the other 2 to the platform.

MoneyToken is unique from other lending platforms in the following ways.

- Loan ranges from $500 to $1,000,000 and more.

- The absence of scoring or credit checks, since loans are backed by a collateral in 1:2 ratio.

- Credits are given out from one credit fund, which makes collecting a credit portfolio unnecessary, as opposed to the regular p2p platforms.

- Loan approval takes seconds and funds can be released almost instantaneously.

- Credit can also be given in stablecoins, which is convenient in case the client plans to use the credit funds inside the cryptocurrency market.

- Its services will be available globally.

- Has it's own stable coin and decentralized exchange.

- No extra costs or hidden services charges and discount on platform services.

Behind MoneyToken is Amanda. Amanda is an Artificial Intelligence Assistant who will provide automated loan operations within the platform.

Amanda is powered by a deep learning AI algorithm, and her goal is to provide human-like services for the platform users. MoneyToken also have an Exchange on which cryptocurrency can be traded.

MoneyToken Sale and Token details

The MoneyToken (IMT) is an ERC-20 Token build on the ethereum blockchain. It can be deposited on the platform to receive Borrower Membership with up to 60% discount. It also gives the opportunity to become a creditor when depositing IMT for Lender Membership and Participation in decentralized voting is enabled. Its token sale is ongoing now and accepted currencies are; BTC, ETH, BCH, DASH, LTC, and NEM.

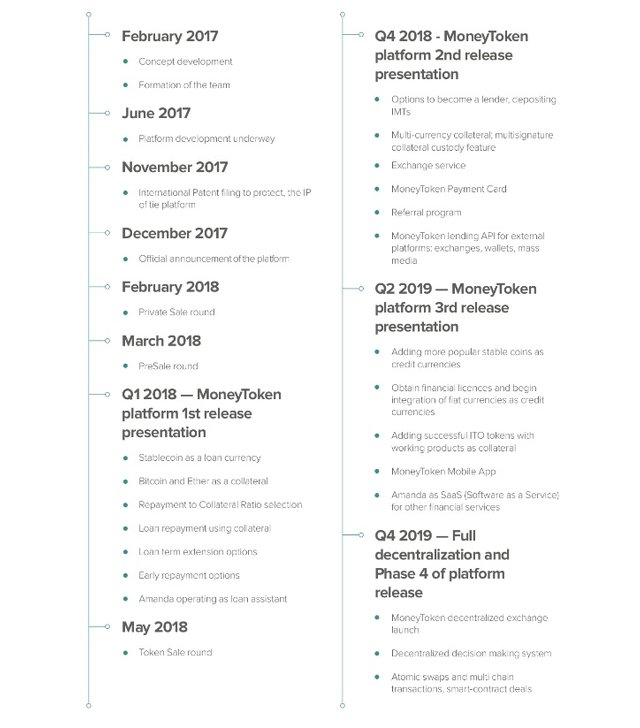

Roadmap

TEAM

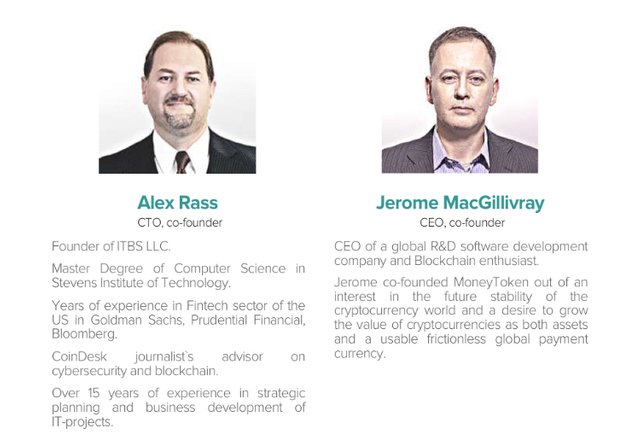

Founders

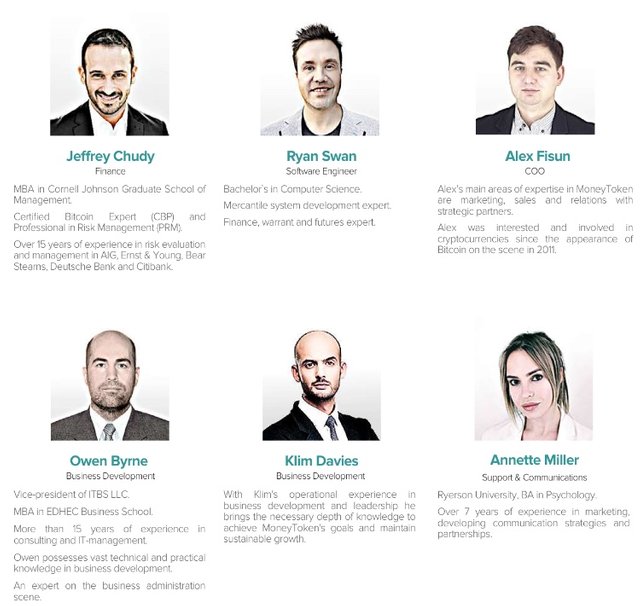

Key Members

Local Ambassadors

Advisors

Useful links

Website

Whitepaper

Twitter

Telegram

Writer Details

Username: Dogecoin92

Bitcointalk profile

Congratulations @royalt123! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your Board of Honor.

To support your work, I also upvoted your post!

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I have heard of crypto backed loans, i think the idea of moneytoken is unique.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is well detailed, I'll take my time to peruse the whitepaper for further information and possibly invest. I love good investment opportunities.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Whats the diff with this projevt and nexo

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi there, the difference between this project and nexo alongside others were listed in the article. Please kindly check through at the 7th Paragraph. Thanks.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Though I just invested in similar project but I will do more findings about this

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit