Human, birth, child, young, aging and death. It is a fact that is inherent in man. This process can not be changed. Most people try to be a profession in order to survive in this process. Thanks to the income generated through this profession, it is possible to get what they want in the period they live, and they can make plans for the future. One of these plans is that the plan's functioning, maturation and passion can last a lifetime. Retirement ... Working in young and healthy periods makes it easy to earn income.

But when it comes to a certain age, people feel the need to pull out of an edge and rest. He wants to get rid of the fatigue of the years. Since it is not possible to earn income by working in this period, it is the most natural right to use the savings it has made in this period. People invest for years to survive over a certain age. These investments are regular and planned. A sector emerges where there is constant circulation of money. Retirement Sector. There are also so many private investors in this sector that are usually under the control of the state and are under the control of the states for the welfare and happiness of their citizens.

In the global context, very serious reforms are needed in the pension sector. While the number of retired individuals worldwide is increasing day by day, very serious regulations are not being made in the funds created for retirees. The global economy is constantly changing at an accelerated pace and life standards are becoming more expensive. While the number of retired people is constantly increasing, there is no increase in the number of registered individuals investing in pensions.

The gap between the two is increasing every day. The assets that filled the pool and the assets consumed from the pool began to be unable to balance each other. Among the reasons for the difference are the mismanagement of the funding sector, the fact that fraud incidents are excessive and that too much control can not be done. This has taken its place among the reasons for triggering the situation of the global financial crisis that may arise.

Traditional pension schemes depend on local stability. It is shaped by the situation of the society and the legal ground in which it is located. It is managed by private employers and governments. Also, most of the time pensions will not be at the desired level. It is not enough to meet the needs of the pensioners. The constant increase in the numbers of retired individuals makes the states more liberal, resulting in extra costs. It is recommended to increase the age of retirement. Therefore, your future retirement structure should be more collective and objective.

When resources are collected in pools designated by governments and private pension funds, they must be indexed to changing employers or governments and brought to individual pension. At present, pensions are protected by different companies and individuals exposed to job changes, it is difficult to keep up with pension plans. With Blockchain technology, a project that believes that such problems can be overcome is a dream. This project, which believes that the problems that arise in the pension sector can be overcome through a decentralized and non-interfering system, is the Acropolis Platform.

The acropolis is a pension platform that aims to use blockchain technology to create long-term solutions to countless issues that damage the existing pension industry. The acropolis is individually adapted from existing pension schemes and aims to speed up the transition to pension and to provide more reliable and auditable control of transactions within this process. It allows individuals to manage all their pensions from one place. Users will have full control over their pensions without needing a third party.

Working with industry-leading experts, the acropolis will work to design and build a platform that supports the existing pension system in a simulated manner and that requires a stronger retirement savings model and facilitates cross-generation migration. The acropolis is creating a pension infrastructure that supports individual retirement in line with changing legal requirements and workplace conditions. By taking legislative alignment into account, it offers a system that facilitates the retirement management process for the end user. The betting situation will be realized by taking advantage of the advantages and features of blockchain technology. It is expected to increase the visibility and audit trail of existing pension funds by taking advantage of the transparent traceability of Blockchain technology.

The ultimate desire of the acropolis is to create a decentralized pension platform that provides safe savings products on the blockchain infrastructure and to ensure that younger generations of workers are able to benefit from transparent, affordable and portable pension services. By using intelligent contracts and blockchain infrastructure it plans to be the largest alternative infrastructure for pensions worldwide. The first application platform to be developed will be a decentralized project led by the Akropolis Foundation, a centralized and trusted institution. This will change over time and will continue as a completely centerless platform. The platform will also be built on top of the Ethereum blockchain. This is because it is considered to be the best choice when considering future steps and expected positions in the future.

The Acropolis Platform serves as a gateway between the Individuals who manage pension investments, Pension Funds and Fund Asset Managers. The value of the system of co-ordination can be adapted to the conditions of various assets and geographical regions. An important point; Although the user has only one account, the sum of the in-chain transactions of the user will not be associated with a specific single identity or address information. Instead, user transactions will be anonymous, similar to identities found in various blockchain operations. Blockchain technology is based on the confidentiality of transactions.

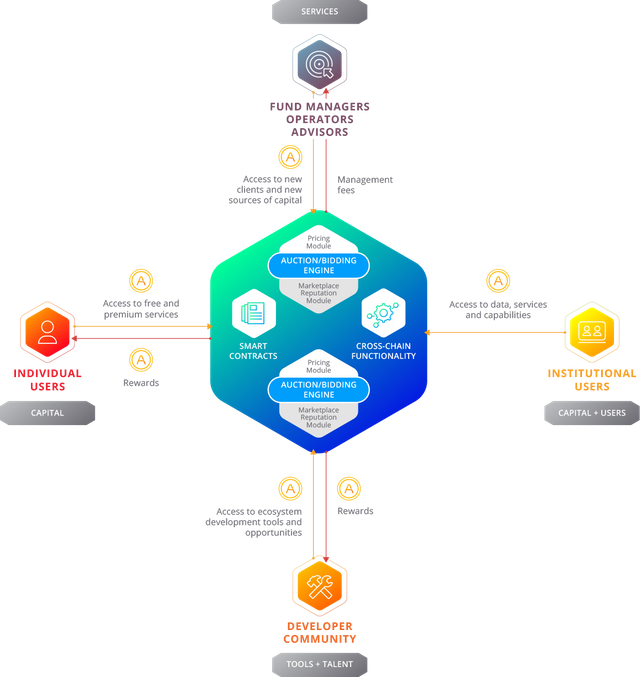

Speaking of the components of the Acropolis Platform:

Individual Users represent a single, non-institutional individual using the Acropolis Platform for retirement savings. These individuals can control all pension transactions themselves. It does not have to rely on any institution or organization for this control.

Pension Funds are institutional assets in the pension sector that have their own platform users. These institutional funds will act in a similar manner to individual users in the Acropolis Platform. They will be more transparent to their customers by doing their own actions in the Acropolis Platform.

Capital Managers or Fund Managers are institutional entities charged with purchasing assets on behalf of individuals or pension funds. They have to go through a rigorous visa process to gain access to the Acropolis Platform. They also have to regularly report assets under their management.

Acropolis Symbols are assets that are provided in the Acropolis Platform to enable the system to operate effectively. These are the key factors for the operation of the Acropolis Platform.

Developers are community members who contribute to the Acropolis Plaformu and provide enhanced services to pensioners.

If we take advantage of what we have for individual users; The acropolis records secure and irrevocable pensions; transparent, objective and real-time feedback. It provides a decentralized portable pension platform. In addition, intelligent contracts allow for the transfer of money or assets between couples. For example, retirement investments made by family members for working young adults may remain locked in the Acropolis system until the desired date. In addition, the transparency and objectivity of the system will affect the rate of global funding that can occur at the minimum level. For example; Poland, Hungary and Brazil. Common protocols are applied in the reporting of remuneration and performance. Providing the inspection and control of malpractice pension funds and ensuring the follow-up of assets provides a great advantage to individual users. The used CryptoCurrency assets can be included in the pension portfolio. Thus, these assets may remain locked by the system until the user reaches the pension.

At the same time, he can actively benefit from the Akropolis Platform for pension funds. Issues such as existing pension systems, supervisory problems, follow up and review of relations with capital managers can be resolved through the Acropolis Platform. If we take a look at some of the benefits that the Acropolis has gotten; it is possible to communicate with many capital managers through a single platform and to plan the funds systematically. it is possible to invest directly in the assets by removing the intermediaries from the center.

There are two main tokens in the Acropolis Platform. These are Acropolis external (Token) and Acropolis Internal (Token) (AIT). First of all, these markers represent a system of money and accounting mechanism to track and record the flow of capital within the system, facilitating the transactions of users entering the system from outside.

AKT Tokens are cryptographic markers whose values can vary according to their position on the market. In order to be able to access the system and access the services, AKT markers are needed. In addition, premium services are provided for the platform, and these markers will be used to purchase intra-platform data.

AIT Tokens are fixed value tokens in the system. Within the system, user funds are represented by AIT Tokens. AITs can be converted both into crypto currencies and into deposits. Essentially, the platform acts as an internal accounting tool in the block chain to provide supervision. It serves as a bookkeeping tool within the system. AITs are completely independent of AKT Tokens. So the Acropolis has a double marker system. Variable-valued markers are converted to fixed-value markers after entering the system. The acropolis removes volatility risks by using two different markers in the same system.

As the platform matures, both on-chain and off-chain data will proliferate. This data will be valuable for various organizations outside the system and these data may be sold for certain values to benefit users.

The incentive schemes within the acropolis site have some kind of value store to encourage useful and useful behaviors of users in the system.

The acropolis plans to act with decentralized identity platforms such as Uport. However, with the precise nature of the data to be maintained by the Acropolis, the first application will be processed into a traditional central database owned by the Acropolis Foundation. Identity and KYC data will be stored in the off-chain chain with all personal data and will be stored by the central Akropolis organization.

Each user will have their own blockchain wallet that will cryptographically verify ownership of all assets that it owns. Technically, a person's wallet will correspond to the Ethereum addresses that are generated for new processes performed on the platform. Each new address created for KYC and AML will be stored in the Acropolis database. The Acropolis will also have a database of users' public keys.

Wallchans and special keys for wallets produced in Blockchain technology are the main problem. If the private key of any wallet is lost and disappears, access to the wallet will no longer be possible. Also, there is no possibility that the key can be brought back. The acropolis is a blockchain platform. As with every blockchain platform, it offers a special wallet for its users and provides a special key for that purse. In the event that this key is lost and forgotten, all the savings you have made in the platform will disappear forever. The acropolis can not give you the guarantee of funds in your wallet. But the Acropolis plans to overcome this problem. With Shamir's Secret Sharing and the future-oriented blockchain-focused Tenzorum Project, the users plan to solve this problem.

The Acropolis Platform will need to improve and update its progress during the transition to the decentralized system. For this reason, the Acropolis Platform has distinguished a certain amount of AKT markers as an incentive for developers to speed up and keep system development alive. Contributors will help extend the underlying blockchain layer or the services or features offered on the platform through the development of the surface application, which is the point of interaction with the user. This will be rewarded with the AKT markers from the funds allocated for developers.

In addition, the Acropolis offers the opportunity to generate revenue using the financial data of the transactions performed on the user's savings. The monetary transactions and the deposits on the funds accumulated by the users are stored by the Acropolis. The acropolis offers the user the ability to earn money from this data. Users may submit to the Acropolis control the data that will be marketed by Acropolis to analysts or financial specialists and sold in bulk. Acropolis completely protects anonymity when sharing data. The proceeds shall be distributed equally between users sharing their data. That is, users will win as they share their data.

The Acropolis plans to make timely contracts in which users can choose to lock their funds over various periods of time due to security, personal and regulatory reasons. For this reason, it is foreseen that the three created wallets will be actively used. The provincial pension can be withdrawn after a certain age (for example, after 60 years of age). Secondly, the distant release wallet can be withdrawn at regular intervals. Third party emergency wallet can be withdrawn in case of emergencies that may occur in line with previously established standards. These purses depend on the user's desire and can be designed to control the investments of the users.

The acropolis is focused on developing a system that advocates legislative amendments that improve the future retirement platform, take advantage of technological advances to meet social needs by drawing lessons from past and failed situations, and meet the needs of users by meeting current legal requirements.

There are four main situations in the Acropolis Platform that are subject to being charged by AKT Tokens;

Premium Service Fees: While the Acropolis has a free policy for basic services, the use of premium services has been charged. These fees vary depending on the service received.

Participation Fees: Fund Administrators or Capital Managers wishing to participate in the acropolis ecosystem will have to host and use AKT tokens to act and operate within the platform. This is a necessity. With the Freemium model individual users will be able to use the platform without the AKT Token. All expenses related to basic operations in free fashion will be covered by the Akropolis Foundation.

Enterprise License Fees: There is an enterprise solution for managing and tracking investments in the Acropolis Platform for Pension Funds. These corporate remedies will allow Fund Administrators to interface with the Pension Funds that want to use private or permitted blockchain applications. To use the Acropolis Platform as this interface will require a certain fee. In this case, both the Pension Funds and the Capital Managers must have the ECT markers.

Performance Fees: Fund managers are offered incentive performance fees in exchange for providing the best possible investment services to the Acropolis community. These fees will be based on transparent templates that will be given to Fund Managers based on the performance of assets under management.

Through its Incentivised Accountability Protocol (IAP), the Acropolis Platform has a general protocol to encourage good behavior of participants in a market consisting of service providers and service users. The IAP is a decentralized contract application on the Acropolis Platform. They also have to report on the actions they are taking and the assets they have in the Pension Funds and Funds Managers. There is no such requirement for individual users. In order to facilitate market transparency, punish bad actors and reward good actors, the Acropolis will include the incentive mechanisms that bet.

The processing of the incentive mechanism requires the stacking of AIT markers of Fund Managers and Pension Funds. In case of any complaint, the AIT markers stacked by the Fund Managers are locked by intelligent contracts. The Complaints Report and the Status Reports of the Fund Manager are reviewed by the Acropolis users and submitted for evaluation. The Fund Manager's penalty will be determined according to the decision of the majority. Each user's vote is sent to the IAP smart contract.

In the event of a positive outcome of the evaluation by the Acropolis users, the AIT indicators under the lock to the Fund Managers are returned and the Acropolis acquires positive reputation scores. If the report is negative, the AIT markers held by the smart contracts are confiscated and negative reputation scores are awarded. The AIT markers, which are confiscated here, is used to present evidence showing the fallacy of the report and to award officials responsible for assessing the validity of the evidence. According to these scorers, users can evaluate Fund Administrators and Pension Funds.

Here it is likely that the decentralized IAP will be under some degree of central oversight. The resulting assessment may lead to consequences that require the legitimate authorities to act. Central observation will therefore be required to determine whether the period of evidence evaluation can be done from a center on the Acropolis or whether it should be communicated to the legal authorities.

The Acropolis Platform has a system that includes incentives to encourage the accountability and transparency of Fund Managers and Pension Funds, as well as the attainment or elimination of good / bad reputation scores against such actions. For example; the funds that give the promises that they have already promised can get reputation scores. Acropolis users may evaluate Fund Administrators or Pension Funds according to their reputation scores. According to this scoring system, organizations or structures in the system are subject to a ranking.

The long-term goal of the acropolis is to maximize the decentralized level of functionality on the platform. Initially centralized by the Acropolis Foundation, the system will eventually leave its place to a largely decentralized mechanism. Because of the legal and regulatory requirements that may arise, this centralized platform and a centralized acropolis mechanism will work together. This central body, which will be referred to as the Acropolis Council, will co-exist with the decentralized organ and act together in various operational functionalities.

In non-decentralized systems, there is a core set of participants that ensure that final and important decisions are made. This group is usually chosen from the participating community. In the decentralized Acropolis platform this group is called the Acropolis Council. Initially, it is planned to be elected by council members, founding members of the Acropolis, and industry-leading experts. The task of this council is to supervise and supervise the databases of funds held by the Fund Managers and Pension Funds in the system and the assets they hold.

The first application of the acropolis will include the central supervision of the Acropolis Foundation and will not be decentralized without detailed evaluation, rigorous testing and careful application. According to Acropolis, as the platform evolves, how decent and decentralized decentralization will be evaluated by platform users will be the basis for future platform planning. That is, decentralization will not be implemented, but if it serves the needs of users of platfrom, it can be used instead.

There are a number of problems that must be addressed by the Decentralized Autonomous Organization (DAO) in order to move to a decentralized system. DAO is the decision-making mechanism of all non-decentralized Acropolis users who will undertake the duties of the Acropolis Council over time. The first problem management scalability that can be encountered. Bringing together a majority in front of any greens can be problematic. Especially if there is a significant increase in the number of users. Secondly, management resistance, that is, the majority of the game is valid. You only need to have AIT tokens for voting. This means that guided people can influence decisions.

Partnerships and consultants established by the Acropolis Platform.

One of the partnerships established by the Acropolis Platform is the ISOLAS law firm, which has been shown for 126 years. He is one of the leading law firms in Gibraltar. The expertise, customer service and solution-focused approach that we have achieved over the course of the past century has an ideal position to address all legal issues in an expert, friendly and effective manner.

Another partnership established by the Acropolis Platform is Kenetic Capital. Kenetic; investment, consulting services, community and technology, and block chain platforms that enable the development and adoption of block chain platforms. The Platform is home to a world-class team, business partners and consultant network.

The partnership with King & Wood Mallesons, recognized as one of the world's most innovative law firms, is a demonstration of the strength of the Acropolis Platform. Asia-based KWM has an international legal network with more than 2000 lawyers in 27 different locations around the world.

Specializing in blockchain technology and information security, Sigma Prime advises financial institutions, large businesses and new companies, focusing specifically on decentralized systems and information security. In addition, the company has extensive experience in cyber security from various perspectives.

Akropolis Platform and Prime Block Capital shake hands for cooperation. Prime Block Capital is an investment fund that focuses on blockchain technologies.

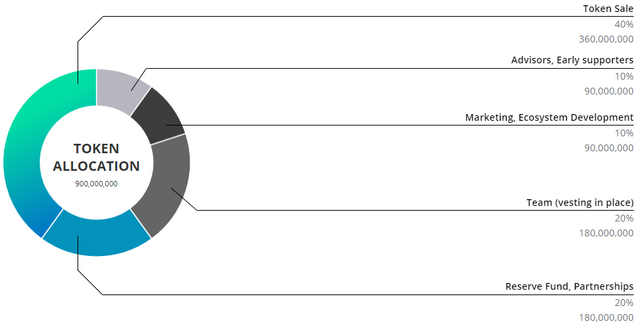

The acropolis, with a total token amount of 900,000,000, plans to sell 40% of these tokens. 20%, development of partnerships and 20% will be distributed as incentives to developers for platform development. 10% marketing and development, 10% initial bonuses to investors and consultants.

sandysan

Profil link : https://bitcointalk.org/index.php?action=profile;u=1071983

ETH: 0x022DfD639385A07a9EE272404854fE6598fEBA4b

I am actually happy to see an article here about Akropolis. AKRO has been a good project ever since. So, I totally agree on what they are saying that they are there to build products that help people save, grow and scale. Apart from that, do you even heard that it is already listed on kucoin? News just recently announce. You can check it if you like

https://www.kucoin.com/news/en-akropolis-akro-gets-listed-on-kucoin/?utm_source=

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit