Having taking over other industries over the year, Blockchain technology is gradually dominating the financial service industries. The available data shows that on a daily bases, Cryptocurrencies continue to gain more against the US Dollar. While many countries are yet to accept the fact that cryptocurrency has come to stay, it is jus a matter of time for the reality to come to be.

These of course is not without it problems and shortcomings. For instance, the digital assets have low recognition which means that it cannot serve some financial function like as collateral. "At the same time, selling cryptocurrency for short-term cash withdrawal and then repurchasing it becomes a risky and unprofitable measure due to a high volatility and commissions of intermediaries."

With the current situation, it is virtually impossible to access loan in the bank without the necessary and bulking prerequisites. With the cryptocurrency, the matter is even worse since creditor do not accept digital currency which also "makes it impossible to obtain real money against a security of cryptocurrency through traditional financial institutions."

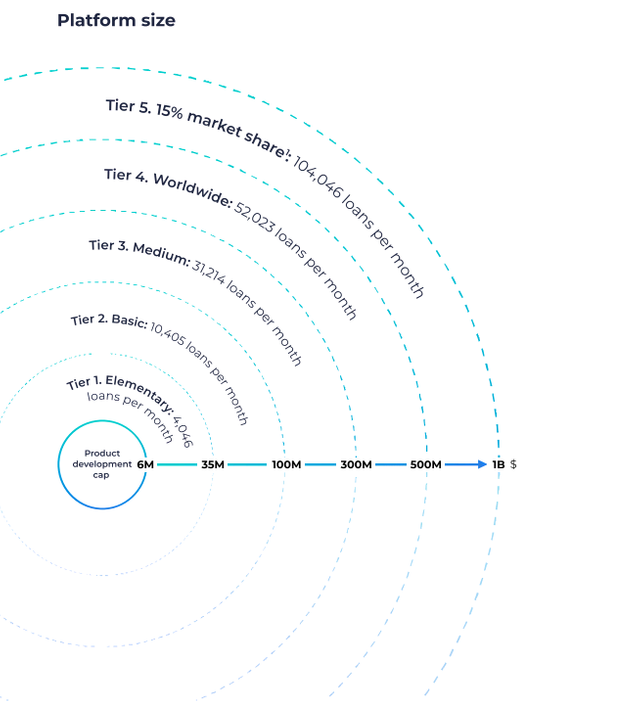

As a solution to these problems and shortcomings, the platform, eCoinomic.net was created and introduced into the global world of cryptocurrency. The global network platform in an attempt to bring solutions will "lends fiat money to individuals and small businesses using crypto assets as a collateral." With these, selling crypto assets to get a loan from traditional bank will not be necessary.

By so doing, eCoinomic.net platform will serve as tue intermediate in place of collateral between the financial institution which is the lender and individuals or groups or institutions as the borrower. As the guarantee, eCoinomic.net bear the risks with a lending procedure and also eliminating the intervention of middlemen. The following are other components of eCoinomic.net which are also worth noting

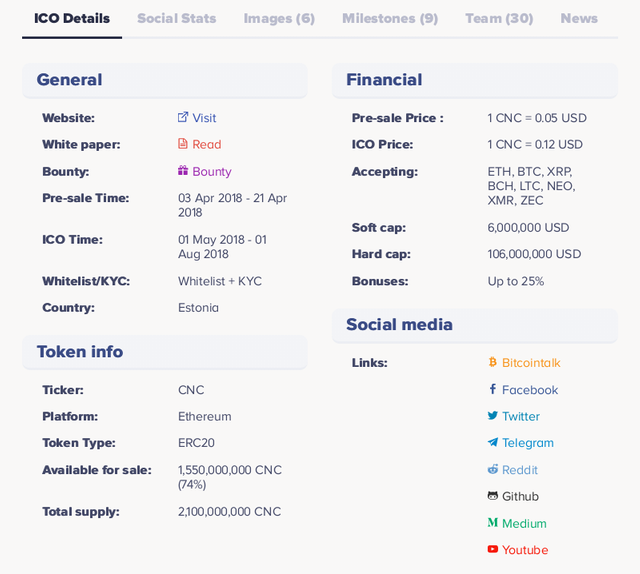

PROJECT INFORMATION

For the crypto holders, eCoinomic.net provides financial services in the following ways:

1 Fiat loans backed by cryptocurrencies as collateral

2 Investment and asset management

3 Exchange

4 Transfers and mutual settlements between users and partner projects

eCoinomic.net is divided into two phases. Firstly, the full version of the platform is expected to be publicly available in the Q4 2018. St this stage, the platform will be lending services backed by the crypto assets. The loans supported by crypto assets present an unique opportunity for their owners to be able to;

》 use fiat money for business expansion

》 hedge an exchange rate risk and thereby reduce an exposure to a market volatility

》 take prompt advantage of crypto assets potential

At this level also, eCoinomic.net provides a collateral management opportunity so as to make it possible for user to be able to swap the cryptocurrency they use as the collateral to another one. By this, "user can choose ETH as a collateral and swap it to BTC within the loan period, thus getting an advantage to manage their crypto assets portfolio."

Other information can also be found in the following :

For more information, visit:

Website: https://ecoinomic.net/

Whitepaper: https://ecoinomic.net/docs/WP

Telegram: https://t.me/joinchat/AAAAAEr4kO0ZRm92LNGwLA

Medium: https://medium.com/@ecoinomic

LinkedIn: https://www.linkedin.com/company/ecoinomic

Twitter: https://twitter.com/Ecoinomicnet

Facebook: https://www.facebook.com/ecoinomic/

Ann Thread: https://bitcointalk.org/index.php?topic=2878954

#eCoinomic #blockchain #ico #cryptocurrency

Authored by Solman: https://bitcointalk.org/index.php?action=profile;u=1903032

Public key: 0xCf9da57D7455aFBD22537a533FE86B880436EE54