PRESENTATION

SOFIN is a project of financial social network which grants an access to the peer-to-peer loans in fiat currencies. It’s a mutual benefit for both participating parties: ones are in the need of financial support, others are ready to lend. The platform itself is not a creditor.

The effectiveness of SOFIN is based on transparency and multi-level verification of borrowers. The platform allows both parties to negotiate the terms themselves, concerning the loan, the rate of interest, the duration and penalties.

The transactions are fully legal since they respect all of the regulations of the borrowers country of residence. The platform guarantees the transaction support, sends the notifications. In case of missing payments, due to the demand of creditor, it sends the data to debt collectors and sets the documents to the court.

The borrowers’ verification is done in four steps. These include the examination of documents, the phone call, the estimation of borrower’s credit history and the confirmation of employment. Both models are already working in the current projects of the team.

With Sofit anyone can select the best terms of a loan, creating a legal package, and getting money online from any device with no hidden fees. The company takes only 9% of the loan amount.

Sofin is a commercial center stage which unites loan bosses and borrowers:

Creditor — private people, banks, microfinance associations and assets;

Borrowers — private people, singular business visionaries and associations.

Advances are issued in the fiat cash of the nation where the borrower dwells. This enables the money to be traded through the SOFIN token if the loan boss and the borrower are from various nations.

The project vision, goal and path

Our point is to give reasonable financing to the fundamental timeframe for all fragments of people in general. The company trust that each individual in any nation ought to have the capacity to acquire cash so as to enhance the nature of his/her life. What’s more, on the terms that a man picks, the SOFIN point is to evacuate boundaries and fringes, to give the entrance to money related assets to the general population of less created nations.

The company will address the every day needs of conventional individuals and business people, opening up decentralized access to back on terms advantageous to the two gatherings, not to the bank or some other middle person.

A great deal of difficulties confronting society are being understood that way:

The populace expends what it needs;

Exchange and produce turnover develops;

New occupations are made.

Another objective is that the venture will manage the point of speculation productivity for Creditors by moving their speculation to different corners of the world through the SOFIN platform.

How it works

Every potential borrower must experience a confirmation system in light of the strategy we have created and as of now tried and which is fruitful in the task on the web IF.

After check, the borrower will be granted a FICO score based on which the imminent leaser will choose to give the advance. In each nation, our nearby illustrative interfaces the neighborhood wellsprings of scoring for the most precise hazard evaluation.

The organization level of pre-legal settlement of is 17%. This is a high rate of the microcredit advertise.

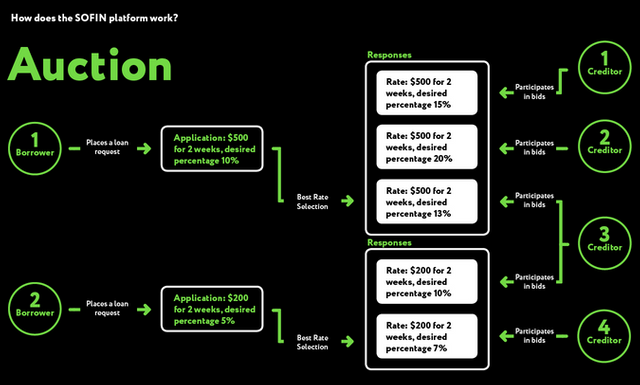

Any Creditor can issue an advance under any conditions. Any Borrower may ask for an advance under any conditions. Subsequently, showcase rivalry directs reasonable conditions for the worldwide economy, without universal fringes and boundaries. The administration will give scoring of the Borrowers, gathering unpaid debts and advantageous installment of advances. At the point when an advance is issued, every single legitimate exchange happen in the programmed mode in the client’s record. The lawful virtue of the exchange is ensured by the stage. To limit dangers, it is conceivable to fund one advance by a few Creditors. So the Borrower can get the sum, and the advance installments will be naturally disseminated by the whole Creditor pool.

SOFIN is based on a blockchain — it allows to keep the verifiable information about all parties, their transactions and arrangements. The money conversion also is done at the platform. SOFIN plans to emit the tokens, which will be traded as a regular listing at the exchange and within the platform itself. The SOFIN tokens are planned to be used as bonuses and cashback for good lenders and trusted loaners with clear history. The will also be eligible for paying the commissions and compounding the loans.

Today, the peer-to-peer lending becomes more and more popular worldwide. The p-2-p platform has got a lot of advantages comparing to microcredit organizations and banks. The average rate is about 15–20% per year, and that is much less than microcredit organizations offer (up to 600%!) Herewith, the return of the lender is much higher than the bank deposits can offer.

Peer-to-peer lending solves global problems — there are more than 2 billions of people worldwide who don’t have any access to financial resources. The total number of people living in the countries where the interest rate is above 20%, is about 3 billion. The P2P platform grants the access to financial resources to almost every social group in any country — on legal grounds.

The key advantages

More open transaction storage system than traditional P2P lending

Loans in cryptocurrency with the legal purity and transparency of each transaction.

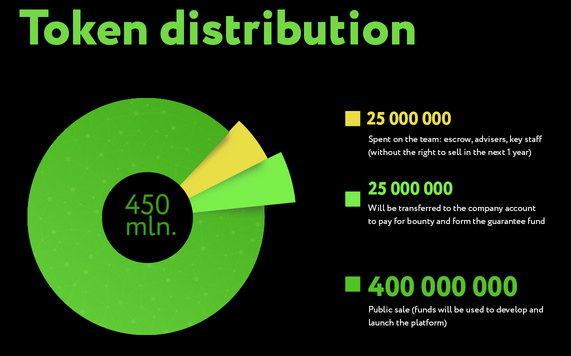

Token Sale and ICO

Token Distribution

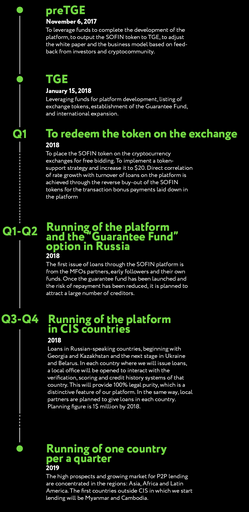

Roadmap

YRC – Your Retail Coach (consulting brand of MCPL for B2C sector)

2010

Creation of the structure that allows entrepreneurs to obtain the necessary funding through the fund’s surety.In three years, the amount of bail was $51 million.

2011

Opening the network of microloan points where the verification of the borrower (private individual), the legal basis and the highly profitable financial model were obtained. The business was successfully sold.

2012

Opening the Verum law firm

2013

Mining rigs, cryptotrding

Opening the Elonsoft IT company

2014-Now

Private P2P loans to entrepreneurs

2016

P2P platform concept

Launch of MFO “Loan Club”

2017

Commencement of system development

Pre-sale

2018

Crowdsale

Listing on exchanges

Launch of the platform in Rusia and the “Guarantee Fund” option

Launch of the platform in CIS countries

2019

Launch of one country per a quarter

The Project Team

The Sofin has been designed and created by a highly experienced team of technology experts. The team’s members bring together expertise that gives them a deep understanding of the challenges faced by many crypto enterprises including the legal, regulatory and compliance issues.

Andrey Tuchkov – CEO

Trofim Zhugastrov – CPO

Nikita Lushpanov – Chief blockchain officer

Vitaly Slobodin – CTO

Anton Kruchko – Chief legal officer

plus the Sofin team & advisers

Finance

Token: Sofin

Abbreviation: SOF

Platform: Ethereum

Accepting: ETH, BTC, USD

Supply: 90m SOF

Tokens Sale Availability

Start date: 15.Jan.2018

End date: 15.Mar.2018

Partners

Be a part of this incredible project. Download the whitepaper for the full scoop.

Till next time…

For more information, please visit:

Website: https://sofin.io/

Bitcointalk: https://bitcointalk.org/index.php?topic=2257607

Twitter: https://twitter.com/sofinplatform

Facebook: https://twitter.com/sofinplatform

Telegram: https://t.me/sofin_ru

Author: TheMichaelMatch

My BitcoinTalk Profile: https://bitcointalk.org/index.php?action=profile;u=1326035

Disclaimer: This article was published in terms of the bounty campaign. I am not a project team member or its representative but a supporter of this incredible project.