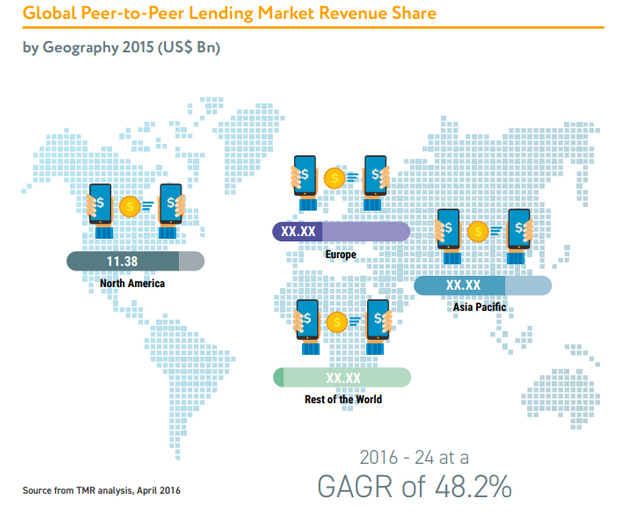

A research statement released by Transparency Market Study says that the chance in the global P2P financing marketplace was well worth US$26.16 billion in 2015. Experts predict that the marketplace value will reach US$897.85 billion by 2024, as it grows at a vital CAGR of 48.2% coming from 2016 to 2024.

Worldwide Peer-to-Peer Lending Marketplace Income Share

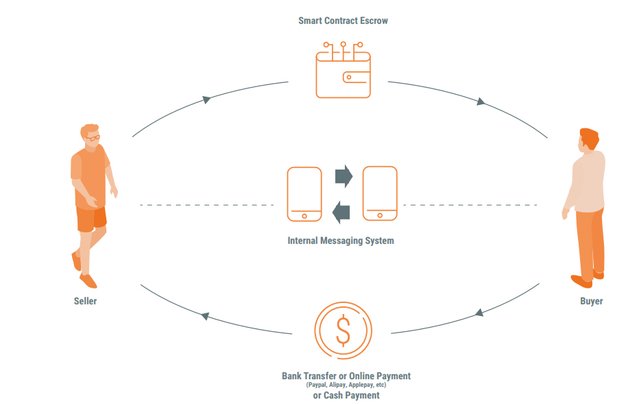

Peer-to-peer (P2P) financing is a significant pattern in online cash lending which entails the aide of loan contracts outdoors of the traditional customer banking program, by connecting borrowers directly with loan providers or traders, through a digital platform. P2G lending’s utilization of digital system decreases costs by getting rid of many functional expenditures associated with traditional bank system, like the price of intermediaries and expense of preserving and staffing requirements natural twigs. Very much of this conserving can then be exceeded along to debtors through lower interest rates than those offered by traditional economic institutions. P2G financing also allows specific loans to become divided into smaller sized models that are released to multiple lenders, allowing risk to end up being varied and distributed among all the lenders.

The Challenges

Traditional lending systems are typically ineffective because of:- Large processing charges: A personal mortgage from any of the major financial organizations comes with a variety of digesting costs, including program fees, origination charges, record planning costs, processing fees, underwriting charges, digital payment digesting costs, prepayment fees, shutting charges, and at very a dozen comparable fees. A customer may finish up spending up to 8% for the loan origination itself, and a smooth charge or percentage charges for all or any of the costs pointed out above.

- Sluggish centralized processes: The traditional financing market comes after an old path with multiple layers of administration and processing, which stretches the general mortgage disbursement schedule further. Anecdotal studies and study reviews show that it could very easily take a week or much longer to process a personal loan. Actual property home loans and business loans can consider many weeks to get prepared. The centralized strategy adopted by the traditional monetary institutions is usually riddled with digesting delays and frequently prospects to an unpleasant credit encounter, as well as chance costs in the value of time delicate transactions.

- Rigid terms of lending: Latest analysis by LendEDU, shows that almost 76% of their focus on group users experienced their mortgage applications refused for one reason or another. In truth, out of the approved loan candidates, only 34.86% proceeded whole the funding procedure. While it is certainly hard to comprehend the reasons behind this low mortgage process finalization percentage, it can be deduced that bad financing conditions could become one of the factors behind it.

- credit scoring demand: The dependence of the conventional lending work on credit score is usually another main issue for loan applicant. Financial establishments and banking institutions consider the recent credit rating as the basis for allowing a loan, departing candidates with not perfect credit histories helpless and underserved. The same keeps for new businesses, startups, and business owners, persuasive them to choose substitute and occasionally costly of extremely unhealthy financing choices.

For more information, visit the link below:

| ICO NAME | LIQUID8 |

|---|---|

| Website | https://lq8.io/ |

| WhitePaper | https://lq8.io/assets/docs/whitepaper_4.pdf |

| https://twitter.com/LQ8_Liquid8 | |

| Telegram | https://t.me/lq8en |

| https://www.facebook.com/LQ8io-Liquid8-152207538972474/ | |

| Youtube | https://www.youtube.com/channel/UCLHu4TfBhLrGhGsPjazWd5w |

| Author Bitcointalk ID | onemancrypto |

|---|---|

| BTT link | https://bitcointalk.org/index.php?action=profile;u=1769254 |

| ETH ID | 0x9028bF231cC510105c202213078d33ce1E2de102 |