Since the creation of the Internet, which attacked many, no invention has created too much noise. But today's electronic money, as well as blocking technologies, have become truly revolutionary discoveries. Since the appearance of Bitcoin, the creation, transfer, and distribution of value have ceased to be limited to gates of the government and central banks. Since any person from anywhere in the world can make quick and secure transactions with another partner without any intermediary or payment gateway for the first time in history.

A lot of holders of cryptocurrency are forced to regularly face blocking of accounts by banks and financial institutions. Digital assets are not considered official structures as a payment instrument. Banks do not allow you to store and pay with cryptocurrency. For this reason, in order to make a profitable financial transaction, generate a deposit or perform other operations, it is necessary to transfer the available assets to standard types of currencies.

Today, crypto-currency users are turning less and less to banking services, and sometimes even refuse them. Soon, humanity can stop treating them. At the same time, banks retain features of the system, on which it is possible to impose a crypto economy.

When working with fiat money, many are forced to face the existing problems of the banking structure, which make it inefficient and complex. One of the keys is the high cost of maintenance. Commercial companies lay large commissions to pay back their expenses. Therefore, for each operation, the client is forced to pay interest. In addition to this inconvenience causes a long period of payment processing and limited territorial coverage.

To its users, MyCryptoBank offers a full range of banking tools to manage its assets. They are available at any time in 24/7 mode using the desktop version or mobile application.

A lot of holders of cryptocurrency are forced to regularly face blocking of accounts by banks and financial institutions. Digital assets are not considered official structures as a payment instrument. Banks do not allow you to store and pay with cryptocurrency. For this reason, in order to make a profitable financial transaction, generate a deposit or perform other operations, it is necessary to transfer the available assets to standard types of currencies.

Today, crypto-currency users are turning less and less to banking services, and sometimes even refuse them. Soon, humanity can stop treating them. At the same time, banks retain features of the system, on which it is possible to impose a crypto economy.

When working with fiat money, many are forced to face the existing problems of the banking structure, which make it inefficient and complex. One of the keys is the high cost of maintenance. Commercial companies lay large commissions to pay back their expenses. Therefore, for each operation, the client is forced to pay interest. In addition to this inconvenience causes a long period of payment processing and limited territorial coverage.

To its users, MyCryptoBank offers a full range of banking tools to manage its assets. They are available at any time in 24/7 mode using the desktop version or mobile application.

What is MyCryptoBank (MCB)

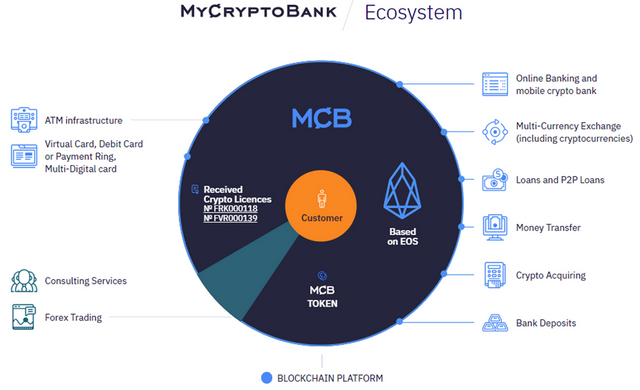

MyCryptoBank is an online bank that allows each customer registered in the electronic banking system to perform various banking operations, additional transactions with CryptoCurrency (payment processing, debit cards, credit and investment services, use of CryptoCurrency assets as collateral for credit and many others) based on BlockChain technology without banking intervention. Thus, MyCryptoBank provides customers with remote access services to bank accounts, products, and services for banking transactions. MyCryptoBank offers its clients a multifunctional platform for banking services, which is a hybrid system that combines traditional and digital currencies. The use of digital currency makes operations faster and cheaper.

About MyCryptoBank (MCB)

Every third person in the world that deals with digital activities are a regular user of FinTech services. Thus, FinTech as a financial future no longer looks like a speculative scenario. The latest data show that over the past 18 months, the growth of decision-making technology for two digits. Leading countries and industries in 2015 have only partially increased. The most active method of money transfers and payments is being developed. According to the FinTech Adoption Index 2017 study, out of 22,000 people polled in 20 countries, 50% use this service for payments and transfers, and 65% will do so in the future.

The globalization of our planet leads to a globalization of relations between all its inhabitants. At present, the demand for digital money is very high. The digital currency of the Internet, a safe based on the Internet, available currencies, helps everyone without a bank account to gain access to funds and also provides a quick and cheap transfer of funds without any geographical restrictions. The popularity of smartphones in developed countries and the speed of their expansion in developing countries allow companies, such as MyCryptoBank, to offer services of the entire banking platform. We can only use it for smartphones and debit cards. The popularity of digital banking in the world is not slowing down. Convenience, speed, and security are not only additional benefits for users.

One direction determines the future of the banking business, banking is based on BlockChain technology. This technology is much faster, more efficient and less error-prone than the traditional automatic clearing house (ACH). BlockChain can save time and money for banks and make practical payments to users. However, the decentralized character of BlockChain significantly violates the effectiveness of fraud and criminal operations.

The globalization of our planet leads to a globalization of relations between all its inhabitants. At present, the demand for digital money is very high. The digital currency of the Internet, a safe based on the Internet, available currencies, helps everyone without a bank account to gain access to funds and also provides a quick and cheap transfer of funds without any geographical restrictions. The popularity of smartphones in developed countries and the speed of their expansion in developing countries allow companies, such as MyCryptoBank, to offer services of the entire banking platform. We can only use it for smartphones and debit cards. The popularity of digital banking in the world is not slowing down. Convenience, speed, and security are not only additional benefits for users.

One direction determines the future of the banking business, banking is based on BlockChain technology. This technology is much faster, more efficient and less error-prone than the traditional automatic clearing house (ACH). BlockChain can save time and money for banks and make practical payments to users. However, the decentralized character of BlockChain significantly violates the effectiveness of fraud and criminal operations.

Smart Contracts is one of the most attractive elements of the BlockChain banking system. This Intelligent Contract allows users to change money, shares, and other assets in a safe and conflict-free manner. As in the traditional contract, the Smart contract determines the terms of the agreement and the penalty for its execution. However, the most important is that this intellectual contract automatically complies with the laws of the rules.

The problems of banks are as follows:

The problems of banks are as follows:

- Commission - Today, there are many intermediaries in the chain of supply of banking services. All of them require payment for their services. All this is expressed in commissions for translations.

- Speed - Transcontinental banking transactions sometimes take up to several working days.

- National Barriers - Some banks have a ban on international transfers with banks of certain countries

- Restriction crypto currency - Banks do not have the technological ability to handle operations with crypto-currencies.

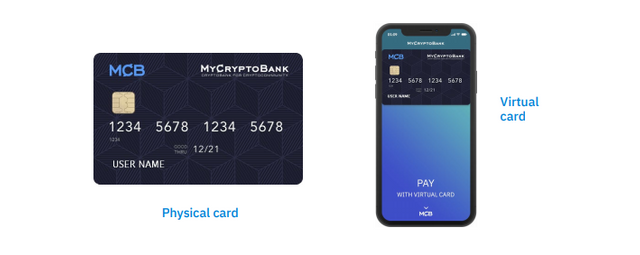

To ensure that holders of crypto-currency can at any time pay with digital assets, they can easily manage them, MyCryptoBank plans to issue virtual debit cards Visa, MasterCard, and UnionPay. Here, the technology of instant payment for Samsung or Apple Pay will be supported. The innovation of MyCryptoBank is the release of a special ring, which also allows you to pay money from your account with one touch. To replenish the deposit or withdraw cash, it is planned to introduce a network of more than 1 thousand of its own crypto-cash machines and attract automata of third-party banks.

The popularity of digital banking in the world is not slowing down. Convenience, speed, and security are not only additional advantages for users, they are standard requirements in modern relations "Client-Bank".

One direction determines the future of the banking business, banking is based on BlockChain technology. This technology is much faster, more efficient and less error-prone than the traditional automatic clearing house (ACH). BlockChain can save time and money for banks and make practical payments to users. However, the decentralized character of BlockChain significantly violates the effectiveness of fraud and criminal operations.

The popularity of digital banking in the world is not slowing down. Convenience, speed, and security are not only additional advantages for users, they are standard requirements in modern relations "Client-Bank".

One direction determines the future of the banking business, banking is based on BlockChain technology. This technology is much faster, more efficient and less error-prone than the traditional automatic clearing house (ACH). BlockChain can save time and money for banks and make practical payments to users. However, the decentralized character of BlockChain significantly violates the effectiveness of fraud and criminal operations.

MyCryptoBank can provide any services inherent in any traditional banks:

- Banking - Available 24 hours a day, 7 days a week. With its help, you can withdraw money from your account. They can be used from a computer or mobile application.

- Translations - Allow to make transfers around the world. Commissions will be minimal, transactions quick and easy.

- Exchange - Allows you to exchange any cryptocurrency, in particular Fiat.

- Loans and P2P loans - It allows directly borrowing from other people without intermediaries or loans from organizations. The interest rate can be influenced.

- ATMs - Allows you to shoot and make money in Fiat. MyCryptoBank ATMs will make their own. And also conclude contracts for the use of existing ATMs of other banks. In the near future, it is planned to put into operation 1000 ATMs.

- Online Account - This function allows you to make payments on the Internet using traditional fiat bills. Such as Visa, Mastercard and so on.

- Debit Cards - This is similar to conventional debit cards. Only in these will the opportunity be added to pay with cryptocurrencies, along with fiat. With its help, you can withdraw money from the crypt into Fiat and withdraw them from the ATM in any country.

- Acquiring - This allows companies to accept payments in cryptocurrency. They will automatically be transferred to Fiat and accounted for according to tax requirements.

- Forex Trading - This is an access to the trading of crypto-currencies in the Forex market, in addition to using the traditional functions of this exchange. This gives certain advantages over other players in Forex, due to the increase in the speed of translation and the reduction of commissions for transfers, when you need to quickly transfer money between people.

- Deposits - Allows you to invest with interest. In particular, using cryptocurrency. At the same time, interest will be accrued in the same cryptocurrency.

- Consulting - Allows you to receive advice on finance and money management from leading industry experts.

Tokens MCB and ICO

Tokens are the central element of the project segment, integrating all components of the financial ecosystem. All tokens will be released during the ICO phase, without any additional throw-in. This ID is used for the internal functioning of the platform, to provide access to certain services, depending on the number of coins held by the user.

Holders get advantages at every stage of the project implementation for an affordable amount of coins. Banking crypto services are open to owners in exceptional conditions, and operational fees will be levied depending on the number of units owned. Customers who have not purchased coins are able to receive services from the crypto bank on standard terms, depending on the volume of tokens belonging to the project ecosystem. Each investor is assigned one of four statuses: standard, silver, gold, and platinum. Requirements for the volume of ownership will change periodically.

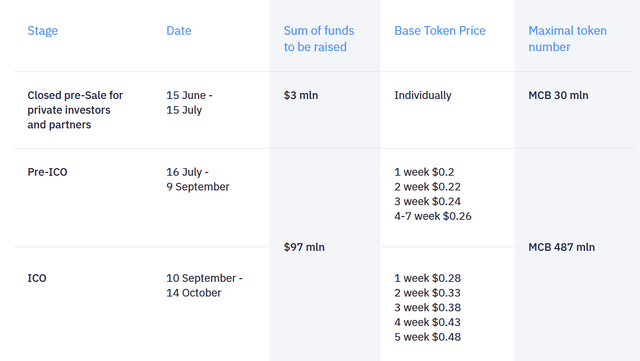

The preliminary stage of sales continues and will end in mid-August, namely on July 16. The main stage is scheduled for the period from September 10 to October 14. The maximum issue for two periods is 30 million and 487 million units respectively. Softcap is equal to three million, and hardcap is one hundred million dollars.

Holders get advantages at every stage of the project implementation for an affordable amount of coins. Banking crypto services are open to owners in exceptional conditions, and operational fees will be levied depending on the number of units owned. Customers who have not purchased coins are able to receive services from the crypto bank on standard terms, depending on the volume of tokens belonging to the project ecosystem. Each investor is assigned one of four statuses: standard, silver, gold, and platinum. Requirements for the volume of ownership will change periodically.

The preliminary stage of sales continues and will end in mid-August, namely on July 16. The main stage is scheduled for the period from September 10 to October 14. The maximum issue for two periods is 30 million and 487 million units respectively. Softcap is equal to three million, and hardcap is one hundred million dollars.

Conclusions

MyCryptoBank will make the transition to a new economy milder, and it will not be a stress for those who are not yet dedicated to the topic and do not want to understand the systems. For them, the transition to better conditions will occur relatively imperceptibly. The project has high expert assessments. It seems that it will be successful.

For more information about the project and the opportunities to participate, go to the links below:

Website: https://mycryptobank.io/

Telegram: https://t.me/MyCryptoBank

WhitePaper: https://mycryptobank.io/docs/MyCryptoBank-white-paper.pdf

Twitter: https://twitter.com/MyCryptoBank

Linkedin: https://linkedin.com/company/my-cryptobank

Facebook: https://www.facebook.com/Mycryptobank

Instagram: https://www.instagram.com/mycryptobank/

Reddit: https://www.reddit.com/user/MyCryptoBank

ANN: https://bitcointalk.org/index.php?topic=4484862

### MY ACCOUNT

BTT Username: sujonitsmy1

BTT: https://bitcointalk.org/index.php?action=profile;u=2175763

Twitter: https://twitter.com/sujonitsmy1

Facebook: https://www.facebook.com/onnoalok

This project deserves a lot of praise, I often hear about this project, I liked the idea, thanks to the author.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Because of the excessive number of intermediaries, traditional banks charge high fees for interbank and international bank transfers, but MYCRYPTOBANK has found an excellent solution!!! Thanks to the author for the very informative, brief and understandable article.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I heard about this project I really like the concept amazing project bro

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@vital-bd Very informative post, good job

Posted using Partiko Android

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit