“Money, Money, Money, Must be funny, In a rich man’s world” — Abba

The Greek philosopher Aristotle came up with four criteria to elucidate what can be considered as ‘good money’ (Lee, 2009)

- It must be durable

- It must be portable

- It must be divisible

- It must have intrinsic value

Money could be anything that can compensate for the exchange of goods and services and does not really have to be physical cash. Dating back, individuals used the barter system for the exchange of goods and the IOUs.

Physical money has been with us for thousands of years for a reason — an exchange mechanism that is governed and recognized by central authorities like the government and various regulatory bodies, globally. Ever since its evolution, cash has become the most common form of exchange.

In the modern day, with the emerging technologies and the advent of mobile devices, new trends have been unfolding where cash transactions are gradually being replaced by digital money.

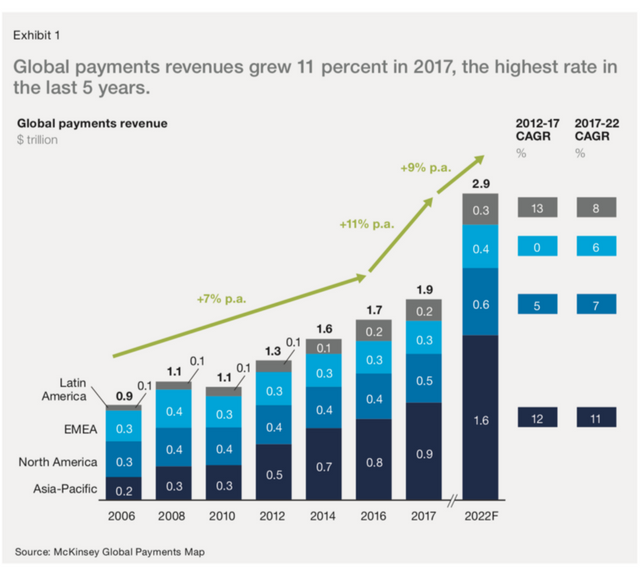

According to McKinsey, Global payments revenues swelled to $1.9 trillion in 2017, the best single year of growth in the last five years.

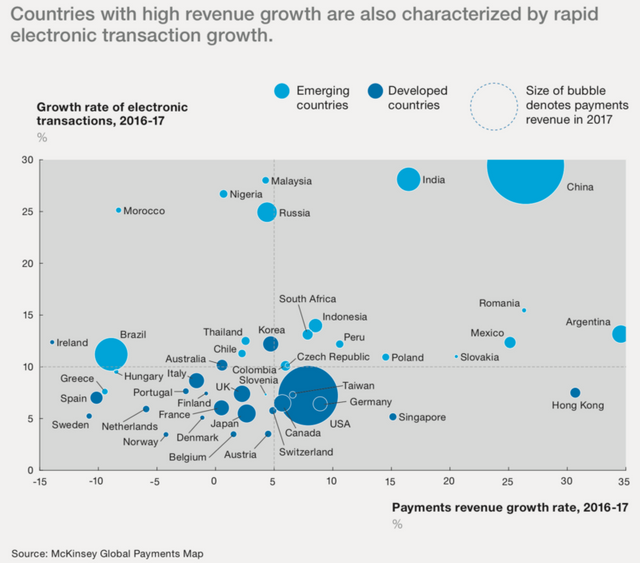

Out of which, electronic transaction growth has also been growing rapidly.

Digital Currency

Rapid developments in technology in the economy have given rise to a gamut of “Digital Currencies” under the pseudonyms of — digital money, electronic cash, electronic currency, cryptocurrency and virtual currency. They possess the characteristics of what was defined as “good money” traditionally and encompasses a unit of account, a medium of exchange and a store of value.

Digital currencies are known to be the “Disruptive Entrants” that are paving the way for innovation and transformation of existing systems of Finance & Payments. They are addressing the pain points within the system and working on instantaneous transactions and borderless transfer-of-ownership, with “ease of access” being under the limelight.

Unfortunately, conventional mechanisms such as financial institutions and banks are taking time to adapt to legacy technology. This hinders the growth and adoption of cryptocurrencies and makes them available to a creamy layer less than 1% of the population who transact in them.

Why do nations and economies need cryptocurrencies?

Fiat currencies are issued by the government and are considered legal tender for the simplest of transactions. Although, cryptocurrencies offer cheaper and faster peer-to-peer payment options than those offered by traditional finance, many governments still do not consider cryptocurrencies as legal tenders for various reasons such as, inter alia, protection of investors, preventing money laundering.

The rise of the internet and ease of access have leveraged consumers with two powerful cards: convenience and choice. There is a demand for efficient and innovative means of transacting and conducting businesses. Let us see how cryptocurrencies can help make this bridge sturdy for the next billion.

5 Long-Term Advantages of Cryptocurrencies

- Financial Inclusion

Globally, 69 percent of adults — 3.8 billion people — have an account at a bank or mobile money provider. There still remains a major chunk of the population that remains unbanked.

Potential geographic markets in which cryptocurrencies can be leveraged include countries with less developed financial infrastructure (fewer brick and mortar banks), but high smartphone usage. Crypto ideally facilitates financial inclusion, creating an impact where digital money (cryptocurrencies) will bring about increased socio-economic mobility boosting prosperity.

- Easy International Payments

According to a 2018 World Bank update, the global average cost of sending remittances was 7.01%. This cost varies depending on the region where the money is being sent, but in general, banks continue to remain the most expensive service providers worldwide.

Cryptocurrencies lower transaction costs and speedy cross border payments. The Internet enables Blockchain, granting universal access, which can be used as a means of financial integration, making payments — faster and cryptocurrency-based money transfers are also more secure.

- Globalization

Through Cryptocurrencies and Blockchain, real-world assets can be tokenized and digitised. Many industries such as real estate, healthcare, finance, environmental conservation and others can be transformed with improved operational efficiencies by moving from vast repositories of fragmented and unfragmented data to structured data for valuable derivation and storage of accurate information.

- Digital & Disruptive Innovation

Innovation in technology has been a window of opportunity to solve many hurdles in traditional and time-consuming processes. An alternative to fiat currencies- cryptocurrencies are an easy way to transact across borders, with low or no intermediate (transaction) fees. Widespread adoption in such emerging tech is the only way to explore its usage. For example, Kenya’s M-PESA system, a mobile phone-based money transfer and micros financing service recently announced a bitcoin device, with one in three Kenyans now owning a bitcoin wallet.

- No Counterfeiting

Physical Money has a disadvantageous property of being counterfeited and circulated that is not under the government’s radar. This leads to a surmounting amount of black money. As Cryptocurrencies have a limited supply, tracking the flow of funds is easier. Additionally, if it’s compliant to incumbent regulations, each person involved with cryptocurrencies is under the decentralized radar.

Consumers will accept and adopt cryptocurrencies on a broad scale only when they:

- Gain adequate knowledge

- See improved availability

- Easily exchange cash for cryptocurrencies

- Reach a comfortable level of effective consumer protection.

Nations with sizeable economies are finding a way for a broader level of acceptance and adoption. The G20 countries are on the helm of bringing in a global regulatory and legal framework for transacting in cryptocurrencies for wider adoption.

As regulatory standards are adopted and more innovative products are introduced to the market, we will see an increase in the number of market participants.

These prime advantages allow cryptocurrencies to compete against traditional finance like banks and financial institutions across many sectors. Cryptocurrencies are pacing us towards a place where the world would interact with the future of money.

Hello,

We have contacted you on Twitter to verify the authorship of your Steemit blog. We would be grateful if you could respond to us via Twitter, please.

https://twitter.com/steemcleaners/status/1125501008149471232

Please note I am a volunteer that works to ensure that plagiarised content does not get rewarded. I have no way to remove any content from steemit.com.

Thank you

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.reddit.com/r/CryptocurrencyICO/comments/bhkg8t/ieo_ico_20_but_some_of_the_same_problems_persist/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit