This is the first of three blogs demonstrating a comprehensive framework for evaluating ICOs. By compiling eleven sources of information - from industry leaders and crypto enthusiasts who have addressed this topic - we were able to create a sample tiered system for evaluating ICOs.

In this first blog, we will discuss the essentials when evaluating ICOs (those factors mentioned in at least seven of the eleven sources). In the second part, we will take a deeper dive (factors mentioned in at least four but not more than six out of the eleven sources). In the third blog, we will discuss specifics (factors mentioned in at most three of the eleven sources). By doing so, one thing will be very clear: many minds giving collective advice affords the investor better, more robust information on financial inquiries. This is what we strive for at Finnoq, and hope this three-part series will be instructive. By helping you make better ICO investment decisions with more complete advice and also by illustrating our mindset, our mission to show an example framework for unbiased advice begins now.

ICO RATING WEBSITES: A NOBLE, “WORK IN PROGRESS” BUSINESS SOLUTION

In order to adjust to the quickly-evolving cryptocurrency market, many websites were set up with the intention of evaluating ICOs via easy and understandable ratings. Although a noble initiative, these websites do have shortcomings, reflective of the systemic and centralized crossroads at which early blockchain adopters exist. First, it has been widely reported that ICO ratings can be sometimes for sale, as apparently “It’s so easy to buy expert ratings” through alleged backroom Telegram deals. Although this blog explicitly seeks not to condemn any site in particular, it is instructive as a future investor to understand how ICO ratings can operate from a B2B perspective.

Second, ICO trackers unfortunately do not always have the systems in place to recognize a scam, as capacity to conduct proper due diligence is not matched with the speed at which the onslaught of ICOs hit the marketplace. Thirdly, there are just not enough reviewers on ICO rating sites as of today, and those who rate could also be participating in a bounty program. Giving outstanding ratings to a mediocre project in order to get some free tokens in the future is understandable, yet unhelpful for a less-knowledgeable investor. Many of the problems mentioned above can be found here. Have a look the recent examples of the fraudulent BlockBroker and Benebit ICOs, as well as this guide of how to unveil an ICO scam.

As you can see, an ICO rating website might seem convenient, but relying on one single site or method can get an investor in a lot of trouble without having a proper framework for ICO evaluation. While ICO ratings websites can be very helpful, the investor needs collective advice from many sources to make optimal decisions (our philosophy at Finnoq).

HYPOTHETICAL EXPERIMENT

No blog from an agile startup would be complete without a Steve Jobs quote, #amiright?

At Finnoq, we are building a protocol to create decentralized and crowdsourced advice, whereby community members can pose questions and get the most out of their inquiry. In doing so, Advisors can earn rewards by giving their best counsel as deemed by our global community.

Within our protocol, many use cases could exist. In this blog, we’d not only like to give you some more robust advice on how experts evaluate ICOs, but also how we guarantee that several opinions gives you the investor more complete advice.

How are we so confident? In this instance, we analyzed 18 factors among industry specialists who sought to evaluate ICOs (11 sources). What did we find? No one source contained all 18 factors. Thus, no single opinion provided “optimal” advice in this exercise. Imagine what would happen if more options were possible, if a global community of 1.000 or more advisors responded to the same question, and if questions were posed on each individual factor.

This is a smaller, less-perfect sample collective statement on a framework for ICO evaluations. This example is neither optimal (as it is not us who decide what is good advice, but you) nor particular to any ICO; rather, we seek to show you how to evaluate ICOs going forward, and also how we at Finnoq contemplate financial advisory.

With that being said, let’s get down to business!

MORE ROBUST ICO EVALUATION: SAMPLE USE CASE IN ACTION

If we can all agree that many decentralized opinions are better than one, then let’s actually take a look at what some industry specialists had to say on the subject. We evaluated 11 sources (listed below and cited accordingly), finding (at least) 18 factors worth mentioning. When asking the hypothetical question “Which factors are the most important in evaluating an ICO?”, these would be some sample responses.

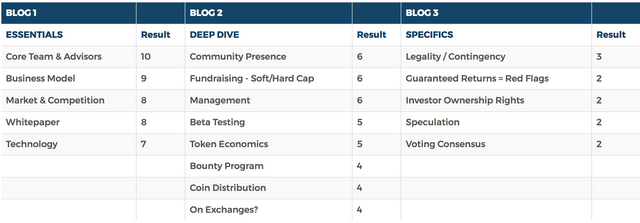

This is just to show you where our heads are: many well-intentioned minds are better than one. Without further adieu, our results can be grouped as follows (with a table and analysis below):

- ESSENTIALS: 7 or more sources mentioned this factor in evaluating ICOs

- DEEPER DIVE: 4-6 sources mentioned this factor in evaluating ICOs

- SPECIFICS: 3 or fewer sources mentioned this factor in evaluating ICOs

THE RESULTS ARE IN THIS TABLE BELOW:

ANALYSIS

In this first part, we will discuss only the “essentials” in greater detail. Stay tuned for the second and third parts of this evaluation (to be published in the coming days).

CATEGORY 1: ESSENTIALS

The following factors were considered essential in this framework (7 or more mentions):

- CORE TEAM & ADVISORS: 10/11 MENTIONS

It is important to look long and hard at the team. By understanding their previous relevant experience and making a judgment call as to their ability to grow a business post-ICO, it will be clear whether the ICO is a worthy investment or not. Further, one must be able to differentiate whether advisors are there to provide guidance or if they are only part of the marketing strategy, when the company is just “window dressing”. Also, if there are more advisors than actual team members, be wary. Finally, not only should the identity of the team be known (if not, run away), but the team members should be transparent, accessible, and approachable on social media or within a community. Community presence in particular will be discussed in the second part of this series.

References used: 1, 3-11

- BUSINESS MODEL: 9/11 MENTIONS

How the company will operate? In practice, “The Achilles heel of token-based models will be how they are concocted to interact with the business model that underlies them.” In particular, Mougayar asks whether buying or selling something is part of the company’s business model. Further, several sources seek to verify the purpose of the tokens being offered. Knowing what kind of token is being issued by the startup (equity, utility, other), for what purpose, and whether the tokens implicitly represent something else of value can determine if the coin is merely a fundraising tool with no return for coin holders (potentially bad sign!). Also, if the marketing materials present a skewed focus towards return on investment, perhaps the token is actually useless except in accumulating short-term profits for the investor and the team. Perhaps most importantly, knowing how much progress and traction the team has built to date, the timetable when the product or service hits the market, and roadmap of milestones of how proceeds will be used gives the potential investor an idea of how the business is performing, both now and in the future.References used: 1-6, 9-11

- MARKET & COMPETITION: 8/11 MENTIONS

The investor must also look at the current market and competition. Is there a market for the product or service (are there others already doing this?), and if so, does the token enable the user to contribute to a value-adding action for the network/market upon which it is being built? Is the project demonstrated by the company unique or an attempt to build upon the strengths of an existing service? If the product or service is already being done, is the operation done by a centralized entity (if not, the blockchain could be a natural competitive advantage!)? Additionally, what is the real market strength, market cap value, and how will projected earnings of the project be factored in the future? In other words, understanding market potential, whether it is likely to grow, and who the competitors are can be a helpful insight into the future success or failure of an ICO. If the competition is stacked, the market is saturated, and the market is on the decline, the ICO might just be a pipedream.

References used: 1-7, 9

- WHITE PAPER: 8/11 MENTIONS

Everything starts with analysis of the White Paper; crucial in evaluating ICOs, it is “is the most fundamental medium for communicating to investors and users the objective and design of a project.” An investor should begin by reading the white paper, reviewing it carefully and in fullto get a look at the big picture. When the technical document “demonstrates research and a clear reason to exist”, the problem and solution can be identified for both consumer and investor. As a potential investor, be critical and note the strong and weak points of a project, because this document is the “silver platter to potential investors”.

References used: 1, 3-5, 7-8, 10-11

- TECHNOLOGY: 7/11 MENTIONS

The founding team needs to demonstrate a strong technical reason for the protocol itself, as well as the token. If such a justification does check out, then an investor must inquire about the technical details (is the code open source and if so, where can I find the source code?) In order to analyze the protocol, one must check out the code of the project to determine its quality and necessity for the proposed ICO. As many investors have already found out, the universal law that using blockchain technology is better has been debunked. Investing in a company employing the appropriate technology and justifying its necessity is crucial in going forward with an ICO.

References used: 1, 3-4, 6, 8, 10-11

CONCLUSION

As you see, we looked at some of the essential factors in evaluating ICOs. In practice, if you read any one of these sources, you’d be able to get “good enough” information. However, in a more volatile marketplace than that of traditional asset classes - including scams, complex technological concepts, and immense subjectivity determined by a small group of centralized actors - you need better than “good enough” information. Unfortunately for all of us, “good enough” just isn’t good enough. Fortunately for all of us, by receiving a collective statement, we are in much better shape to receive advice and ultimately make better investment decisions.Understanding the essentials above will give you a solid foundation for building the comprehensive framework to evaluate ICOs like an industry pro. Stay tuned for part two of this blog, as we discuss those deep dive factors. We look forward to hearing your comments on part one, and do not hesitate to contact us with your thoughts on anything Finnoq related.

DISCLAIMER

Although we believe there are 18 factors worth mentioning, it is not for us to decide on the protocol. This is just an example. Our proposed protocol seeks to decentralize power. Thus, it is you the global community who decides what is important knowledge, and not us. Additionally, results in an actualized protocol would be anonymous; thus, attributing answers to particular members of the community would never happen. What we found does not indicate that the source is somehow uninterested in other parts. The authors wrote articles focused on elements pertaining to ICO evaluations; if we were to ask the question on the actual protocol, their responses would probably be different. That being said, we would still collect the responses and be able to give better advice than any one single contributor (as no one contributor made mention of all 18 factors). Finally, rewards and incentives for answering questions will be discussed in greater detail in a later blog series, so stay tuned. The point of this exercise was to show that many minds are better than one.

SOURCES USED

https://blog.icofunding.com/how-icos-are-being-rated-and-how-to-evaluate-a-token-yourself-948cbef6a921

https://medium.com/@wmougayar/tokenomics-a-business-guide-to-token-usage-utility-and-value-b19242053416

https://medium.crypto20.com/ico-evaluation-deep-dive-13-questions-to-ask-77ee444c0b99

https://medium.com/@petehumiston/50-questions-to-ask-when-evaluating-an-initial-coin-offering-ico-82d130501ee0

https://thenextweb.com/contributors/2017/12/18/4-step-guide-evaluating-mad-world-icos/

https://www.coindesk.com/moon-bust-questions-ask-evaluating-icos/

https://www.coinannouncer.com/4-keys-evaluating-ico-investments/

https://medium.com/@ntmoney/discussing-cryptotoken-best-practices-5ff4b9184933

https://www.bitcoinmarketjournal.com/ico-due-diligence/

https://cryptopotato.com/10-keys-evaluating-initial-coin-offering-ico-investments/?fb_comment_id=1431590406935042_1468304953263587#f2a3f6fa9af888

https://hackernoon.com/evaluating-tokens-and-icos-e6c22c1885bb