The world of crypto money has been shocked by the fraud news coming from Turkey one after the other. Investigations were initiated after the allegations that #Faruk #Fatih #Özer, the founder and manager of #Thodex, fled abroad with about $ 2 billion .

Whenever such a fraud case is encountered, the famous fraud events in the history of crypto money and the pyramid schemes or, in other words, ponzi schemes come to mind. Here are 5 great cryptocurrency fraud stories that are unforgettable and fresh in minds.

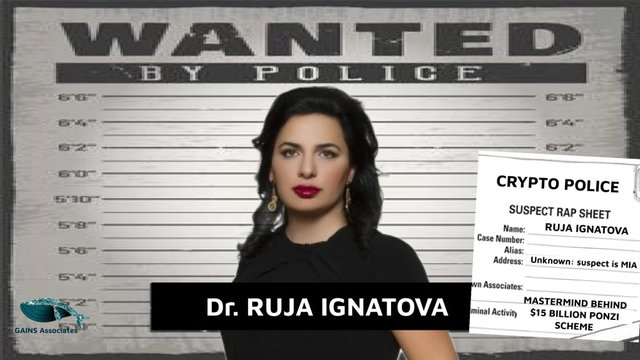

🚨The Crypto Queen and OneCoin in Losses🚨

The OneCoin incident was perhaps the most unusual scam in the history of cryptocurrency.

In 2016, Dr. #Ruja #Ignatova announced to the world that it was developing a cryptocurrency that was Bitcoin's rival, it dragged thousands of people after her. The 36-year-old business woman's motto, who awarded her the nickname " #Crypto #Queen", was quite ambitious. This claim was shouted as follows:

"After 2 years, nobody will even talk about Bitcoin."

However, of course, the situation was not as expected. When Ignatova claimed that the #OneCoin cryptocurrency, which he said he had developed, would "bring the end of Bitcoin", the value of Bitcoin, the world's first and today's most well-known currency, had already risen to several hundred dollars. Excited investors aspired to be part of the Crypto Queen's dream of "revolution" and billions flowed here.

Between August 2014 and March 2017, about 4 billion euros flowed into OneCoin from Pakistan to Brazil, Canada to Norway and even Palestine from all over the world.

As OneCoin was growing, Ignatova was enjoying its wealth by presenting magnificent shows in different parts of the world, attracting investors.

Buying millions of dollars worth of houses in Bulgaria and throwing big parties in his luxury yacht Davina became a part of this luxurious life. However, there were problems accumulated behind this luxury. Investors began to worry as the establishment of the system that allows OneCoin to be converted to other currencies was constantly delayed.

In October 2017, it was announced that all concerns would be addressed with a major event in Portugal, but Dr. The lipstick did not show up. He did not respond to phones and messages either. Dr. She lost billions of euros in lipstick. There was no cryptocurrency or anything.

He was succeeded by his older brother, #Konstantin #Ignatov, but after he was detained at an airport in the US in 2019, he directly admitted the charges against him, including fraud and money laundering. "Crypto Queen" is still missing.

🚨PlusToken🚨

Another of the most famous crypto ponzi scheme stories is the crypto wallet #PlusToken, which has been accused of stealing the money of more than 4 million people, mainly Chinese and Korean investors.

PlusToken was established in 2018. PlusToken offered Asian investors between 9% and 18% monthly returns. However, he was trying to make a difference by emphasizing face-to-face meetings with potential investors as well as using social media effectively.

PlusToken advertisements and posters were also hung on the walls, thus instilling confidence in the investor, giving the impression that everything was legal.

In 2019, customers who had a hard time pulling their profits off the platform became increasingly worried. It was soon realized that the PlusToken team was at losses from different cryptocurrencies, including the largest currencies Bitcoin, Ethereum and EOS, with a figure of more than $ 3 billion.

They also left a note behind them. The note they left wrote the following statements:

"Sorry, we ran away."

🚨Bitconnect🚨

Launched by the company, which emerged in 2016, a year later and increased its value in a short time, Bitconnect was also among the 10 most popular cryptocurrencies for a period.

#Bitconnect was actually a borrowing platform where users gave Bitcoin and received Bitconnect.

The system, which offers users more daily interest and income than the Bitconnect figure they lend, is also known today as the "Farm Bank structure of the crypto money industry".

In 2018, the Texas Securities Board decided to stop the company, confirming rumors that the company was a ponzi scheme, a pyramid scheme. After the decision, the Bitconnect price fell 92 percent first, and then dropped to zero.

The figure collected by Bitconnect corresponds to a huge amount: It is thought to have raised more than $ 2.5 billion in total.

🚨Bitcoin Savings & Trust🚨

Bitcoin Savings & Trust is considered one of the first cryptocurrency pyramid schemes in the USA.

When it emerged between 2011 and 2012, it promised investors a 7 percent return per week.

The company headed by #Trendon #Shavers says it sells Bitcoin. He also asked the investor to sell Bitcoins on the grounds that he needed more liquidity.

In 2013, Trendon Shavers, who was caught alleging that Bitcoin Savings & Trust was a pyramid scheme, was accused of defrauding investors and sentenced to 18 months in prison.

🚨Pincoin and iFan🚨

Investors were promised 40 percent earnings within a month through two different ICOs, the "Initial Coin Offering" #Pincoin and #iFan managed by Modern Tech.

Modern Tech, headquartered in #Vietnam, attracted and attracted investors by organizing face-to-face events in Asian countries.

After the news in the media, the allegations that Modern Tech had a ponzi scheme became increasingly strong and there were large protests in front of the company's office in Vietnam.

It is stated that company executives stole more than $ 660 million from investors.