Introduction

Yesterday on this challenge, I talked about one of my favorite features of Huobi exchange; Margin Trading, where I gave us a detailed explanation on how to use this feature on the Huobi platform. Today we are going to be talking about another of my favorite features.

Huobi User Protection Fund

As a crypto trader, one of the most important (if not the most important) criteria I look for while choosing an exchange is security. No one likes to lose money. January 2018, a Japanese exchange, CoinCheck, lost over $500 million, as they were hacked and the hackers stole 523 million NEM coins. This event resulted in the token falling by 20% within 48hours. Next February, BitGrail lost $185 million NANO to hackers. A few months later, in mid-April, an Indian exchange Coinsecure reported $3 million stolen.

Events like these are why people are skeptical while selecting an exchange to use, and that's where Huobi comes in.

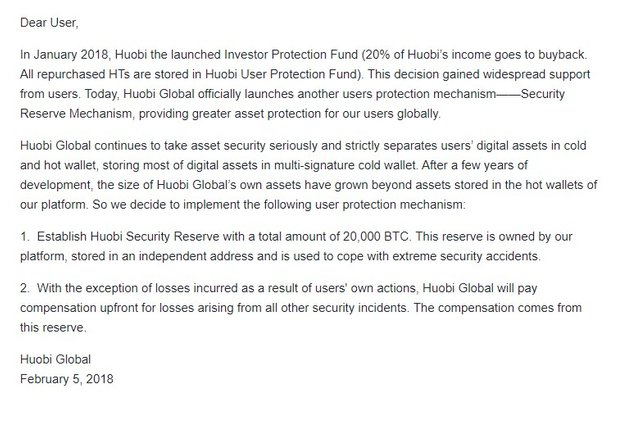

Memo From Huobi to Users

Huobi Buyback

In 2018, Huobi launched a buyback known as Huobi User Protection Fund. This means Huobi uses 20% of their income to buy Huobi tokens, which are stored in cold wallets. In case of an emergency like the ones cited in the previous paragraph, Huobi will have the funds to reimburse its users. You can call it "saving for a rainy day". Emergency funds are very important as they allow an exchange to have adequate resources if they experience an unexpected expense. For example, a project’s exit scam like the case in Confio, having to refund a user's assets if a flaw is exploited by hackers, or if official Huobi’s email addresses were compromised and used to steal private keys and other information. Also, in the case of the loss in value of the coin, the Protection Fund would enable users to receive the correct amount of fiat. You are assured your money is safe from external influences.

The User Protection Fund is funded from the revenues generated by Huobi quarterly. Each quarter, Huobi uses 20% of its generated revenue to buy back Huobi Tokens (HT) from the open market, to be stored in the User Protection Fund, a cold wallet, which is secure and auditable, ensuring that Huobi has the funds needed in case of an emergency. Huobi announced their first buyback occurred on the 16th of April 2019 and saw Huobi saving 38.6 million HT in a safe cold wallet, designated for the User Protection Fund.

Is The Huobi Token Safe?

My psychic abilities tell me some people are wondering if the Huobi Token is a sure method of insurance. Well, the buoyance of the emergency fund is dependent on the success of Huobi itself, and that of the Huobi token, as the fund will be solely dependent on them. Huobi Tokens has a total supply of 500 million. Huobi token allows users to receive reduced trading fees, to enable teams to create security deposits so as to be listed on HADAX, and to be able to vote for listings on HADAX. hadax is a hybrid form of a decentralised exchange where pro crypto traders choose the cryptocurrencies to be listed using Huobi token, and the token will have other uses as the platform grows.

Conclusion

Unlike in banks, where transactions can be reversed, the blockchain is a totally different ball game. This is one reason why hackers have increased attacks on exchanges. This makes the User Protection Fund even more important, plus it also fosters growth of Huobi, as more investors join, knowing they are secured.

What do you think? Do you like this feature? Let me know?

Cc;

@steemitblog

@steemcurator01

@steemcurator02

****THIS POST IS POWERED UP 100%****

Tweet

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for taking part in the Spotlight on Huobi Challenge.

And thank you for setting your post to 100% Powerup.

Keep following @steemitblog for the latest updates.

The Steemit Team

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit