Background

With the aim of providing a professional trading experience for traders as well as being committed to provide the best performance for trading digital assets, exchanges will do all it takes to make sure their trading platforms are getting traders satisfied. Welcome to another Spotlight on Huobi challenge post and in this post, I will be looking at the Huobi trading platform, if you missed my previous post on the Spotlight on Huobi challenge, I will be dropping the links to the posts at the end of this post.

Trading generally involves buying and selling, this trade could be coins/tokens, contracts or other financial instrument and the first thing to check as a user or trader to give ratings to an exchange is its trading platforms and this includes the trading options available, Liquidity and volume, security, reserve funds and then the interface with all these criteria checked, it has placed Huobi exchange among one of the best exchanges with a very good trading platform to trust.

Huobi Trading Platform

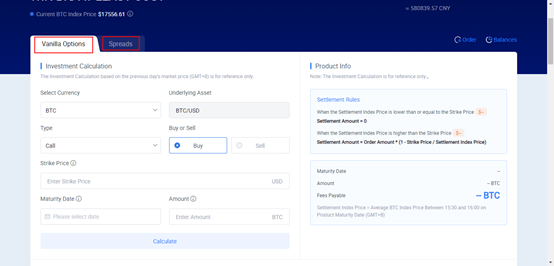

Huobi has a very easy to understand trading platform with different trading options for different traders either for short term or for long term purposes. The trading options include Spot Trading, margin trading, Brokerage (OTC), Derivatives which covers futures trading, coin-margin swap, USDT-margined swap, and Options. I will be explaining the Spot Trading in this post and my experience with it.

Spot Trading

In other to start trading on Huobi, the spot trading account (which is the general account) needs funding. Funding can be done in any cryptocurrency of your choice provided it is listed on Huobi. Funds can be deposited, transferred, bought via debit/credit card (simplex) and/or bought via P2P trade.

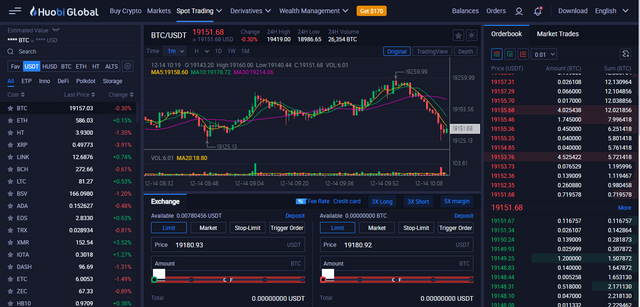

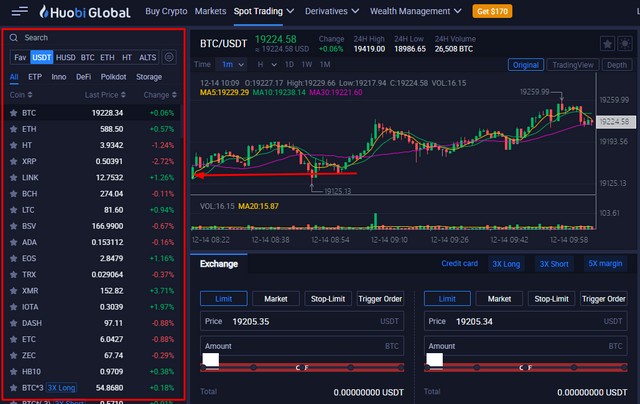

The spot trading market is a market where orders are traded for immediate result in other to exchange one coin for another. On Huobi trading page, there are 6 trading base coins in which coins and tokens can be traded, these trading base coins are USDT, HUSD, BTC, ETH, HT, and ALTS (currently, the alt being traded is BTT/TRX). When trading with USDT, traders can trade coins based on their characteristics, like Exchange Traded Product (ETP) [BTC3, ETH3, BTC*(-3)], Defi coins [KAVA], Inno coins [Sushi, VALUE, XRT, BCHA], Polkdot [LINK, DOT, AKRO, KSM, RING], and Storage Coins [FIL, BTT, BHD, STORJ]. Buying and selling of coinsis dependent on trading bases

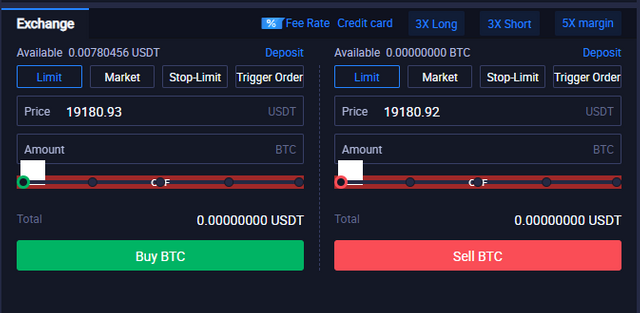

After selecting the trading pair, traders can manually set their price and amount of coins to trade on the trading entry tab which comprises of the buy and sell where traders can choose whatever price they want to set.

When prices are created and order placed, your orders stays in the order book and get filled price reaches the placed order.

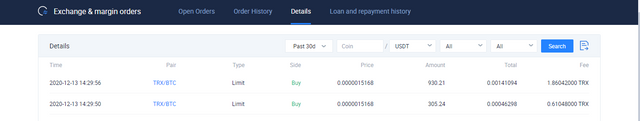

When the order filled, it appears on the transaction history page. Traders can check the history of their trade dating back to as long as they want.

Margin Trading

Margin trading is a trading that involves using borrowed funds from other users to trade so as to amplify the expected result. This trading pattern has its good and its bad sides as it amplifies both profit and loss. With Margin trading, traders have more capital to trade as they can trade the same position while keeping less capital. With margin trade, traders place an amount for loan (known as margin) and then get amplified trading (known as leverage). With Margin, trader can buy long and sell short.

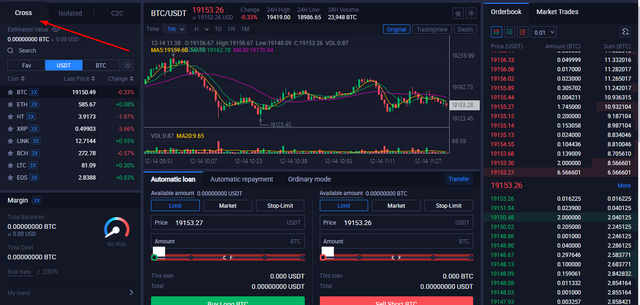

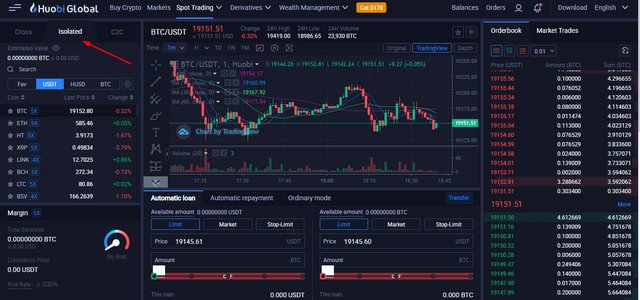

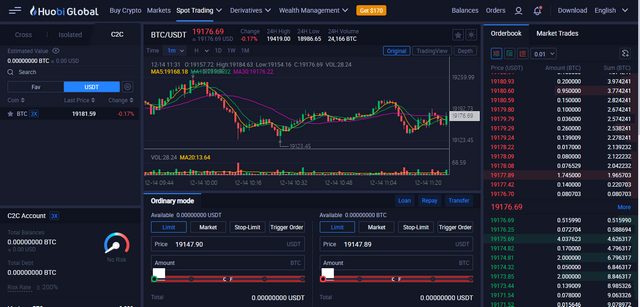

There are three pages on the margin trading platform which are, the cross-margin trade, the isolated-margin trade, and C2C.

Cross Margin: This is the margin trade that involves using one trade balance to trade different positions. When the trades being in profits, the trader enjoys maximum profit but when one trade position reaches a risk of 110%, the entire positions are liquidated to pay the loan and interest.

Isolated Margin: Just like the name implies, you can trade position singularly and one balance cannot be used to trade several positions and liquidation in one doesn’t affect other positions.

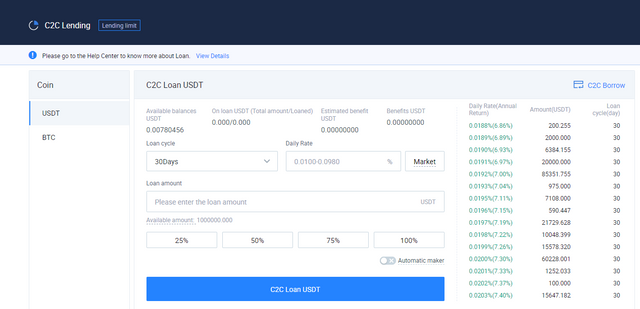

C2C Margin: This is the market where lenders and borrowers meet to place orders depending on the amount and the interest expected. Two coins can be traded on this market, BTC and USDT.

The date to be repaid, the amount to be paid as interest and so on are determined in this market.

Buy Long/Sell Short

When traders buy long, they expect that the coin should increase in price after which they sell short thereby keeping their gains. While when traders pick a sell short position, they expect that the price of the coin to drop and then they can buy low and make profit. Margin trade is very risky as traders can lose all or part of their coins.

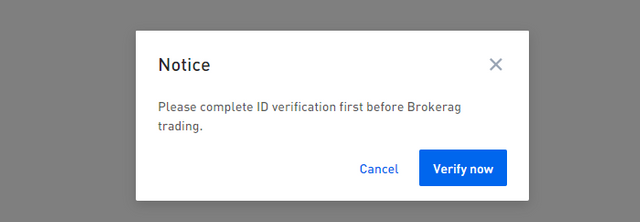

Brokerage (OTC)

In other to use this service traders need to verify their account by doing the simple KYC procedures. It is also known as over the counter trade is meant to satisfy the needs of large volume traders who do not want to trade on the exchange but want to do it via personal desk trade.

This is a trading option allow traders to trade with fiat currencies depending on the type of payment required. The trader can pick a Buy/Sell call after which assets are transfered from the spot balance to OTC Options Balance.

When the trade is complete, the OTC Desk releases the tokens to the party involved in the trading.

Spot Trading Fee

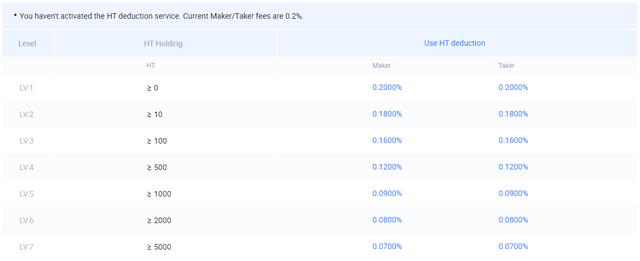

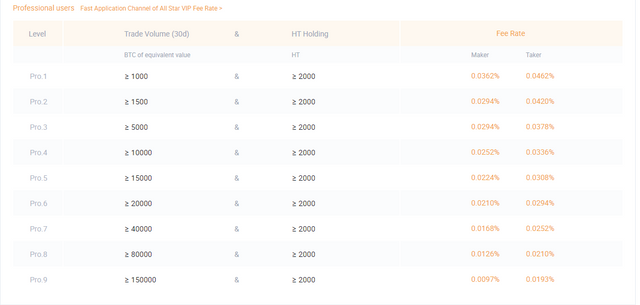

Trading fees differ for traders depending on either the trader is a maker or taker. Makers are traders who create liquidity in the market while taker are traders who want to fill their trades immediately so they take from the existing market.

Takers and makers are charged 0.2% for trading but get deductions when trading fees are deducted for holders of HT depending on the number of HT held by the trader.

Conclusion

Trading on Huobi Spot is easy to comprehend, with enough liquidity for traders who are takers. Giving traders access to numerous choice of coins as well as up to 6 base coins to trade is another reason why huobi exchange is a good option.

To Be Continued...

Previous Post

Spotlight on Huobi Challenge with 7th Anniversary Celebration Rewards; The Beginner's Guide to Huobi

Spotlight on Huobi Challenge; Reviewing Huobi Global as an Ecosystem

Thanks for promoting Steem by sharing you post on twitter

( If you no longer want to receive notifications and upvotes from us, reply to this comment with the word

STOP)Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Link to twitter share: https://twitter.com/gbenga_exito/status/1338457595816910850?s=19

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for taking part in the Spotlight on Huobi Challenge.

And thank you for setting your post to 100% Powerup.

Keep following @steemitblog for the latest updates.

The Steemit Team

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit