Hello steemians, it was planned to discuss how to trade (buy/sell)on Huobi Global platform in this second post in the #ilovehuobi contest, but by browsing through some good articles for the rest of the members, I noticed that the topic is very consumer, so I tried to find new and useful content for users of this great platform. In fact, the recent release of USDT Margin Swaps has been an interesting topic, so I researched and submitted this article I hope you an enjoyable follow up.

Introduction :

No one can deny that the cryptocurrency market is attracting more and more professional traders and investment companies, for this exchange platforms have diversified its financial derivative products in order to capture more interest from traders.

Faced with a booming futures contracts, Huobi has therefore decided to rebranding its crypto derivatives, renaming Huobi Derivatives into Huobi Futures to facilitate decision-making by traders on the future price.

Futures having become the generic term for this type of financial product in the crypto sector.

Aside from futures contracts are options and perpetual swaps, the latter has seen massive adoption in the crypto markets allowing users to bet on the future price of a token with no predetermined expiration date (as opposed to futures contracts).

Perpetual swap contracts on Huobi :

For this type of derivative products there are basically two subscription possibilities, either perpetual USDT margined swaps or Coin margin swaps.

What is USDT-Margined Swaps?

It is a derivative of digital assets that allows, like any market on margin, traders to benefit from the rise or fall in value of assets by opening of course long or short positions. Traders can close their positions at any time as there is no delivery for USDT margin swaps.

Every 8 hours the USDT margin swaps are settled and after the realized PnL and unrealized PnL will be transferred to the user's account balance.

It offers traders leverage to trade from 1x to 125x the amount chosen in their positions, you have to be careful because the more leverage is high, the higher the risk of liquidation.

Currently, Huobi offers 15 trading pairs on its USDT margin swaps, including TRX, BSV, EOS, XRP, BTC, ETH, BCH, LTC, LINK, DOT, FIL, BNB, YFI, YFII and Uniswap's native token. , UNITED.

The differences between perpetual USDT-margined and coin margin swaps:

A perpetual USDT margin swap is a linear contract which stores the margin in USDT stablecoin whereas a perpetual coin margin swap stores the margin in the selected cryptocurrency, such as TRON (TRX), Ether (ETH), Bitcoin (BTC) ), XRP, etc.

There are two reasons why I prefer USDT margin swaps:

- Unlike coin margin swaps, the profit / loss calculation is simpler and clearer for a USDT perpetual margin swap contract, The PnL is displayed on a linear and clear curve at a glance in USDT .

- By trading through USDT perpetual margin swaps, which use stablecoin as a margin, traders can exceed the risk of holding the token without needing to hedge their positions, unlike perpetual margin coin swaps, the margin is based on the underlying cryptocurrencies such as which are very volatile against the USDT.

How to use Huobi USDT-Margined Swaps:

Having understood Huobi's USDT Perpetual Margin Swaps, I turn now to explain how to trade these positions at stable margins.

Step 1: Create a Huobi account

Before you start trading USDT Margin Swaps, you need to create a registered and verified account on Huobi Futures.

- On the official Huobi exchange website, go to the "Sign Up" . You can follow my previous post which covered all the registration and verification process.

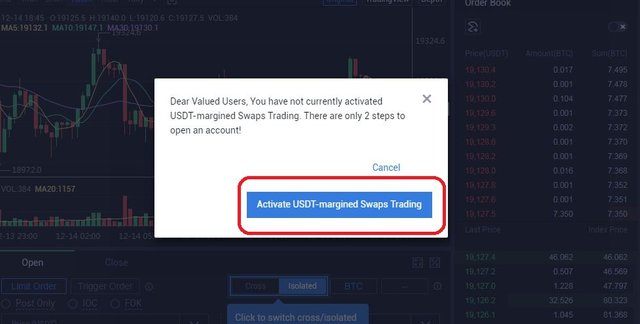

- After registration and verification, go to “https://futures.huobi.fm” and select the “USDT margin swaps” tab.

- Log into your Huobi account and open USDT margin swaps.

Step 2: Deposit USDT funds

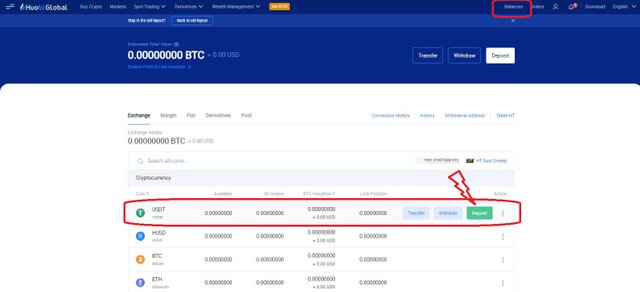

- Log into your Huobi trading account.

- Select "Balances" -> "Exchange Account" and Choose the USDT token

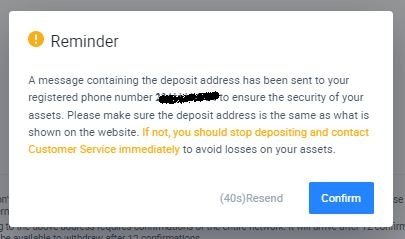

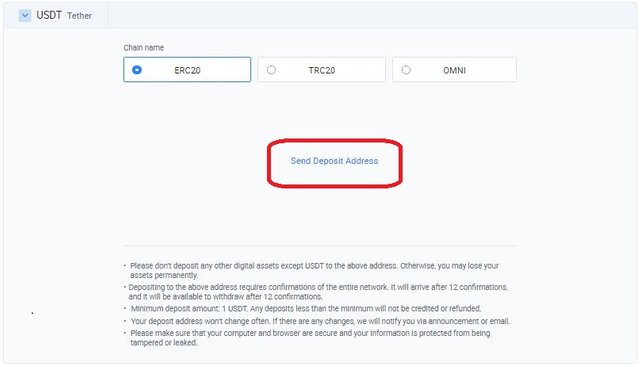

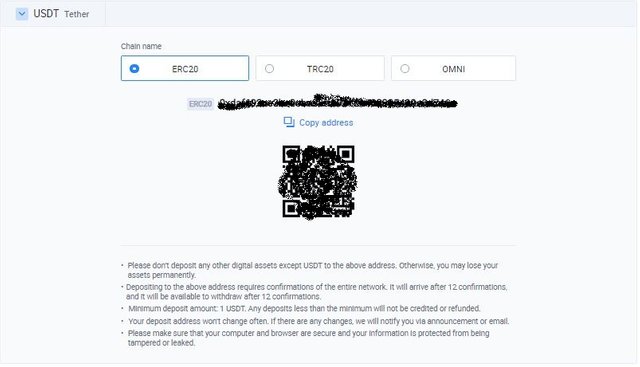

- By clicking on Deposit, you have the choice between 3 following blockchain to obtain a deposit address: ERC20, TRC20, OMNI

Choose to copy the deposit address or scan the QR code to be able to send USDT tokens to this address.

Go to your USDT wallet and type that copied address.

Step 3 : transfer the tokens to your “derivatives account”.

Once you have deposited USDT into your “trading account” the next step is to transfer the tokens to your “derivatives account”.

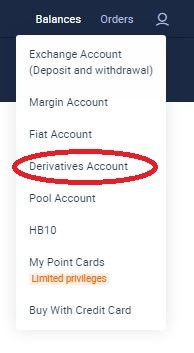

- Access the "Balances". Choose "Derivatives account"

Choose the swaps you want to exchange and select "Transfer".

Select the transfer from “Exchange account” to “Derivatives account” and set the amount you wish to transfer and click on “Confirm.

Step 3 : Trading USDT margin swaps.

Some key terms you should know before you start opening your USDT margin swap positions:

- Position margin: This is the amount of margin allocated when you open a position, it is the quotient of the entry value of all the contracts you hold, on the selected leverage, adding unrealized PnL.

- Order margin: this is the minimum amount of balances used to keep orders open, it is the quotient of the value of all orders opened by the leverage chosen.

- Funding rate: This is the sum of the fees paid by traders regardless of whether they buy or sell at the time of settlement every 8 hours.

- Choose "Derivatives" and select "USDT-margined swaps".

- The "Trading" page is displayed, choose the cryptocurrency you wish to trade.

- To place an order choose the "Order Type" "Open Long" if you think the price will increase; "Open short" if you think the price will go down and set the price and quantity you want.

Types of orders on Huobi Futures

On Huobi Futures, a trader takes a position in perpetual USDT margin swaps either through direct purchase in the market or an order. There are several commands that are available:

Limit order: it is an order for which you place your position in the order book with a specific price that you determine in advance. When you place a limit order, the trade will only be executed if the market price reaches the price you specified. So, you can therefore use limit orders to buy at a lower price or to sell at a price higher than the current market price.

Trigger order: This order, more interesting than the others, includes several components, a stop price and a limit price. The stop price is simply the price at which the limit order will be triggered. The limit price is the price at which the limit order will be triggered.

This means that once your stop price has been reached, your limit order will immediately be placed in the order book.

Best Bid Offer Only you suppose to define the quantity of assets to buy, the system will directly take the last price of the opponent at the time of reception of this order to place the order.

Optimal N Order: In the event of violent market fluctuations, this order helps mitigate your losses by placing orders based on BBO prices in the Optimal N.

Flash close: A feature to make it easier for traders to place an order using prices in the 20 optimal based on BBO prices. And unfilled parts will automatically convert to limited order.

Conclusion :

To conclude, it can be said that perpetual USDT margin swaps carry several advantages over coin margin swaps. By offering a direct and linear method to calculate profits, it avoids the risk of volatility.The Huobi platform is a pioneer in the field of USDT margin trading, providing a clear and inexpensive platform to complement your stable derivatives trading.

Cc:-

@steemitblog

@steemcurator01

@steemcurator02

This post payout set to be 100% power up

Best Regards,

@kouba01

Thank you for taking part in the Spotlight on Huobi Challenge.

And thank you for setting your post to 100% Powerup.

Keep following @steemitblog for the latest updates.

The Steemit Team

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you!!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you!! Super post!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit