The International Monetary Fund (IMF) is a universal association headquartered in Washington, D.C., comprising of "189 nations attempting to encourage worldwide money related collaboration, secure budgetary steadiness, encourage global exchange, advance high business and manageable financial development, and decrease neediness around the globe.

History:

The IMF was initially spread out as a piece of the Bretton Woods framework trade assertion in 1944. Amid the Great Depression, nations pointedly brought hindrances to exchange up in an endeavor to enhance they're coming up short economies. This prompted the depreciation of national monetary standards and a decrease in world exchange. This breakdown in universal financial co-task made a requirement for oversight. The agents of 45 governments met at the Bretton Woods Conference in the Mount Washington Hotel in Bretton Woods, New Hampshire, in the United States, to talk about a structure for after war worldwide monetary co-activity and how to remake Europe. The IMF formally appeared on 27 December 1945, when the initial 29 nations endorsed its Articles of Agreement. Before the finish of 1946 the IMF had developed to 39 individuals. On 1 March 1947, the IMF started its money related activities, and on 8 May France turned into the main nation to acquire from it. The Bretton Woods framework won until 1971, when the United States government suspended the convertibility of the US$ (and dollar saves held by different governments) into gold. This is known as the Nixon Shock. The progressions to the IMF articles of understanding mirroring these progressions were confirmed by the 1976 Jamaica Accords.

Organization:

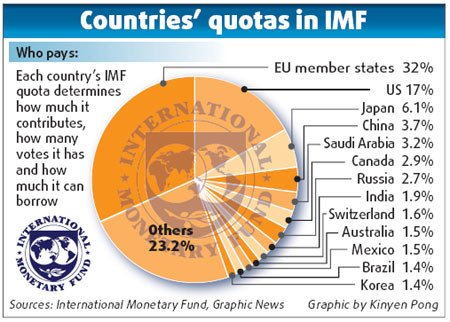

Every part contributes a whole of cash called a portion membership. Amounts are audited at regular intervals and depend on every nation's riches and monetary execution—the more extravagant the nation, the bigger its share. The amounts frame a pool of loanable subsidizes and decide how much cash every part can acquire and how much voting power it will have. For instance, the United States' roughly $83 billion commitment is the greater part of any IMF part, representing around 17 percent of aggregate quantities. As needs are, the United States gets around 17 percent of the aggregate votes on both the leading body of governors and the official board. The Group of Eight industrialized countries (Canada, France, Germany, Italy, Japan, Russia, the United Kingdom, and the United States) controls almost 50 percent of the store's aggregate votes.

Operation:

Since its creation, the IMF's central exercises have included settling cash trade rates, financing the transient adjust of-installments deficiencies of part nations, and giving guidance and specialized help to obtaining nations.

Stabilizing currency exchange rates:

Under the original Articles of Agreement, the IMF supervised a modified gold standard system of pegged, or stable, currency exchange rates. Each member declared a value for its currency relative to the U.S. dollar, and in turn the U.S. Treasury tied the dollar to gold by agreeing to buy and sell gold to other governments at $35 per ounce. A country’s exchange rate could vary only 1 percent above or below its declared value. Seeking to eliminate competitive devaluations, the IMF permitted exchange rate movements greater than 1 percent only for countries in “fundamental balance-of-payments disequilibrium” and only after consultation with, and approval by, the fund. In August 1971 U.S. President Richard Nixon ended this system of pegged exchange rates by refusing to sell gold to other governments at the stipulated price. Since then each member has been permitted to choose the method it uses to determine its exchange rate: a free float, in which the exchange rate for a country’s currency is determined by the supply and demand of that currency on the international currency markets; a managed float, in which a country’s monetary officials will occasionally intervene in international currency markets to buy or sell its currency to influence short-term exchange rates; a pegged exchange arrangement, in which a country’s monetary officials pledge to tie their currency’s exchange rate to another currency or group of currencies.

Financing balance-of-payments deficits:

Members with balance-of-payments deficits may borrow money in foreign currencies, which they must repay with interest, by purchasing with their own currencies the foreign currencies held by the IMF. Each member may immediately borrow up to 25 percent of its quota in this way. The amounts available for purchase are denominated in Special Drawing Rights (SDRs), whose value is calculated daily as a weighted average of four currencies: the U.S. dollar, the euro, the Japanese yen, and the British pound sterling. SDRs are an international reserve asset created by the IMF in 1969 to supplement members’ existing reserve assets of foreign currencies and gold. Countries use the SDRs that have been allocated to them by the IMF to settle international debts. More than 20 billion SDRs were allocated to members in successive allocations from 1969 through 1981. The IMF has several financing programs, or facilities, for providing these loans, including a standby arrangement, which makes short-term assistance available to countries experiencing temporary or cyclical balance-of-payments deficits; an extended-fund facility, which supports medium-term relief; a supplemental-reserve facility, which provides loans in cases of extraordinary short-term deficits; and, since 1987, a poverty-reduction and growth facility. Each facility has its own access limit, disbursement plan, maturity structure, and repayment schedule. The typical IMF loan, known as an upper-credit tranche arrangement, features an annual access limit of 100 percent of a member’s quota, quarterly disbursements, a one- to three-year maturity structure, and a three- to five-year repayment schedule. The IMF charges the same interest rate to every country that borrows from a particular financing facility. Loans typically carry annual interest charges of approximately 4.5 percent. In many cases, parliaments have refused to implement conditions attached to IMF loans. For example, in Russia in July 1998, the parliament flatly rejected a number of the tax reforms that were key conditions of an IMF loan that had been approved a day before. In Argentina in December 2001, the government's agreement with the IMF was soon floated by the parliament. In Turkey in 1998, the parliament forced the government to break its promise to the IMF to hold down the wage increases of public sector workers. In Indonesia in 2002, the parliament decreed that the government should not extend its then current IMF program.

Advising borrowing governments:

The IMF consults annually with each member government. Through these contacts, known as “Article IV Consultations,” the IMF attempts to assess each country’s economic health and to forestall future financial problems. The fund also operates the IMF Institute, a department that provides training in macroeconomic analysis and policy formulation for officials of member countries.

Failures of IMF:

• Lack of Stability in Exchange Rate

• Lack of Stability in the Price of Gold

• Inability to Remove Restrictions on Foreign Trade

• Rich Nations Club

• No help for development projects

• Interference in Domestic Economies • High Rate of Interest

• Anti-developmental policies

• Support of Dictatorship

Alternatives:

In March 2011 the Ministers of Economy and Finance of the African Union proposed to establish an African Monetary Fund. In 2014, the China-led Asian Infrastructure Investment Bank was established. At the 6th BRICS summit in July 2014, the BRICS nations (Brazil, Russia, India, China, and South Africa) announced the BRICS Contingent Reserve Arrangement (CRA) with an initial size of US$100 billion, a framework to provide liquidity through currency swaps in response to actual or potential short-term balance-of-payments pressures.