Futures traders must be no stranger to the [Mark Price] in the position interface, yet most of them may regard it as a price mechanism without knowing its real function. At present, major crypto exchanges use several price mechanisms such as the index price and the latest price, except for the mark price alone. That makes many users wonder: why bother applying three different price mechanisms instead of using one?

Besides reducing risks in futures trading, these three price mechanisms can make the trading market more transparent, and each provides specific advantages in the trading process. The latest price, which is the simplest among the three, refers to the real-time trading price of derivatives such as spot contracts and futures. Now let’s focus on the relatively more complicated index price and mark price.

What is the index price?

The index price refers to the weighted average of spot quotations of cryptos in multiple mainstream exchanges. In CoinEx Exchange, for example, the index price of the BTC linear contract (the USDT-margined contract) is equally determined by the spot quotations from Binance, Huobi, Okex, and CoinEx, and is updated every 5 seconds, thereby keeping its fluctuations within a normal range when one of the four exchanges shows significant price deviations.

If an exchange takes the latest price as its only price mechanism, without the index price, some crypto prices may be miles apart from the actual market price in the case of massive malicious trading incidents. That would pose soaring forced liquidation risks to its futures traders.

What is the mark price?

The mark price combines the index price and the funding fee basis that decreases with time, and serves to calculate the floating PNL and the price index for forced liquidation. In conventional futures trading, the latest price is generally used to calculate the unrealized PNL, and that makes positions prone to forced liquidation arising from volatile fluctuations when the market is being manipulated or illiquid.

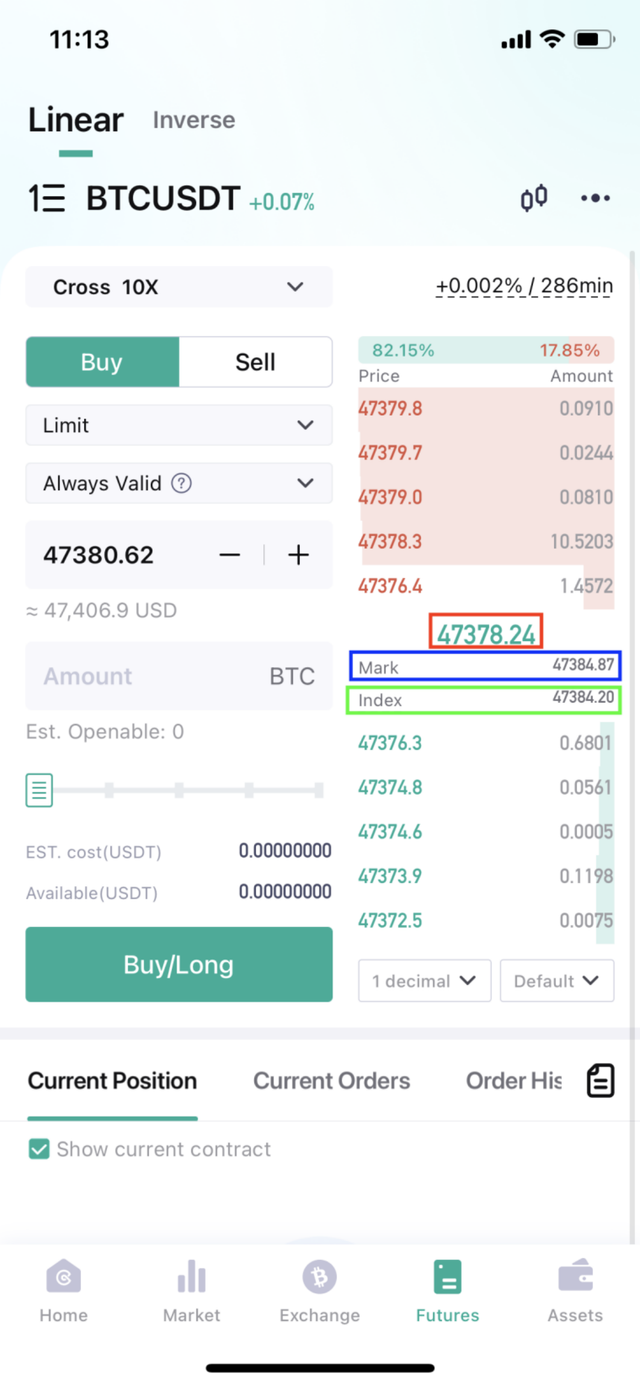

In crypto futures trading, by contrast, the mark price functions to calculate the unrealized PNL. CoinEx Exchange employs a unique system called Fair Price Marking, which sets the mark price, instead of the latest price, as the fair price, to protect users from unnecessary liquidations as well as losses and make the futures market stable.

Where can I check the said information?

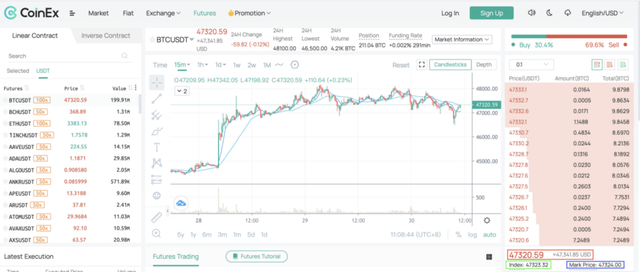

You can check the latest price, index price and mark price on the CoinEx website or the CoinEx App.