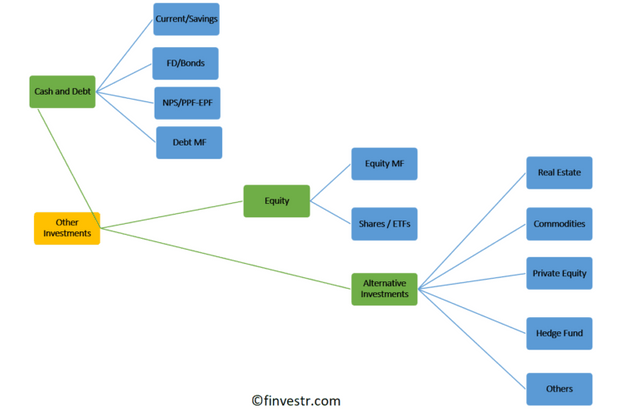

Your life is nothing but assets you generate and the liabilities you pay as per the discussion of our previous post. Investment products are divided into categories that we invest in and make money eventually. I created something to understand this product segregation a little better. (Note the yellow box from the previous post is the same other investments)

This map of products makes it easier to select the category and eventually the product type in that category.

So here goes the rule of thumb keeping in mind the current market conditions:

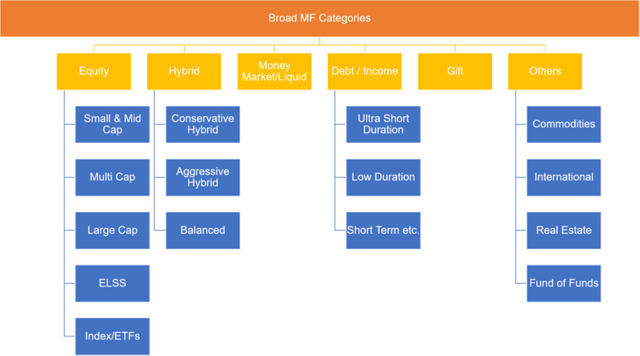

- If you need to the money within a month go for a cash/savings or a liquid fund

- If you need to park money for 3-9 months go for liquid or Ultra Short-term debt fund

- If you need to park money for 1 – 2 years go for Short Term Debt or Hybrid conservative fund

- For more than 3 years go for Hybrid Aggressive funds or Large cap /Index funds.

- More than 3 years but less than 5 years go for Multi-Cap funds

Now let’s say you decided your timeframe and the category, the next question is which scheme to choose in that category?

All combined there are approx. 18,000 schemes!

Oh, ya one more thing did I mention I will write about insurance?

Ok then, apart for term insurance (no returns) and health insurance nothing is worth spending your money. Of course, there is the mandatory insurance for your vehicle.