The government of Republic of India has created it obligatory to supply Aadhaar variety whereas filing tax returns also as linking it with PAN (Permanent Account Number) card. just in case you are doing not link your Aadhaar variety along with your PAN card, your PAN card would be invalid.

PAN Card

PAN (Permanent AccountNumber) could be a distinctive 10-digit alphanumerical variety assigned to every payer. PAN card is issued within the variety of a laminated card by IT (Income Tax) Department below the management of the CBDT (Central Board of Direct Taxes). It conjointly is a very important identity proof like driving license and Aadhaar card. The PAN variety once assigned remains unaffected by the modification of address inside or across states in Republic of India.

Aadhaar Card

Aadhaar variety could be a 12-digit random variety issued by the distinctive Identification Authority of {india|India|Republic of Republic of India|Bharat|Asian country|Asian nation} (UIDAI) to the residents of India. someone, UN agency could be a resident of Republic of India, will voluntarily enter for getting Associate in Nursing Aadhaar variety. Aadhaar card is a very important document and is an indication of identity also as proof of address.

- How to link PAN with Aadhaar?

There square measure 5 alternative ways to link PAN with Aadhaar.

- Link PAN with Aadhaar via taxation web site (For registered users)

- Link PAN with Aadhaar via taxation web site (For non-registered users)

- Link PAN with Aadhaar through SMS

- Link PAN with Aadhaar via Aaykar Setu App

- Link PAN with Aadhaar through offline method

Link PAN with Aadhaar via taxation web site (For registered users)

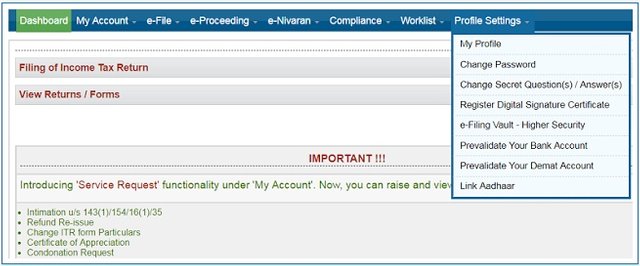

In order to link PAN with Aadhaar, registered users head over to taxation e-filing web site and follow the steps mentioned below:

- Log in to the e-Filing portal of the taxation Department by getting into your log-in Id, password, and date of birth. If you are new, then you have got to register yourself 1st on taxation e-filing web site. Click on “Register Here” then enter your PAN details and build a positive identification when substantiative the OTP.

- Once you're logged in to the web site and your account opens, currently click on “Profile Settings” tab and choose the choice “Link Aadhaar”.

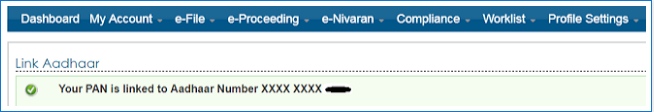

If your Aadhaar is already connected with Aadhaar then you may see a message on the screen as “Your PAN is connected to Aadhaar variety XXXX1111”.

If your PAN isn't connected with Aadhaar then a kind can seem on the screen.

Enter the desired details like name, date of birth and gender as per your PAN card knowledge.

Next, enter your Aadhaar variety.

currently enter the captcha code and click on on “Submit” button.

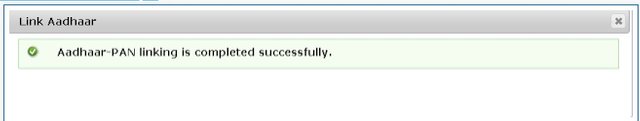

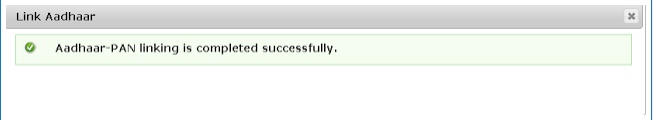

Once submitted, a pop-up message can inform you that your “Aadhaar-PAN linking is completed successfully”.

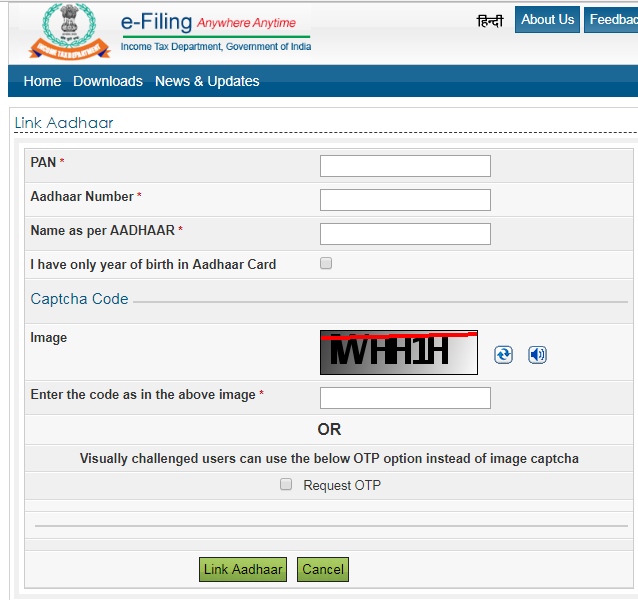

Link PAN with Aadhaar via taxation web site (For non-registered users)

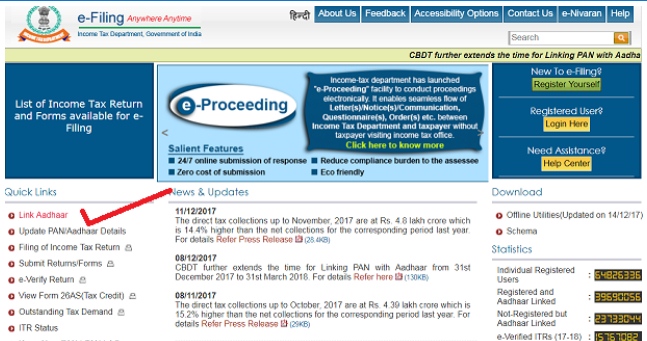

If you're not a registered user at the e-filing web site and you furthermore mght don't desire to register yourself then you'll be able to use this methodology to link your PAN with Aadhaar. A link has been given at the homepage of the e-filing web site. simply follow the steps mentioned below to link PAN to Aadhaar.

- Visit e-filing web site https://www.incometaxindiaefiling.gov.in/home

- Click on “Link Aadhaar” below “Quick Links” on the e-filing web site.

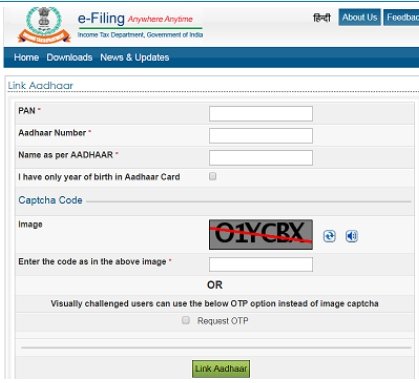

- it'll open a replacement page wherever you're needed to fill a kind by getting into your PAN variety, Aadhaar variety, Name as per Aadhaar.

- Tick the option: “I have solely year of birth in Aadhaar card” (If your Aadhaar card has solely year of birth).

- Enter the captcha code and click on on “Link Aadhaar” button.

- Once submitted, a message on the screen can inform you that your “Aadhaar-PAN linking is completed successfully”.

Link PAN with Aadhaar through SMS

Now you'll be able to link your PAN with Aadhaar card through SMS conjointly.

SMS format

UIDPAN12 digit Aadhaar No.10 digit PAN No.

Now send SMS to 567678 or 56161

For example, if your Aadhaar variety is 112233445566 and PAN is AABPA1111B. simply send Associate in Nursing SMS to 567678 or 56161 as

UIDPAN 112233445566 AABPA1111BLink PAN with Aadhaar via Aaykar Setu App

Now you'll be able to conjointly link your PAN with Aadhaar card via Aaykar Setu App

Download the Aaykar Setu app on your smartphone. Link your PAN with Aadhaar by mistreatment PAN/TAN feature of Aaykar Setu App.Link PAN with Aadhaar through offline method

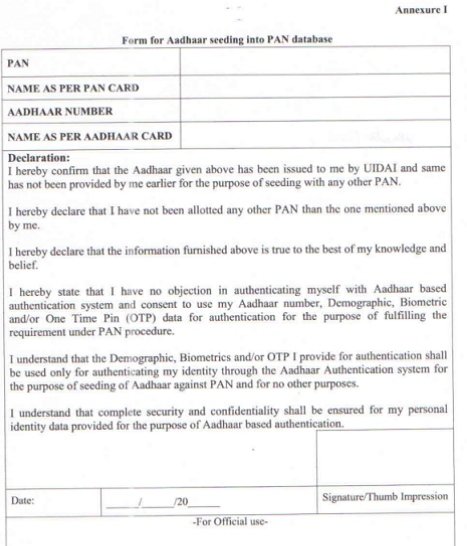

Now you'll be able to link your PAN with Aadhaar through the offline method employing a single page kind. the one page kind is simply another procedure by a paper medium for linking PAN with Aadhaar. the entire method is manual.

You have to fill the shape and submit this kind to selected PAN Service Centers of NSDL or UTIISL along side PAN card and Aadhaar card copy. If there's a twin then you would like to go to the middle in person for fingerprint authentication.

Note: This post was originally printed in April 2017 and has been utterly updated for accuracy and comprehensiveness.

- You may conjointly prefer to read: seven habits that canmake you made

- You may conjointly prefer to read: advantages of investment in Mutual Funds

- You may conjointly prefer to read: what's Gratuity andhow to calculate Gratuity?

- You may conjointly prefer to read: little Business ideas

If you likable this post, share it along with your friends and colleagues through social media. Your opinion matters, please share your comments.

- How to link PAN with Aadhaar?