Here are five of the most popular technical indicators used by traders on TradingView for cryptocurrency trading:

Moving Averages

Moving averages (MA) are used to smooth out price data and identify trends in the market. A simple moving average (SMA) is calculated by adding the closing prices of an asset on a certain time period and dividing the sum by the number of periods. An exponential moving average (EMA) places more weight on recent prices, making it more responsive to short-term price flactuations.

Moving averages can be used to identify trends and potential entry and exit points for trades. For example, if the price of a cryptocurrency crosses above its 50-day moving average, it may signal a bullish trend and a potential buying opportunity.

Relative Strength Index (RSI)

The Relative Strength Index (RSI) is a momentum indicator that measures the speed and change of price movements. It ranges from 0 to 100 and is used to identify overbought and oversold conditions in the market. When the RSI is above 70, it is considered overbought and when it is below 30, it is considered oversold.

Traders can use the RSI to identify potential trend reversals and to confirm buy and sell signals. For example, if a cryptocurrency is oversold and its RSI is below 30, it may signal a potential buying opportunity.

Bollinger Bands

Bollinger Bands are a volatility indicator that shows the upper and lower price boundaries based on the standard deviation of price movements. The bands are formed by plotting a moving average in the middle of the chart and adding two standard deviations to create the upper band and subtracting two standard deviations to create the lower band.

Bollinger Bands can be used to identify potential trend reversals and to confirm buy and sell signals. For example, if a cryptocurrency is trading near its lower Bollinger Band, it may signal a potential buying opportunity.

Fibonacci retracements

Fibonacci retracements are used to identify potential levels of support and resistance in the market based on the Fibonacci sequence. The most commonly used retracement levels are 38.2%, 50%, and 61.8%.

Traders can use Fibonacci retracements to identify potential entry and exit points for trades. For example, if a cryptocurrency is trading near a Fibonacci retracement level, it may signal a potential buying or selling opportunity.

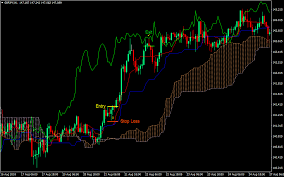

Ichimoku Cloud

The Ichimoku Cloud is a comprehensive indicator that shows support and resistance levels, trend direction, and momentum in the market. It consists of five lines: the Tenkan-sen, Kijun-sen, Senkou Span A, Senkou Span B, and Chikou Span.

The Ichimoku Cloud can be used to identify potential trend reversals and to confirm buy and sell signals. For example, if a cryptocurrency is trading above the cloud, it may signal a bullish trend and a potential buying opportunity.