Who wouldn't want to be independently wealthy? Fuggetaboutit! But what does it mean to you? At this point, you might be thinking I've had an epiphany of sorts and gone philosophical, instead of talking economics, geopolitics, and financial markets. Nope. Why discuss this now, you may ask?

Due to a confluence of circumstances across the aforementioned categories, mercantile sense is whispering in my ear, thus creating a queasy sensation in my gut that says the risk of a black swan type event is exponentially higher and nearer on the horizon. Therefore, I'm suggesting it's time to evaluate your financial positions and personal goals.

_“Hope for the best, plan for the worse.” – Lee Child _

“I’m really glad Alyssa asked me this question,

because it was something I hadn’t thought about in a very long time, if

ever. She helped challenge me to not associate a specific dollar amount

with being wealthy, but to really think about what would make me happy

in my life.” – Heath and Alyssa

“You are wealthy when you have something money can’t buy. For

me, that includes: 1) Health 2) Virtues 3) True friends 4) Loving family 5) Good reputation. I will also throw financial independence under the

definition as well- but that is something money can buy.” – Quora

_“A week after Thanksgiving in 1940, Jesse Lauriston Livermore

walked into the Sherry-Netherland Hotel in New York, had two drinks at

the bar while scribbling something in his notebook, then proceeded to

the coat room where he sat on a stool and shot himself in the head. He

was 62 and left behind $5 million, down from the $100 million fortune he

had amassed just ten years earlier. And the note he had scribbled? _‘My

dear Nina: Can’t help it. Things have been bad with me. I am tired of

fighting. Can’t carry on any longer. This is the only way out. I am

unworthy of your love. I am a failure. I am truly sorry, but this is the only way out for me. Love, Laurie’ – The Reformed Broker

Since we’ve wandered into the topic of money “can’t buy me love…”

_“’Jesse Livermore knew how to make real money.

Seligman’s kid never played for peanuts. Seligman and Livermore never

missed the big moves’… One of the greatest traders in the history of

the world was Jesse Livermore. He was rumored to have died broke, that

is patently false. Jim Sinclair’s father, Bert Seligman (also one of

the greatest traders in history) was business partners with Jesse

Livermore, and Sinclair (in one of his KWN interviews) let listeners

know that Jesse was an extraordinarily wealthy man, all the way to the

end of his life. Fortunately, his lessons from the markets were

chronicled and are available for those who are willing to learn…” (free

book Reminiscences of a Stock Operator) _– September 6, 2010 Jim Sinclair Commentary

What is Money?

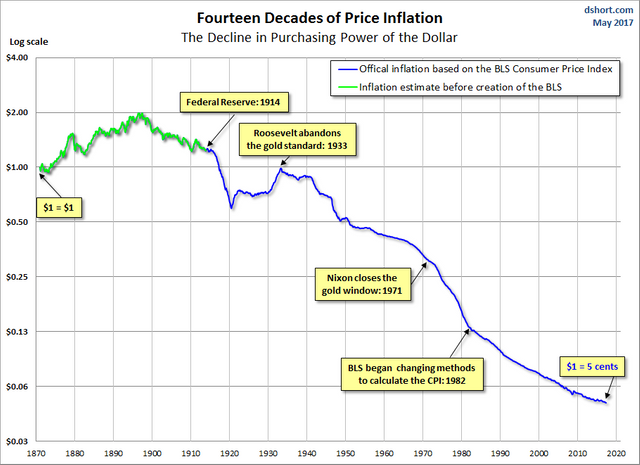

“The classic definition of money involves three functions: store of value, medium of exchange, and unit of account. Of these, store of value is the most important.

If users have confidence in value then they will accept the money as a

medium of exchange. The unit of account function is trivial. The store

of value is maintained by trust and confidence. Gold is an excellent

store of value because it is scarce and no trust in third parties is

required since gold is an asset that is not simultaneously the liability

of another party. Fiat money can also be a store of value if confidence

is maintained in the party issuing the money. The best way to do that

is to use a monetary rule. Such rules can take many forms, including

gold backing or a mathematical formula linked to inflation. The problem

today is that there is no monetary rule of any kind. Also, trust is

being abused in the effort to create inflation, which is a form of

theft. As knowledge of this abuse of trust becomes more widespread,

confidence will be lost and the currency will collapse. Cryptocurrencies

offer some technological advantages, but they also rely on confidence

to maintain value and, in that sense, they are not an improvement on

traditional fiat currencies. Confidence in cryptocurrencies is also

fragile and can easily be lost. It is true that stable systems have

failed repeatedly and may do so again. The solution for individual

investors is to go on a personal gold standard by acquiring physical

gold. That way, they will preserve wealth regardless of the monetary

rule or lack thereof pursued by monetary authorities.” – Jim Rickards August 8, 2014 Interview w/Financial Sense

On June 13th and 14, the FOMC will have their next pow-wow to determine monetary policy going forward. Whether or

not they raise interest rates another .25% is irrelevant in the big

picture, as Lacy Hunt eloquently laid out within my June 6th interview. What is the purpose of the Fed?

The Federal Reserve System is the central bank of the United States. Here is the overview:

“It performs five general functions to promote the effective

operation of the U.S. economy and, more generally, the public interest.

The Federal Reserve:_

- conducts the nation’s monetary policy to promote maximum

employment, stable prices, and moderate long-term interest rates in the

U.S. economy; - promotes the stability of the financial system and seeks to

minimize and contain systemic risks through active monitoring and

engagement in the U.S. and abroad; - promotes the safety and soundness of individual financial

institutions and monitors their impact on the financial system as a

whole; - fosters payment and settlement system safety and efficiency

through services to the banking industry and the U.S. Government that

facilitate U.S. dollar transactions and payments; and - promotes consumer protection and community development through

consumer-focused supervision and examination, research and analysis of

emerging consumer issues and trends, community economic development

activities, and the administration of consumer laws and regulations.”

Not much about the $USD being a “store of value” is in those bullet points.

Hmm. Poof, and it’s gone.

In conclusion, a film named " The Gambler" came out in 2014 that contained thoughtful dialogue about money and wealth. Let me set the scene before you watch the following clip. Mark Wahlberg has approached John Goodman for a large loan. Mark needs the loan to gamble his way to financial independence and pay off previous debts to other sharks. Albeit, this is about gambling and I don't recommend such folly, but the writers inserted some sage advice into the script and Goodman delivered – exquisitely, I might add. This movie clip is rated "R," so don't watch it if that offends you. The content is the money quote and my humble advice to end this post.

Plan Your Trade, Trade Your Plan

TraderStef on Twitter

So if the "Federal Reserve" is a private institution, no more federal than"Federal Express(Fedex), then how is it that the president of the United States appoints The Federal chair person if its not part of the U.S government ?? O.o

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit