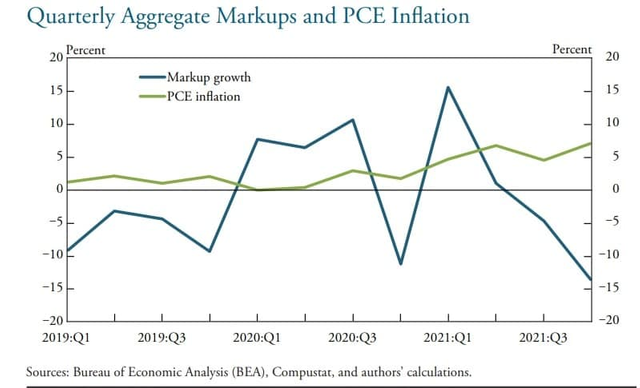

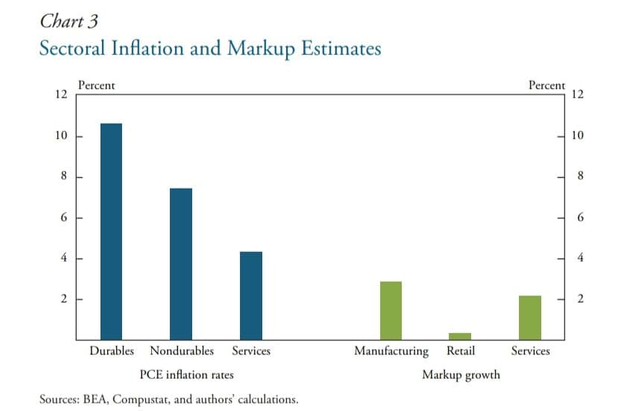

I missed this Kansas City Federal Reserve paper from a few months ago. It looked at the "greedflation" hypothesis. It didn't find much evidence for it. It did find that firms increased markups in 2020 and early 2021, but markup growth actually declined in the second half of 2021. It also found that markup growth was similar across industries with very different demand and inflation, suggesting that markups weren't due to differential demand from the pandemic.

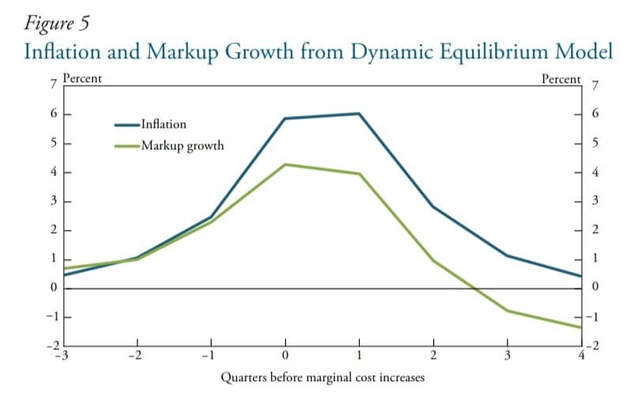

A model of firms expecting higher future marginal costs and thus raising markups initially in anticipation fits the data more accurately.