Missed this at the time, but this is a good piece from the CEA on the inflation of the pandemic.

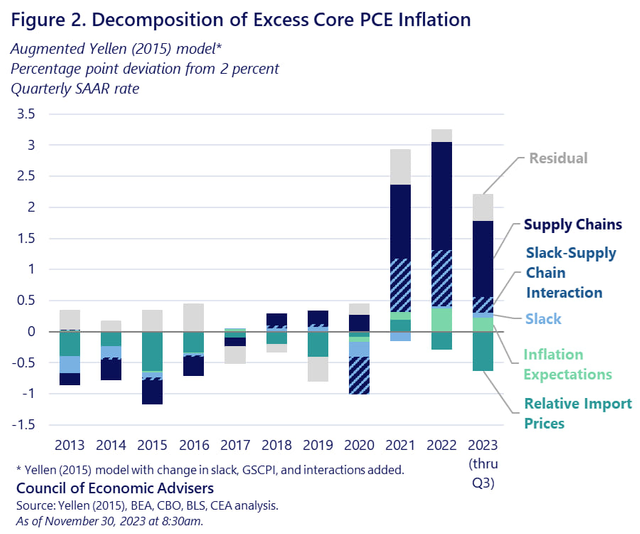

Here they took a model that Yellen developed in 2015 and added a supply chain bottleneck component to it. Then using the model they decomposed excess (above the Fed's target) core inflation by each component.

Slack here means labor market slack.

Since supply chain bottlenecks can interact with demand, they also incorporate its interactions.

As you can see the inflation of recent years is to a large degree explained in whole or in part by this supply chain disruption and its interaction with the change in demand. As the piece notes demand not only was strong, but shifted in composition from services to goods during the pandemic.

Not the first piece to do such a decomposition, but this always struck me as the most comprehensive story of the past few years rather than it simply being a story of just "pandemic stimulus" or "pandemic supply chains".